Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Those that view the message of the market on a daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

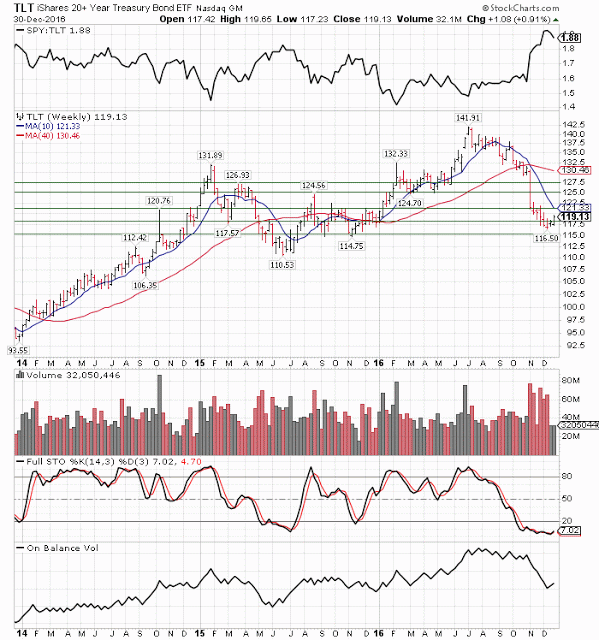

While coordinated 'stimulus' supports a countertrend rally of commodities foreshadowed by negative concentration discussed months ago, it won't reverse defensive global capital flows regardless of the hype. Defensive flows likely includes US Treasury bonds (NASDAQ:TLT) until the wolf pack culls the herd of weak European and Asian debt. Only after they're thinned will the focus turn to the US. Gentleman could very well prefer government bonds, notes, and bills at least in the initial stages of the next panic.

What Mellow omitted is that investors prefer the public sector (bonds) when confidence in the private sector (stocks) is failing. Investors preferred bonds in 1929 because confidence in the private sector was failing. While gentlemen could prefer bonds in the initial stages of the next panic, they'll like turn on them as confidence in the public sector falters from an already shaken position. This will burn a majority populated by central bankers and followers of today's bullish headline hype rather quickly.

Subscriber Comments

Chart

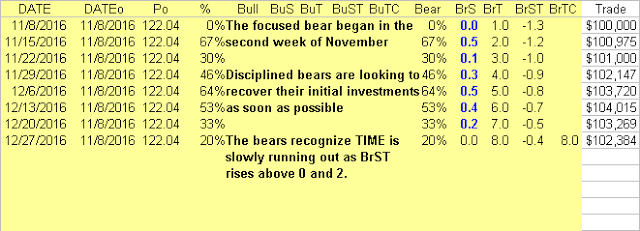

T-Bonds focused bear opportunity has produced 20% annualized gain (excluding dividends) since the second week of November (see TLT Matrix). This opp recorded an impressive 67% and 64% annualized gain in the second and first week of November and December, respectively. Disciplined bears that withdrew initial investments by the first week of December are letting their profits run while watching DI and TIME.

Bonds DI has risen to a Q2 74%. This accumulation of energy necessary favors at least a counter-trend rally (short-covering) over the short-term. The bears that did not withdraw their initial investment or more in late November or early December could easily be recognized as pigs in the coming weeks.

Smart money, a small minority listening to the message of the market, recognized the decay of TIME as BuST rises above 0 and approaches 2. BrST = -0.4 defines a trend approaching its mid point.

TLT Matrix

The weekly close below support at 115.05 supports the down impulse, while a close above resistance from 121.25 could reverse it. A reversal favors testing of higher resistance.