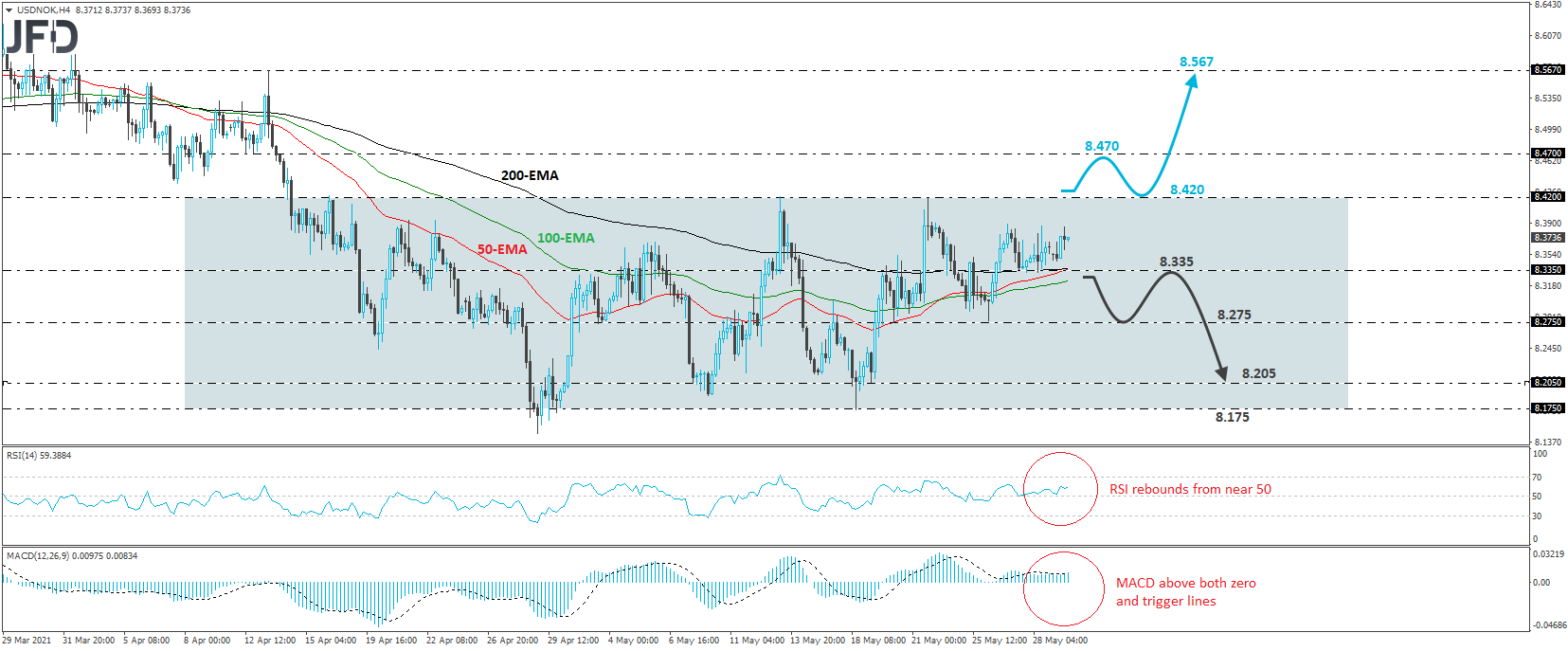

USD/NOK traded slightly higher today, after hitting support at 8.335 on Friday. Overall, the rate continues to trade within the sideways range that’s been containing most of the price action since Apr. 14, between 8.175 and 8.420. Thus, although the pair looks to be getting closer to the upper bound of the range, as long as it stays between its boundaries, we will hold a neutral stance.

In order to start examining whether the bulls have gained the upper hand, we would like to see a decisive break above 8.420. This will confirm a forthcoming higher high and may signal the exit out of the aforementioned range. We may then see the bulls targeting the 8.470 zone, marked by the inside swing low of April 12th, the break of which is likely to see scope for larger upside extensions, perhaps towards the peak of the day after, at around 8.567.

Shifting attention to our short-term oscillators, we see that the RSI turned up again after hitting support at 50, while the MACD, already positive, has just poked its nose above its trigger line. Both indicators detect positive momentum, but, as we already noted, we prefer to wait for a break above 8.420 before we turn our eyes to the upside.

On the downside, a dip below 8.335, marked by the lows of Thursday and Friday, may signal that traders of this pair want to keep it range-bound for a while more. The rate may enter a sliding mode within the range, with the first support being at 8.275, marked by the low of last Wednesday, and the next one at around 8.205, defined by the low of May 19.