Sentiment was given a boost at the open with Trump’s announcement that U.S. and Mexico have reached an agreement on immigration, providing another tailwind for equity markets.

Over the weekend headlines poured in that U.S. and Mexico had reached a deal with curb migration, allowing Mexico to avoid the 5% tariffs threatened by Trump. Still, the tariffs have been “indefinitely suspended” and sceptics were quick to point out the deal merely repackaged concessions already made by Mexico in previous negotiations.

Although details remain unclear, Trump claims “strong measures” will be taken by Mexico to stop migration at the southern border. And late on Sunday Trump has added that Mexico will make large agricultural purchases from the US.

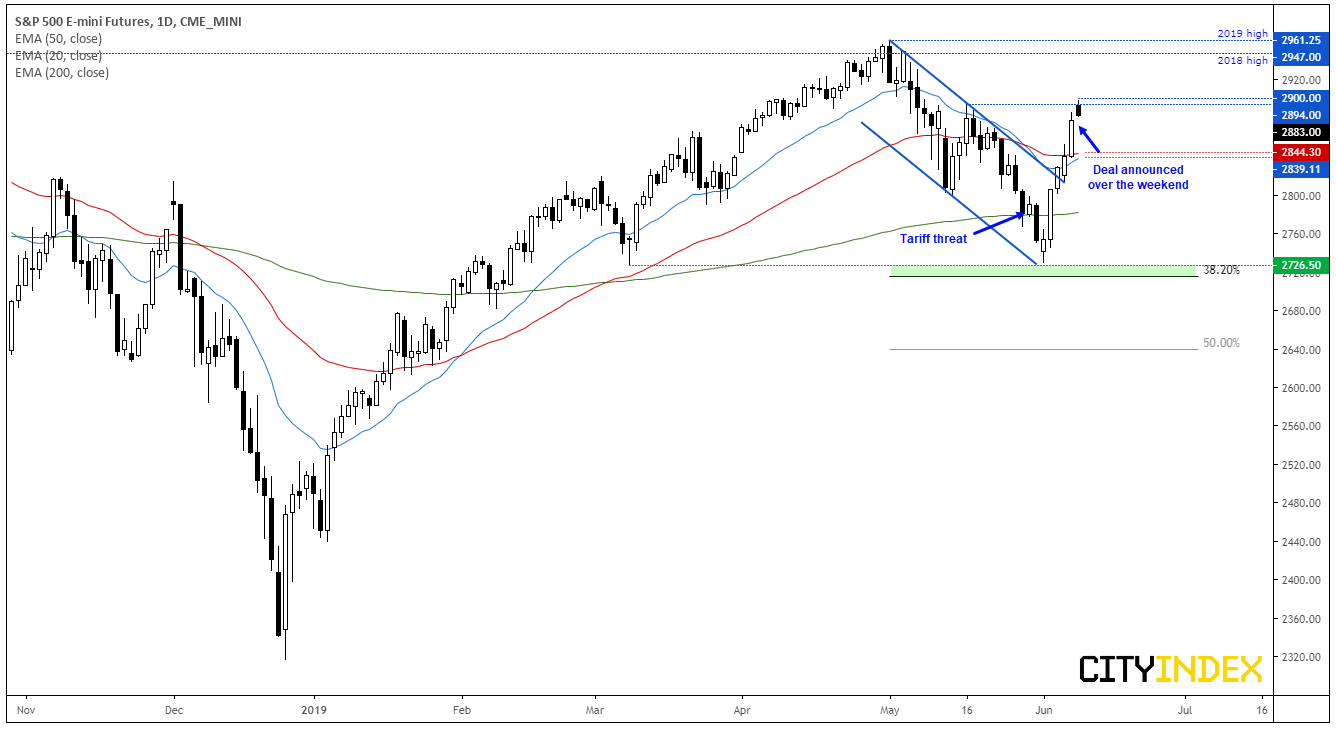

Markets have taken it as a constructive step forward which has provided a sense of risk-on at the start of the Asian session. S&P Futures gapped up to 1-month high, equities across Asia were in the black, USD/JPY spent a brief period above last week’s high, USD is currently the strongest major whilst CHF and JPY are currently the weakest.

