So far, 2021 has not been a good year for investors in entertainment giant Walt Disney (NYSE:DIS). The shares, which trade around $172.04, are down 5.4% year-to-date. However, the stock is up over 38% in the past 12 months.

The 52-week range for DIS stock has been between $117.23 (Oct. 29, 2020) and $203.02 (Mar. 8, 2021). Since hitting a record high in March, Disney shares have lost more than 15%. The company’s market capitalization stands at $310.8 billion.

Disney issued robust Q3 FY21 metrics on Aug.12, showing revenue growth for the first time in five quarters. Quarterly revenue came in at $17.02 billion, up 45% year-over-year. Adjusted earnings per share (EPS) was 80 cents compared with 8 cents a year ago.

The company reports revenue in two main segments:

- Disney Media and Entertainment Distribution (revenue was $12.68 billion, compared with $10.71 billion in the prior-year quarter);

- Disney Parks, Experiences and Products revenue was $4.34 billion, compared with $1.06 billion in the prior-year quarter).

Investors were pleased with results from Disney’s theme parks which had suffered during COVID-related lockdowns, as well as continued profitability from Disney+ and other streaming services. During the recent quarter, the company had reopened all Disney parks around the globe.

On the results, CEO Bob Chapek said:

“We continue to introduce exciting new experiences at our parks and resorts worldwide, along with new guest-centric services, and our direct-to-consumer business is performing very well, with a total of nearly 174 million subscriptions across Disney+, ESPN+ and Hulu at the end of the quarter, and a host of new content coming to the platforms.”

Before the quarterly announcement, DIS stock was trading shy of $180. The next day, on Aug. 13, it hit an intraday high of $187.58. However, since then the shares have been choppy and have come under pressure. On Tuesday, they closed at $172.04, down about 9% since the recent high seen on Aug. 13.

Next Move In DIS Stock?

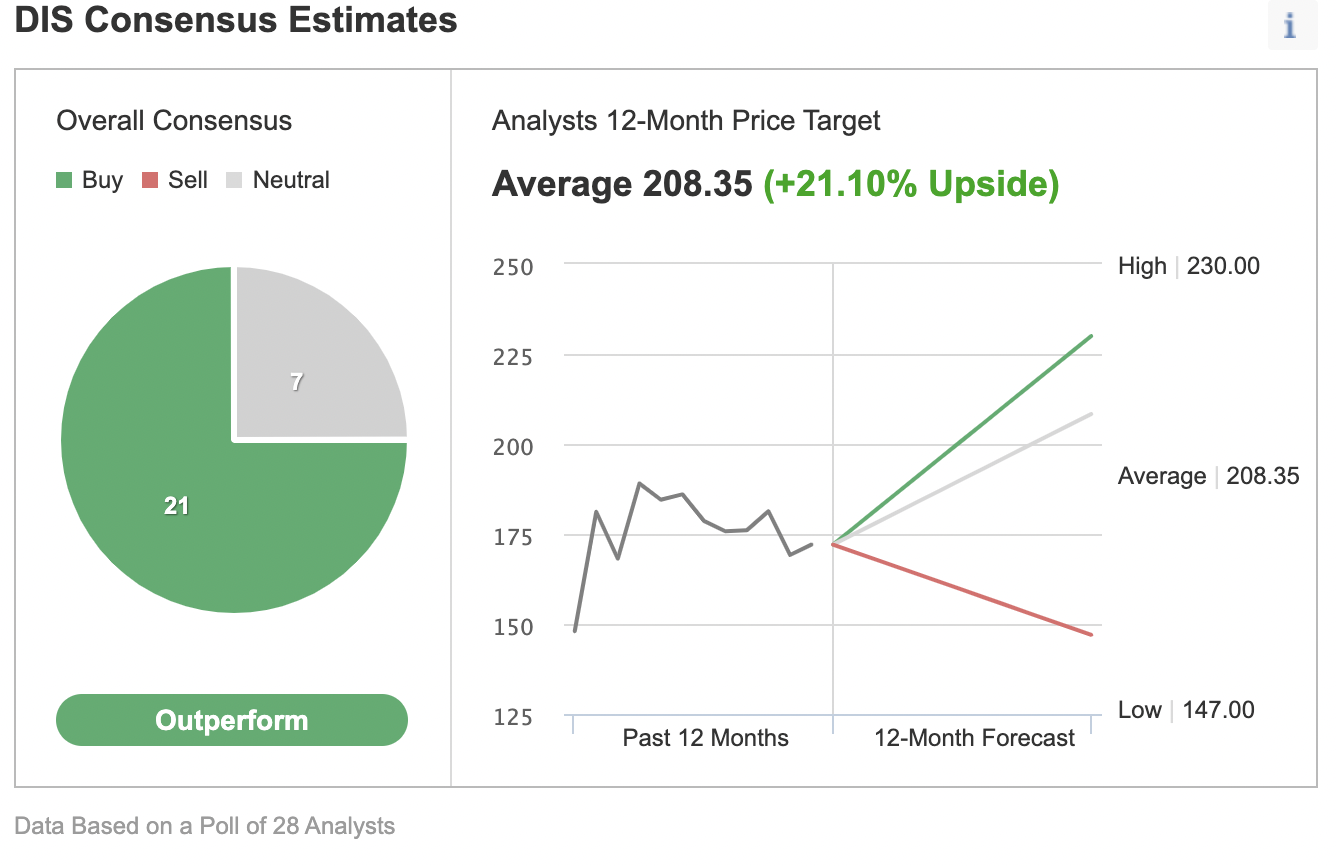

Among 28 analysts polled via Investing.com, Walt Disney shares have an “outperform” rating, with an average 12-month price target of $208.35. Such a move would imply an increase of close to 22% from the current level. The target range is between $147 and $230.

