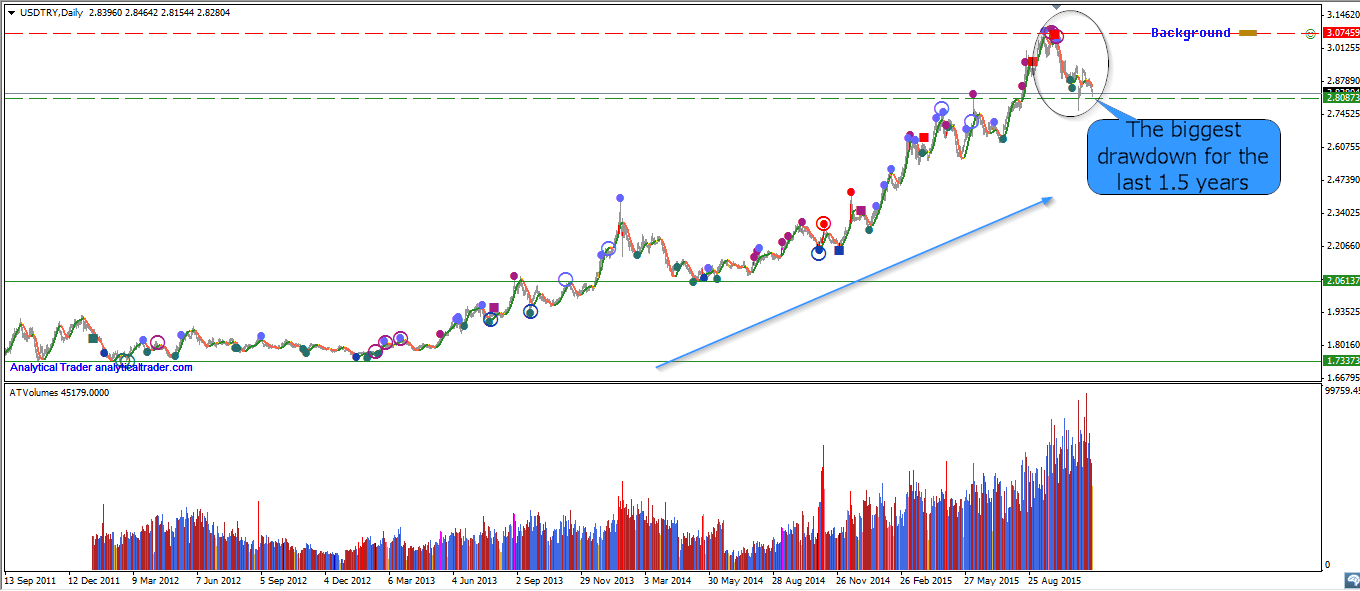

If we look at big picture in USD/TRY, we can see that Turkish lira is moving up and now we have the biggest drawdown for the last 1.5 years.

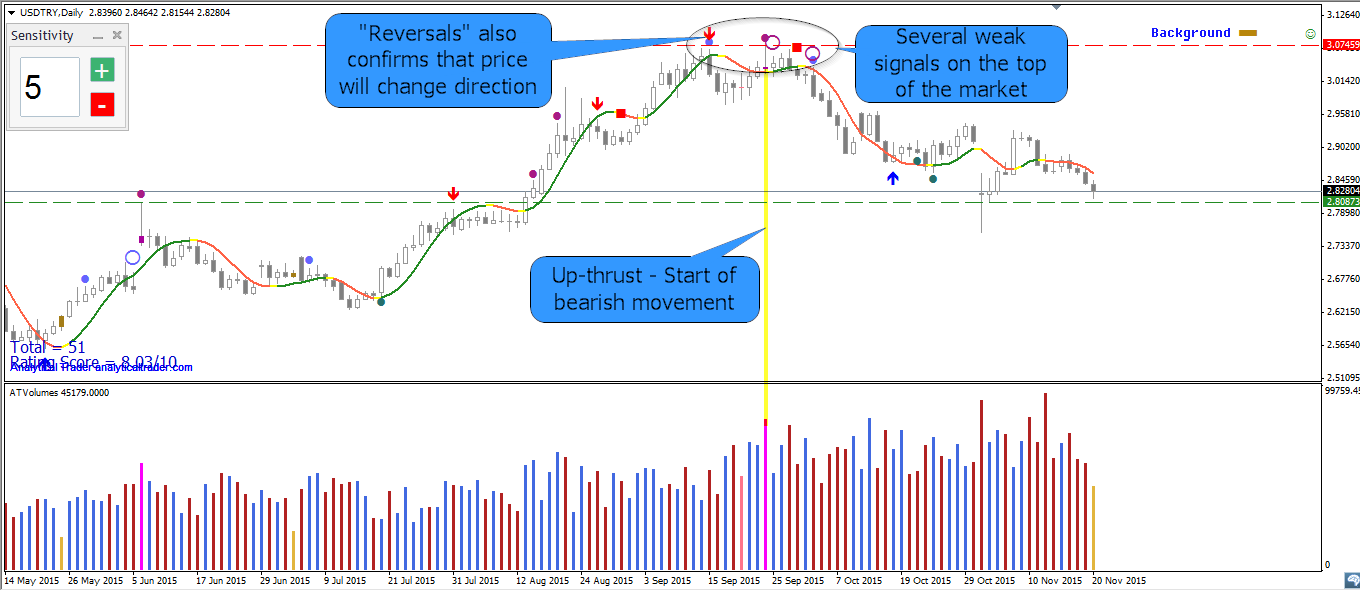

Let’s look closely at the top of the market before price changed direction. Here we see several weak signals detected by VSA indicator. Reversal is also confirming price reversal. I want to draw special attention at up-thrust bar. This is a strong bearish signal suggesting that the price will continue to fall, especially when we have confirmation – following down-bars. Up-thrust has big volume representing high activity in this point. High of this bar is higher than previous one. Weak holders often place stop orders at the level of previous high and here these orders were activated. But it seems that professionals are not interested in upward move at the moment – the bar was closed on the lows. It means that selling absorbed buying in this bar.

There is a potential stop of the drawdown in H4 timeframe – wide spread down-bar on high volume closed on the highs. Also we have a Major Demand and Reversal in this place.

It makes more difficult to profit in USD/TRY in long trades, because of swap value in this instrument: long swap is -67,6; short swap is 32,9. Therefore this instrument is interesting for Carry Trading (trade based on the different interest rates between two countries. The carry trade process involves selling currency of country with a low interest rate and using it to buy currency from a country with a higher interest rate). Therefore the drawdown is a very interesting moment to short this instrument on the top of the market or at the end of up-waves.