Facebook Inc (NASDAQ:) has a massive user base of over 2 billion that makes it highly attractive to advertisers.

However, given the fact that the numbers are already at sky-high levels, a relative slowdown is imminent. It is approaching full penetration in North American and European markets. Nevertheless, growth in Asia and the rest of the world should provide some cushion in the foreseeable future.

For the third quarter, the Zacks Consensus Estimate for monthly average users (MAUs) in the United States and Canada is 238 million, up a mere 3.9% from the prior-year quarter’s actual figures while MAUs in Europe are projected to be 364 million, up 6.4%.

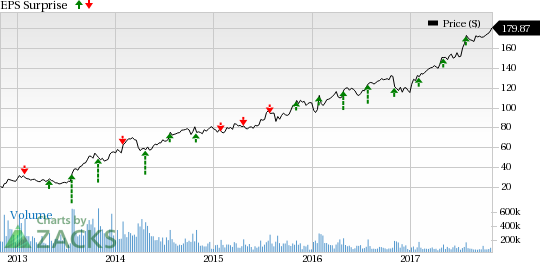

Facebook, Inc. Price and EPS Surprise

Facebook, Inc. Price and EPS Surprise | Facebook, Inc. Quote

On the other hand, the Zacks Consensus Estimate for MAUs in Asia is 782 million, up 24.3% year over year while rest of the world MAUs is projected to be 680 million, up 15.8% from the prior-year quarter’s actual figures.

The growth in these regions is primarily due to increasing use of mobile Internet, which is in tune with Facebook’s growth strategy. Consequently, Facebook is expected to see 26.4% year-over-year jump in mobile MAUs to 1.33 billion in the third quarter of 2017.

However, it is to be noted that average revenue per user from regions like Asia remains significantly below the United States and Canada and this quarter is not going to be any different. The Zacks Consensus Estimate for U.S and Canada ARPU is $20.51 whereas that for Asia ARPU is $2.23.

Instagram – Another Cash Cow

Facebook’s subsidiary platform, Instagram with its 800 million strong user base has emerged as a very important growth driver for Facebook ever since its availability to worldwide advertisers last year. It is expected to be so in the about-to-be reported quarter. Instagram’s user base primarily comprises teenagers and millennial, a very coveted demography for advertisers.

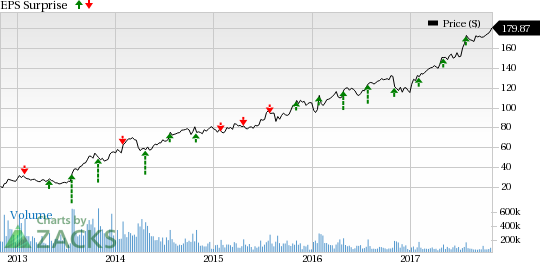

Facebook, Inc. Revenue (TTM)

Facebook, Inc. Revenue (TTM) | Facebook, Inc. Quote

This will be the second full quarter after Facebook opened Instagram Stories platform for all types of advertisers. Moreover, it is trying to make ads more effective and relevant on its platforms and has launched new ad products like Value Optimization and Lookalike Audience, which are likely to boost ad revenues in the about to be reported quarter.

However, Facebook continues to refrain from presenting exact numbers with regard to contribution from Instagram.

With Instagram, Facebook is fending off competition primarily from Snap Inc’s (NYSE:) Snapchat. Competition for ad dollars remains intense with the likes of Alphabet’s (NASDAQ:) YouTube and Twitter (NYSE:) and a host of relatively new entrants like Pinterest.

Facebook is scheduled to report its third-quarter 2017 earnings on Nov 1 after market close.

At present, Facebook sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Watch this space for more as we bring you a detailed discussion on Facebook earnings.

Wall Street’s Next Amazon (NASDAQ:)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>