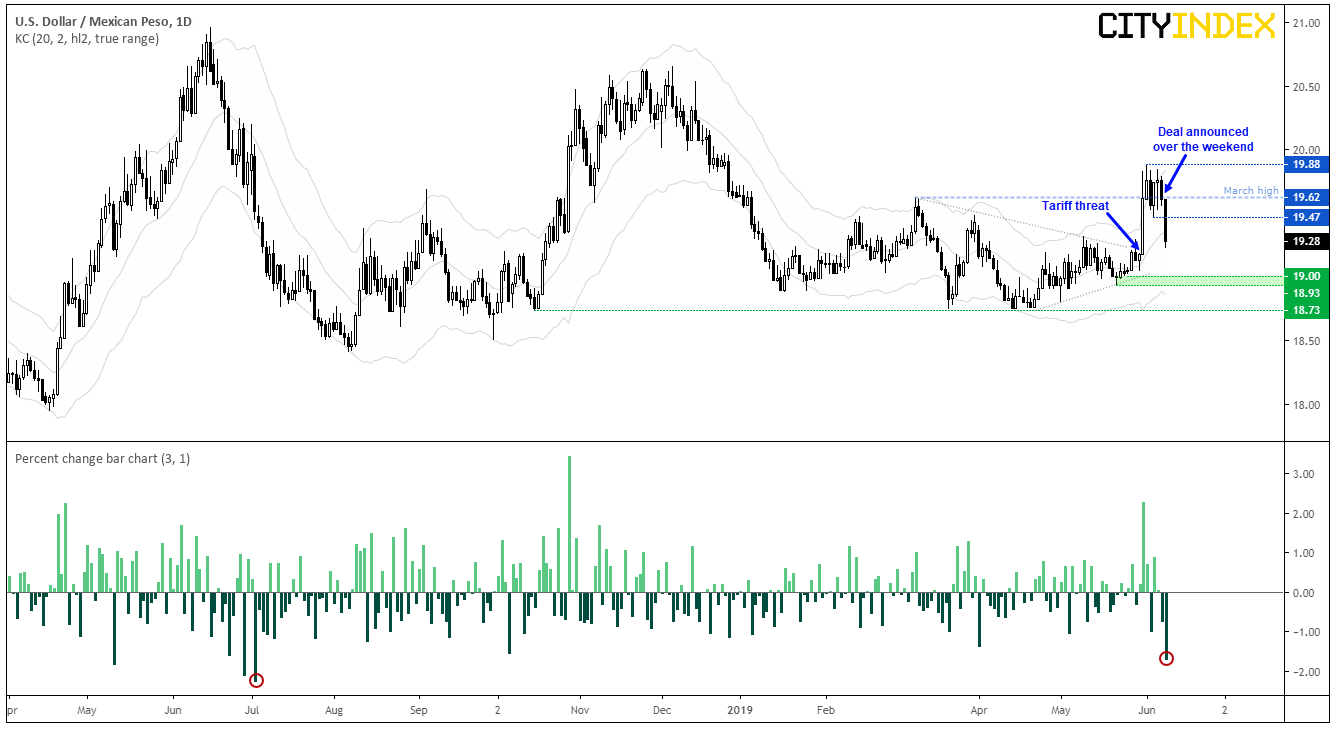

Of course, the biggest beneficiary so far today has been the Mexican peso which recouped a large chunk of losses it sustained when Trump announced the surprise tariffs. Currently trading -1.7% on the session after gapping lower at the open, USD/MXN is on track for its most bearish day since July 2018. After failing to hold above the March high, USD/MXN is back within range with potential to revisit $19 in light of recent developments and soft wage growth within Friday’s NFP data.

Index futures popped higher at the open, although the S&P500 futures markets appears set to close its gap. Still, equity prices are now being supported by a lift in trade sentiment following the US-Mexico announcement, and rising expectations of a Fed cut following Friday’s NFP data set.

Resistance has been found around 2,900 yet we expect the index to remain supported as bulls seek to buy the dips. The S&P has posted a solid 6% rally from tis low and price action has broken easily back above the 200 and 50-day eMA’s. Furthermore, the 20-day eMA is curling higher and could cross back above the 50, and the two averages currently provide a dynamic support zone around 2,840.