Chart: Investing.com

In other words, Wall Street is optimistic about the long-term move in DIS stock despite the recent choppiness and decline. Thus, a number of investors might consider buying the stock for their long-term portfolios. But investing in 100 shares of Disney would cost around $17,090, a considerable outlay for most people.

Meanwhile, others could still be nervous about how volatile Disney shares could become around the next earnings date of Nov. 10. Therefore, some investors might prefer to put together a "poor person's covered call" on the stock instead.

So, today we introduce a diagonal debit spread on Disney by using LEAPS options, where both the profit potential and risk are limited. Such a strategy could be used to replicate a covered call position at a considerably lower cost, and also help decrease the portfolio volatility.

Investors who are new to the strategy might want to revisit our previous articles on LEAPS options first (for example, here and here) before reading further.

Diagonal Debit Spread On DIS Stock

Current Price: $170.90

A trader first buys a “longer-term” call with a lower strike price. At the same time, the trader sells a “shorter-term” call with a higher strike price, creating a long diagonal spread.

Thus, the call options for the underlying stock have different strikes and different expiration dates. The trader goes long one option and shorts the other to make a diagonal spread.

In this strategy, both the profit potential and risk are limited. The trader establishes the position for a net debit (or cost). The net debit represents the maximum loss.

Most traders entering such a strategy would be mildly bullish on the underlying security. Instead of buying 100 shares of DIS, the trader would purchase a deep-in-the-money LEAPS call option, where that LEAPS call acts as a “surrogate” for owning the stock.

For the first leg of this strategy, the trader might buy a deep in-the-money (ITM) LEAPS call, like the DIS 19 Jan. 2024, 130-strike call option. This option is currently offered at $51.80. It would cost the trader $5,180 to own this call option that expires in about two years and three months instead of $17,204 to buy the 100 shares outright.

The delta of this option is close to 80. Delta shows the amount an option’s price is expected to move based on a $1 change in the underlying security.

If Walt Disney stock goes up $1 to $171.90, the current option price of $51.80 would be expected to increase by approximately 80 cents, based on a delta of 80. However, the actual change might be slightly more or less depending on several other factors that are beyond the scope of this article.

For the second leg of this strategy, the trader sells a slightly out-of-the-money (OTM) short-term call, like the DIS 17 Dec. 2021 175-strike call option. This option’s current premium is $4.80. The option seller would receive $480, excluding trading commissions.

There are two expiration dates in the strategy, making it quite difficult to give an exact formula for a break-even point in this trade. Different brokers might offer “profit-and-loss calculators” for such a trade setup.

Calculating the value of the back-month option (i.e., LEAPS call) when the front-month (i.e., the shorter-dated) call option expires requires a pricing model to get a “guesstimate” for a break-even point.

Maximum Profit Potential

The maximum potential is realized if the stock price is equal to the strike price of the short call on its expiration date. So the trader wants the DIS stock price to remain as close to the strike price of the short option (i.e., $175) as possible at expiration (on Dec. 17, 2021), without going above it.

Here, the maximum return, in theory, would be about $732 at a price of $175 at expiry, excluding trading commissions and costs. (We arrived at this value using an options profit-and-loss calculator). Without the use of such a calculator, we could also arrive at an approximate dollar value. Let’s take a look:

The option seller (i.e., the trader) received $480 for the sold option. Meanwhile, the underlying DIS stock increased from $170.90 to $175.00, a difference of $4.10 per share, or $410 for 100 shares.

Because the delta of the long LEAPS option is taken as 80, the value of the long option will, in theory, increase by $410 X 0.8 = $328.

However, in practice, it might be more or less than this value. There is, for example, the element of time decay that would decrease the price of the option. Meanwhile, changes in volatility could increase or decrease the option price as well.

The total of $410 and $328 comes to $738. Although it is not the same as $732, we can regard it as an acceptable approximate value.

Understandably, if the strike price of our long option had been different (i.e., not $130.00), its delta would have been different, too. Then, we'd need to use that delta value to arrive at the approximate final profit or loss value.

Here, by not investing $17,090 initially in 100 shares of Walt Disney, the trader’s potential return is leveraged.

Ideally, the trader hopes the short call will expire out-of-the money (worthless). Then, the trader can sell one call after the other, until the long LEAPS call expires in about two years and three months.

Bottom Line On DIS Stock

Pandemic months have meant tough times for Walt Disney. However, given the diversity of revenue and the resilience of operations, the company is once again seeing revenue growth. As such, we find DIS stock to be a solid choice for most portfolios, either as a buy-and-hold investment or as part of a trading strategy as in the example given above.