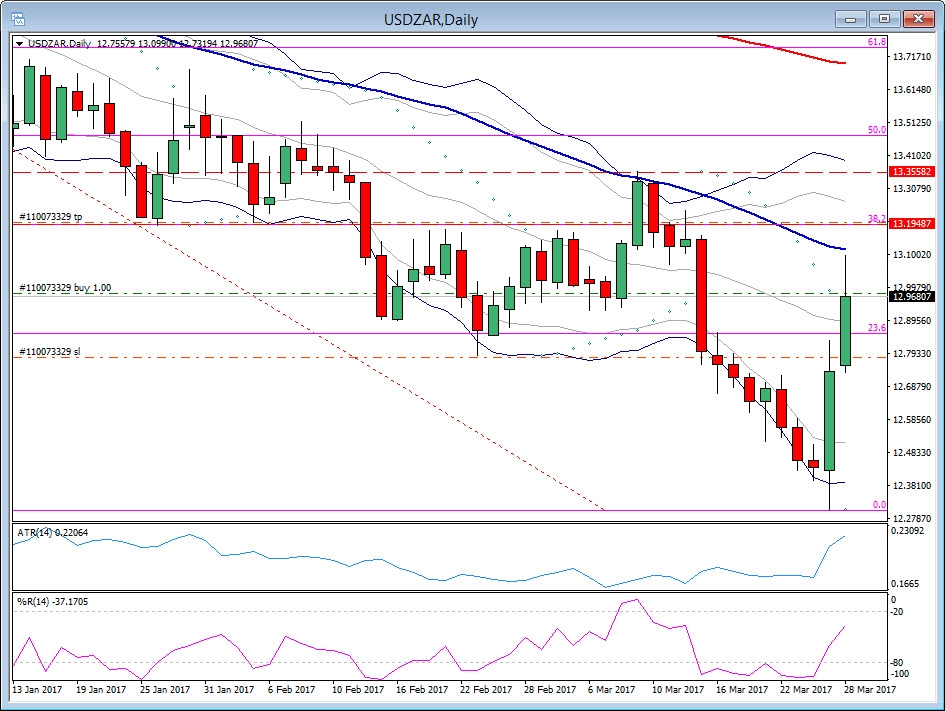

USD/ZAR Daily

Global stock markets started to stabilize yesterday and Asian markets bounced back with materials and financial companies leading the way. The dollar and Wall Street regained some composure after the storm caused by the Trump administration to achieve promised health care reforms, with investors seeing positives in Trump’s healthcare bill failure and speculate that he might also not be able to pass measures that are restrictive to global trade.

As I wrote yesterday,

Still, it is interesting to see that even though Brexit comes into view this week that the drama over the ACA was ended on Friday, the fact that the healthcare bill was canceled appears to be the major driver of today’s rally.

However, that was not the case with USD/ZAR pair, which has rallied above 13.00 driven mostly by politics in South Africa. Despite yesterday’s US dollar weakness, pair manage yesterday to be lifted to a one-week high of 12.83, which was 50 pips away from yesterday’s low, breaking the 50-day MA at 12.64.

This morning it became public through Bloomberg News that President Jacob Zuma is planning to fire his Finance Minister Pravin Gordhan, with USD/ZAR stormed higher to two-week high of 13.09 in the wake of such a scenario. The 4-hour strengthens in the USD/ZAR prompted a long position due to the break of the significant 200 period EMA at 12.96.

Hence based on the political concerns taking place in SA since yesterday, an entry was taken at 12.97. Based on a 14 day ATR number, target was set at 13.20, which is the confluence of the 38.2 Fibonacci level. Target 2 is at 13.35, which is month’s high. Additionally, the turn of Parabolic SAR yesterday and the aggressive slope of Williams’ Percentage range moving towards oversold territory, suggests a possible upward momentum.