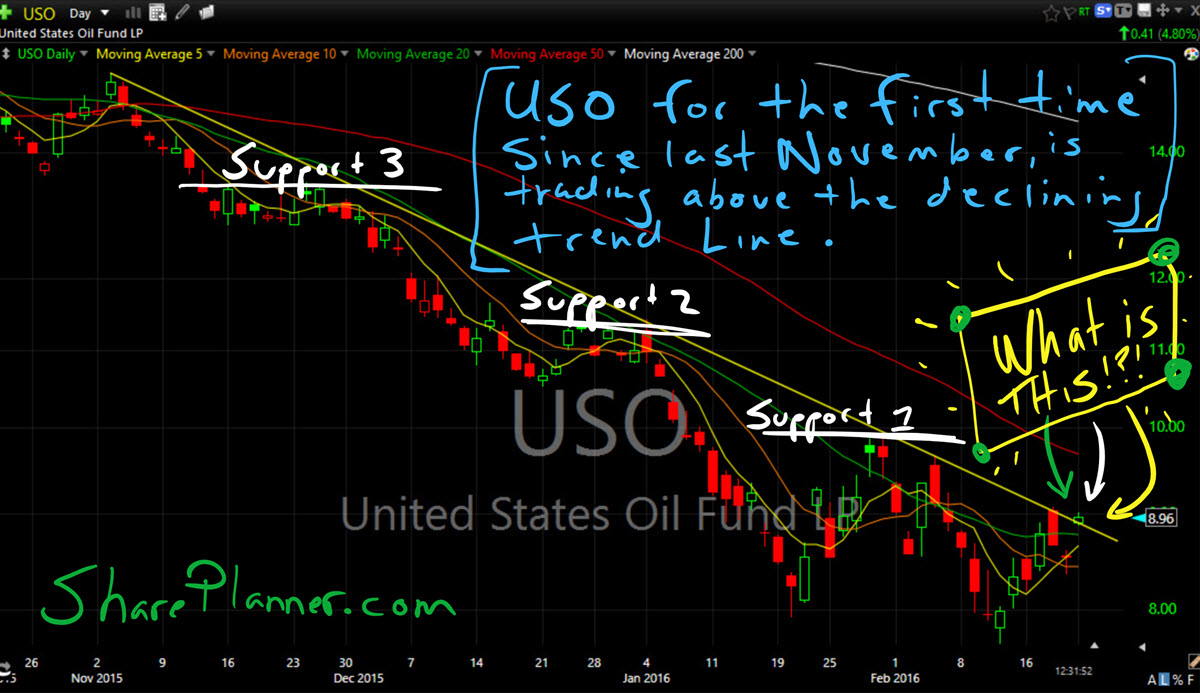

I talked last week about the possibility of the oil ETF (USO (N:USO)) breaking the downtrend off of the November highs.

And now it is.

This is really monumental. Because this downtrend has been as stubborn as an ox for nearly four months now. Breaking it leads me to believe that there is a bigger move on the horizon, now, for the downtrodden commodity.

And if that is the case...well watch out stocks, because if the coupling of stocks and oil to the downside was any indication, then a hard bounce that establishes some new higher-highs for once should send stocks into the stratosphere.

Now, I'm not saying that the oil bottom is in. But when we are looking at trading from a few weeks to a month or two, then yes, there could be some definite upside to this market before everything hits the fan -- again.

Remember, back in 2008 from March into May, the market rallied like a boss, before ultimately falling all over itself into the Great Recession.

So check out the USO Technicals: