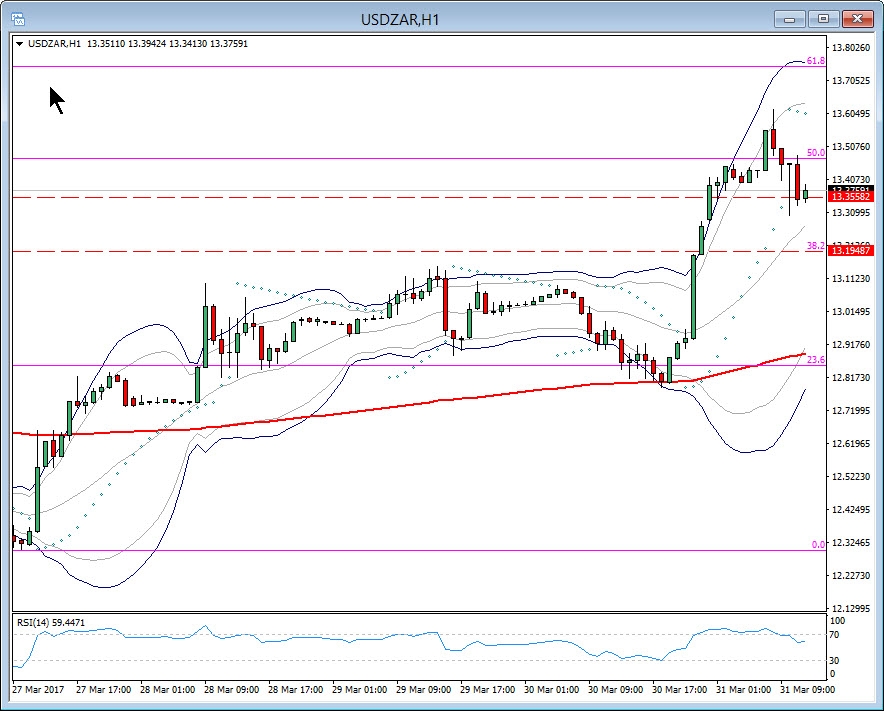

USD/ZAR, H1

On 28th of March I wrote:

This morning it became public through Bloomberg News that President Jacob Zuma is planning to fire his Finance Minister Pravin Gordhan, with USD/ZAR stormed higher to two-week high of 13.09 in the wake of such a scenario. The 4-hour strengthens in the USD/ZAR prompted a long position due to the break of the significant 200 period EMA at 12.96. Hence based on the political concerns taking place in SA since yesterday, an entry was taken at 12.97. Based on a 14 day ATR number, target was set at 13.20, which is the confluence of the 38.2 Fibonacci level. Target 2 is at 13.35, which is month’s high. Additionally, the turn of Parabolic SAR yesterday and the aggressive slope of Williams’ Percentage range moving towards oversold territory, suggests a possible upward momentum.

Both target 1 and 2 were achieved overnight and early today respectively.

The USD/ZAR rallied today to two months high of 13.61, after it became public by Reuters news that South African President Jacob Zuma has appointed Malusi Gigaba as the country’s new finance minister, replacing Pravin Gordhan, based on the statement from the president’s office just after midnight on Thursday.

After reaching the two months high, the pair in the 4- hour chart is looking to run out of steam. Hence 200 day EMA and 61.8 Fibonacci level could provide some resistance to the move up to 13.68- 13.75 area, based on daily chart review. However, the last 4-hour strong down candle closed at 13.35 displaying a possible short term bearish move, while this can be confirmed by shorter time frames. In the hourly chart, Parabolic SAR turned negative earlier when the pair rolled back to 13.30 level with 4 strong down candles, while RSI currently at 59. Additionally, a positive US data today could provide further weakness of the pair within the day.