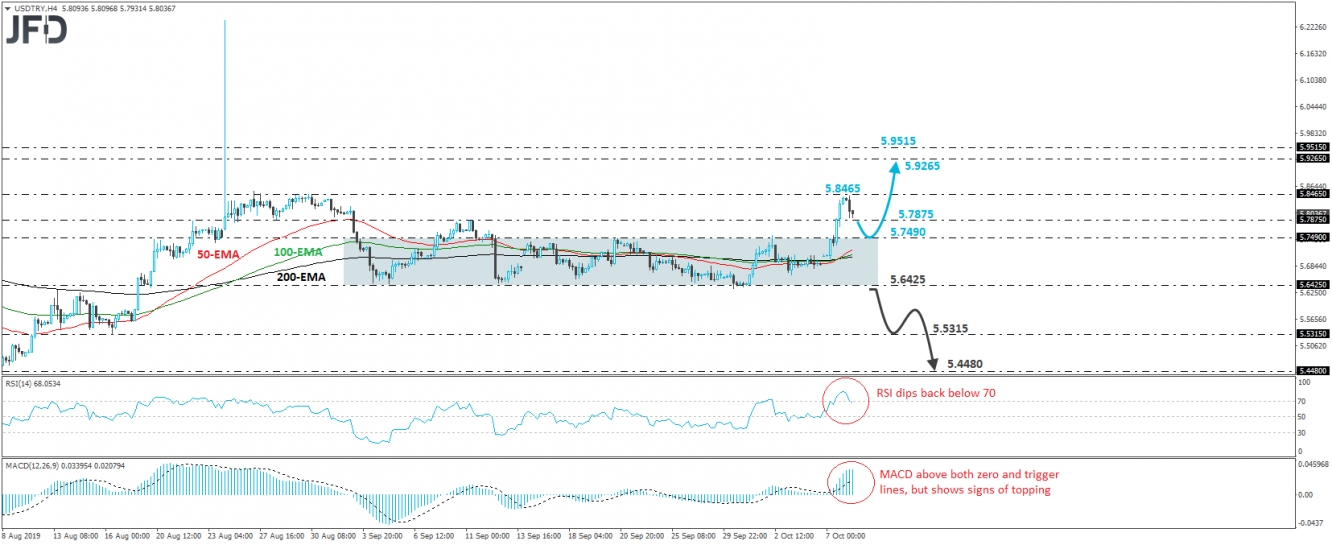

USD/TRY surged yesterday, after US President Trump said that he could destroy Turkey’s economy if it takes “off limits” actions in Syria. His comments followed the US’s withdrawal from northeastern Syria, which raised concerns that Turkey will carry out an invasion in the region. The rally brought the rate above the upper bound of the sideways range that’s been containing most of the price action since the beginning of September, with the pair hitting resistance near the 5.8465 barrier, before pulling back. As long as USD/TRY continues to trade above the upper bound of that range, we will consider the near-term outlook to be somewhat positive.

In our view, the retreat may continue for a while more, perhaps for a test near the 5.7490 zone, which is the upper end of the aforementioned sideways path. That said, the bulls may re-take charge near that zone and perhaps push for another test near the 5.8465 hurdle, which acted as a decent resistance between August 27th and 30th. If they don’t stop there this time around, a break higher would confirm a forthcoming higher peak and may set the stage for extensions towards the 5.9265 zone, which is near the high of June 14th, or the 5.9515 area, marked by the inside swing low of May 10th.

Taking a look at our short-term oscillators, we see that the RSI topped within its above-70 zone and just dipped below 70, while the MACD, although above both its zero and trigger lines, shows signs of topping as well. These indicators support our view that some further retreat may be in the works before the next positive leg.

On the downside, we would like to see a decisive break below the lower end of the range, at around 5.6425 before we start examining whether the bears have gained the upper hand. Such a dip would confirm a forthcoming lower low and could pave the way towards the 5.5315 hurdle, defined by the low of August 16th. Another break, below 5.5315, could extend the slide towards the low of August 8th, at around 5.4480.