Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

The US dollar has had a rough couple of days as the constant drumbeat of weak economic reports from the world’s largest economy starts to take its toll. Today brought another trifecta of disappointing data releases: March Building Permits came out at a 1.04M annualized rate (vs. 1.08M expected); Housing Starts were even worse at just 930k annualized (1.05M was expected); and even Initial Unemployment Claims ticked up to 294k (vs. 284k eyed and 281k previously). While none of these misses are particularly concerning in themselves, they add to the “death by a thousand paper cuts” syndrome for USD bulls.

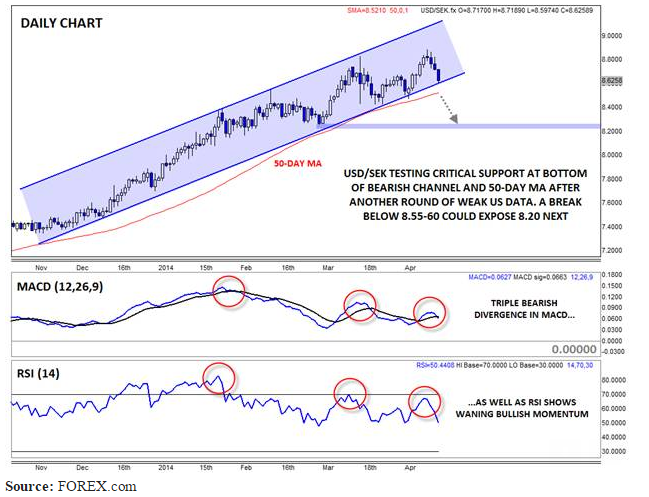

One pair that could be particularly vulnerable to further weakness in the greenback is USD/SEK. For over an entire year now, USD/SEK has been consistently trending higher above its 50-day MA, rising a staggering 35% over that period. While it’s always risky to bet against an established trend, there are a number of technical signs that the buying pressure has been losing steam over the last few months. Though they’re both still in generally bullish territory, both the MACD and RSI indicators have formed triple bearish divergences (where price made three higher highs, but the indicators each put in three lower highs); these patterns show that the buying pressure has been waning since late January and increase the probability of a medium-term top forming.

As we go to press, the exchange rate is testing support at the bottom of its bullish channel and the 50-day MA in the 8.55-8.60 zone. If these levels give way, a deeper retracement toward previous support at 8.40 or 8.25 is likely in the short term. If US economic data still cannot stabilize, the dollar could fall further as traders continue to push out their expectations of a Fed rate hike. On Sweden’s side, traders should keep an eye on Tuesday’s jobs data, where the unemployment rate is expected to tick down to 8.2% from 8.4%, providing a possible bullish catalyst for the krona.