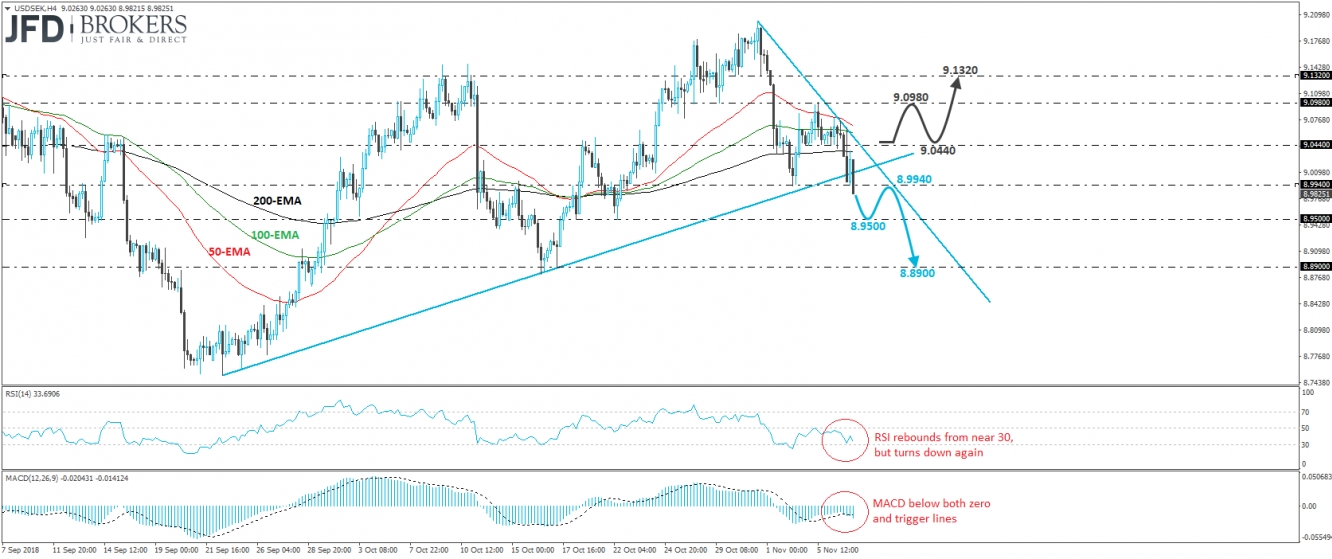

USD/SEK tumbled on Wednesday, breaking below the upside support line drawn from the low of the 24th of September. The slide also brought the rate below the support (now turned into resistance) barrier of 8.9940. Taking these signs into account, as well as the fact that the rate is now trading below a new downtrend line drawn from the peak of the 31st of October, we would consider the short-term outlook to have turned negative.

We believe that the break below 8.9940 may have opened the way for the 8.9500 territory, defined by the lows of the 18th and 22nd of October. If the bears maintain their momentum and manage to overcome that support zone, then we may see them driving the battle towards our next key support area of 8.8900.

Looking at our short-term oscillators, we see that the RSI rebounded after it hit support fractionally above its 30 line, but today, it turned down again. The MACD, already negative, has topped and fallen below its trigger line. Both indicators detect downside speed and corroborate our view for further declines.

On the upside, we would like to see a clear break above 9.0440 before we start examining whether the bears have lost the battle, at least in the near-term. Such a move could confirm the break above the aforementioned short-term downtrend line, as well as the return above the upside support line taken from the low of the 24th of September. The bulls could then target the 9.0980 zone, marked by Monday’s peak, the break of which could carry extensions towards the 9.1320 territory, defined by the inside swing lows of the 30th and 31st of October.