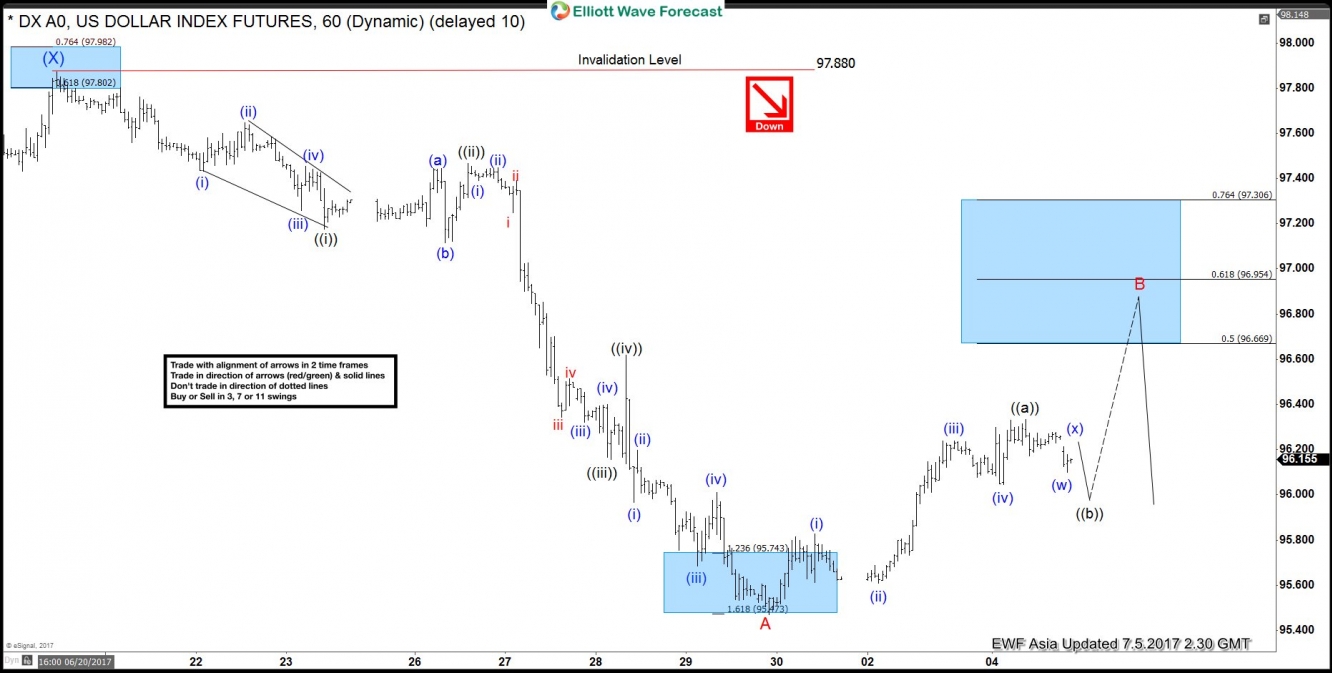

Short term US Dollar Index Elliott Wave view suggests the rally to 97.88 high on 6/20 ended Intermediate wave (X). Decline from there is unfolding as an impulse Elliott Wave structure with extension and ended at 95.47 low on 6/29. This 5 wave move could be Minor wave A of an Elliott wave zigzag structure structure, where Minute wave ((i)) ended at 97.17 and Minute wave ((ii)) ended at 97.47. Minute wave ((iii)) ended at 96.15, Minute wave ((iv)) at 96.61 and Minute wave ((v)) of A ended at 95.47.

Minor wave B bounce is currently in progress to correct cycle from 6/20 peak. The subdivision of Minor wave B is unfolding as an Elliott wave zigzag structure. Minute wave ((a)) ended at 96.33 and near term, Minute wave ((b)) pullback is in progress to correct cycle from 6/29 low in 3, 7, or 11 swing before turning higher again. While the pullback stays above pivot at 6/29 low (95.47), USDX has scope to extend higher one more leg towards 96.66 - 96.95 area to end Minor wave ((c)) of B. Afterwards, while bounces stay below pivot at 6/20 high (97.88), expect USDX to resume lower again. We don't like buying the proposed bounce.

USDX 1 Hour Elliott Wave Chart