LEDE

The airline stock prices have not all participated in the bull market, but using options to invest in the idea that the stocks “won’t go down a lot,” has in fact been a massive winner, and as important, has revealed the gem all option traders seek — “edge.”

PREFACE

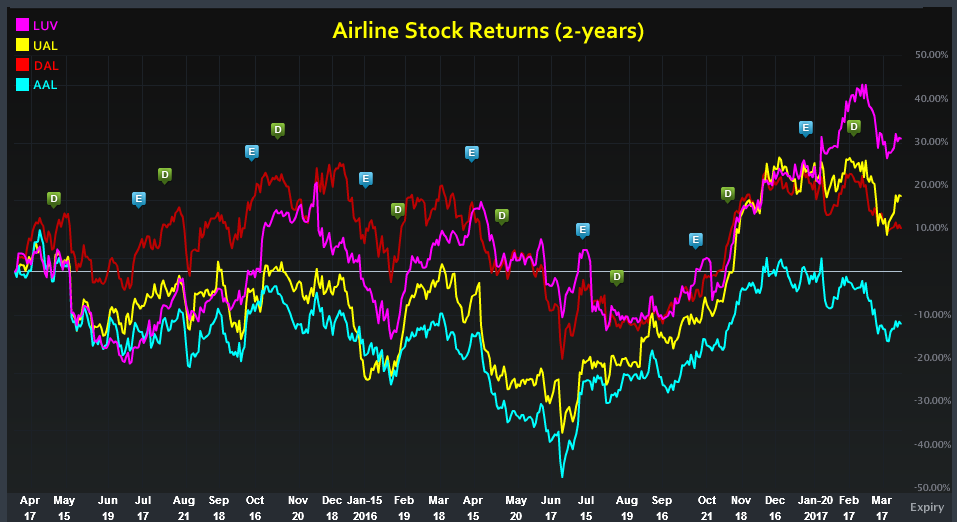

We can start with a two-year stock return chart for four airlines:

Delta Air Lines Inc (NYSE:DAL) is the company we will focus on today — it’s in red.

While Delta Air Lines Inc (NYSE:DAL) stock is up about 9% over the last two-years, we can also see that American Airlines Group Inc (NYSE:AAL) is actually down 13%, while United Continental Holdings Inc (NYSE:UAL) is up 17% and Southwest Airlines Co (NYSE:LUV) is up 30%.

But, the real analysis starts when we look at the option market.

Delta Air Lines Inc (NYSE:DAL)

Selling a put is in fact an investment strategy that benefits from the stock “not going down a lot.” And while that sounds tame, if not boring, it has been far from that. Here is what selling an out of the money put has returned in Delta Airlines over the last 3-years:

That’s a 105% return while the stock was up just 37%. Further, the strategy showed 32 winning trades and 7 losing trades, for a win-rate of 82%, and that brings us to a critical point:

If a trade wins more often than the probability that is priced in, it has edge.

Here is that same thought process, but in English: A 30 delta (out of the money) put should end up in-the-money about 30% of the time (delta is roughly a measure of probability). In other words, if we sold a 30 delta put, we would expect that we could have a winner 70% of the time.

EDGE

If we can find an option strategy that has a 30 delta, but if selling it wins more than 70% of the time with a positive return, then we have edge. This is exactly what we found with Delta Airlines over three-years.

CONSISTENT

Skepticism is natural — what we need to do now is look at this short put over various time periods. We see that it has worked over the last three-years, now let’s look at the last two-years:

That’s a 65.7% return while the stock itself has been up just 9%, and again we see a win-rate above the 70% we would expect with a 30-delta option.

It’s not a magic bullet — it’s just easy access to objective data.

Finally, we look at this short put over the last six-months, these are the results:

That’s a 27.4% return while the stock has been up just 16% — and again — the 85.7% win-rate is larger than the 70% the option market was pricing in.

WHAT JUST HAPPENED

This is how people profit from the option market — it’s preparation and edge discovery, not luck.

To see how to do this for any stock or ETF and for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author has no position in While Delta Air Lines Inc (NYSE:DAL), American Airlines Group Inc (NYSE:AAL), United Continental Holdings Inc (NYSE:UAL), or Southwest Airlines Co (NYSE:LUV).