There have been precious few opportunities to purchase U.S. stock weakness over the last seven months. Specifically, the smallest dips have reversed course quickly, always finding a way to grind higher. On the other hand, some exchange-traded vehicles along the more modest rung of the risk ladder have caught the attention of institutional buyers.

Consider SPDR Barclays Convertible Securities (CWB). This ETF seeks the price and yield performance of the Barclays U.S. Convertible Bond Index > $500M — an index that tracks U.S. convertibles with issue sizes greater than $500 million. With a slight increase in treasury bond yields pressuring income assets over the past few days, sellers have pushed the price of CWB lower. However, on May 7, CWB witnessed $45 million flow into the fund for a 4% increase in assets under management. The trading occurred on nearly 5x the average trading volume.

At present, CWB delivers an approximate annual yield of 3.75%. It has also been adept at capital appreciation in 2013. Year-to-date, CWB’s total return is roughly 8.25%.

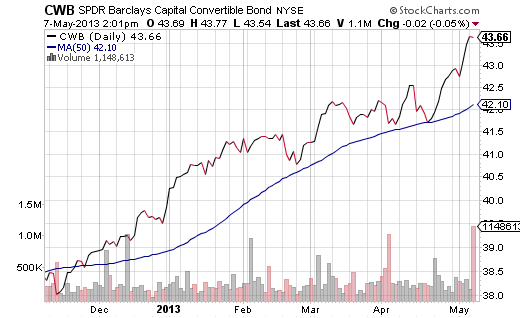

Since the November elections, CWB has rocketed higher alongside gains in broader U.S. equities. Technical analysts might be more impressed with the exchange-traded fund’s ability to bounce higher on every minor pullback to a 50-day moving average.

Why would an institution(s) that purchases in large blocks pursue convertible bonds in the first place? After all, the annual yield is not necessarily a steal at 200 basis points above comparable Treasuries… at least not with the potential for convertibles to sell off sharply alongside a stock scare. The most likely reason is the pressure that institutional investors face with respect to putting cash to work.

Consider the money manager who has waited patiently all year for stocks to correct a modest 5% — an event that has happened each year in the first 5 calendar months since 1996. Alas, the market has kept on climbing like the Energizer Bunny on his way to the peak of Mount Everest. The institutional money manager may continue to wait with a higher-than-desired cash allocation, or he/she can look for a middle-of-the-road compromise. I believe that a cautious institution determined that if the market keeps rising, CWB will garner some of that upside; if markets sell off, CWB should not experience as much of the downside. Moreover, the monthly payouts of a decent annual yield could work well if the during the summertime the market moves sideways. In other words, someone may have made the decision to participate without chasing.

The question that an individual investor may need to ask himself/herself is whether SPDR Barclays Convertible Securities (CWB) is a reasonable compromise for excess money market dollars. Personally, I would be more inclined to wait for a modest pullback to a price point of $42.1 at the 50-day. What’s more, I would be equally cognizant of an exit approach, utilizing a stop-limit loss order near $39.1. When the S&P 500 fell 19.8% from “top-to-bottom” in the summer of 2011, CWB dropped roughly 17.8%; that may be more downside risk than a number of income enthusiasts have in mind.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Using The Convertible Bond ETF To Participate, Not Chase

Published 05/08/2013, 03:27 AM

Using The Convertible Bond ETF To Participate, Not Chase

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.