The new North America trade agreement is still awaiting ratification in the US and Canada. The IMF estimates that Canada will reap most of the benefits, which suggests the ratification will ultimately support the Canadian dollar more than the Mexican peso and US dollar.

The bumpy road to ratification

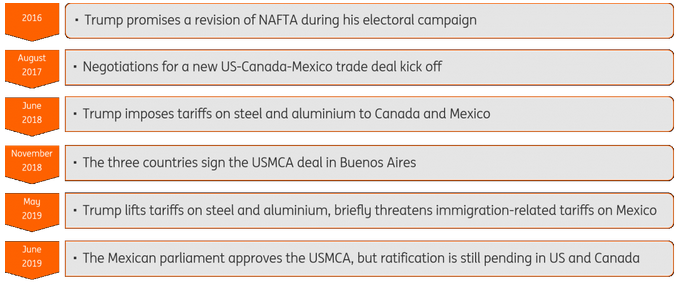

The history of the Unites States-Mexico-Canada Agreement has been a complex one from the very beginning. The chart below shows the timeline of the bumpy road that has led to the signing of the deal and to the ratification phase.

While the Mexican Parliament ratified the agreement on 20 June 2019, US and Canada still have to follow suit. We investigate below the reasons that have so far delayed the ratification in the two countries.

US: Democrats still blocking the process

Voting had been delayed over the summer due to Democrat concerns about whether the deal went far enough to protect American workers and environmental standards. There were also fears the USMCA could result in higher future medicinal drug costs in the US by giving some drugs extended protection from cheaper alternatives.

The uncertainty over the path of USMCA ratification has increased in the wake of the impeachment proceedings initiated against President Trump. Some in the Democrat party are reluctant to give President Trump a political win on trade and continue to favour blocking the trade deal. Similarly, partisan warring may make it more difficult for Donald Trump to conclude other trade deals that require congressional approval, such as a US-UK free trade agreement after Brexit.

However, there are some signs of hope. A growing number of Democrats, particularly those that flipped historically Republican seats at last November’s mid-terms, fear voting against USMCA could be construed as obstructionism. This could provide Republicans with ammunition to claim that the Democrats are acting in a partisan fashion by opposing initiatives that benefit their constituents.

So, assuming drug pricing can be addressed (House Democrats are looking to legislate on this) there are signs that the Democrats will be prepared to support the deal. After all, House Speak Nancy Pelosi has re-affirmed she wants to get legislation passed and this is the most obvious.

Canada: Federal elections got in the way

The Canadian House of Commons started debating the USMCA in late June 2019. Prime Minister Justin Trudeau’s government had support from the main opposition party, the Conservative Party, to back the trade deal, which was only opposed by the smaller New Democrats Party. However, the parliament failed to vote on the ratification before 11 September, when parliament was dissolved ahead of the Federal elections, which will be held on 21 October.

It will be up to the new parliament to ratify the USMCA as one of their first legislative actions. But some concerns may arise. Trudeau is marginally below the Conservatives in the latest opinion polls. The Conservatives, led by Andrew Scheer, claimed they would back the USMCA only because a trade deal was needed, but have been very vocal in criticising how, in their view, too many concessions were made to the US.

However, at this stage it seems unlikely that the new Canadian government will try to renegotiate the USMCA and the ratification should come later this year.

Implication for the three economies

In brief, the USMCA provides changes in four areas compared to NAFTA:

The country of origin rules for automobiles is raised to 75% of their components from 62.5%

New provisions for labour: 40 to 45% of a car must be made by workers that earn at least $16 per hour

Canada gives free access to a portion (3.6%) of its diary market to the US and also raises duty-free limits on US products

Intellectual property: copyright terms are extended, along with patents for pharmaceutical drugs (this last point has been highly criticised by some US Democrats including Senator and Presidential contender Elizabeth Warren).

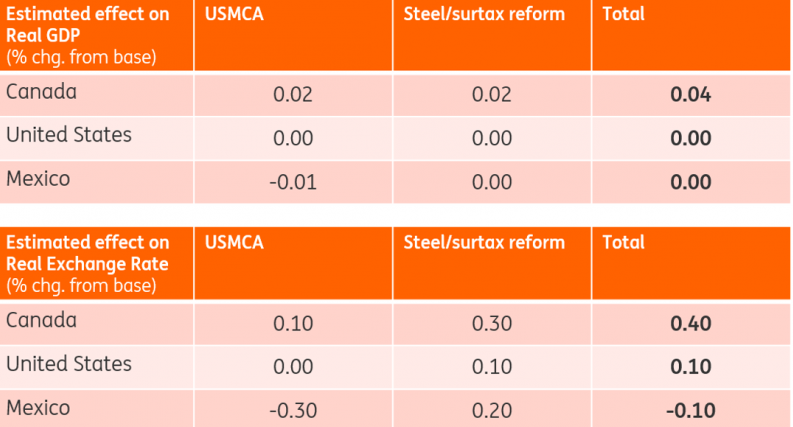

In a research paper published in March 2019, the IMF estimated the impact of a combination of the USMCA and the removal of steel and aluminium tariffs (which were lifted in May 2019) on GDP and the real exchange rate in the three countries.

Both tables clearly suggest how both the ratification of the USMCA and a tariff-free environment on steel and aluminium will mostly benefit the Canadian economy, likely resulting in a stronger Canadian dollar (in real terms).

The impact on the US and Mexico in terms of economic activity is expected to be negligible. However, it is interesting to note how the estimates flag the risk of a negative impact on the Mexican peso real exchange rate.

Market impact: good news for CAD

Looking at the longer term estimated impact above, it seems reasonable to expect that the ratification of the deal, especially in the US where the outcome seems more uncertain, to be mostly positive for the Canadian dollar.

CAD has been quite sensitive to the developments in the USMCA negotiations, with progresses in the negotiations often curbing the negative effect of escalating global trade tensions and oil price slumps in the short term.

We expect the ratification of the USMCA to provide not only short-term support to CAD, but – as signalled in the IMF projections – possibly help the currency in the longer term, thanks to the positive effects on Canadian economic activity.

In the US, the story seems to be more of a political nature, with the USMCA unlikely to result in any material change in the economic outlook. In turn, the US dollar may be the least receptive currency in the event of ratification. Some may speculate that the openness of Democrats to the USMCA would suggest a reduced chance of Congress voting for President Trump's impeachment, which might ultimately benefit the dollar. However we suspect very little risk premium related to Trump’s impeachment is priced into the dollar, which once again suggests a limited FX impact of the ratification.

Turning to Mexico, the peso would likely react positively to the ratification in the short term, but probably in a more muted way than CAD. Estimates suggest that Mexico's economy would not benefit to the same effect, and any positive impact may well be watered down by the fact that a trade deal would not necessarily exempt Mexico from fresh US tariffs. The risk of President Trump announcing new tariffs on Mexico for non-trade-related matters (such as immigration, as happened last May) likely remains in place.

For the business community (long-term investment), external trade with the US is now a much more uncertain proposition than it used to be, regardless of whether the agreement is ratified or not, which hampers the impact on growth of the eventual ratification.

In conclusion, we expect the ratification of the USMCA in the coming months to mostly benefit the Canadian dollar. In the short-term, this could partly offset the effect of more US-China trade tensions. In the longer run, IMF estimates of the positive impact on Canada's economy support our expectations for a fierce rebound of the loonie in 2020, with USD/CAD moving close to the 1.25 level in a year's time.

We do not consider USMCA as an input in the USD equation for the foreseeable future, while the potentially negative impact on the Mexican peso should not drive USD/MXN far from 19.50 in the first half of 2020.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more