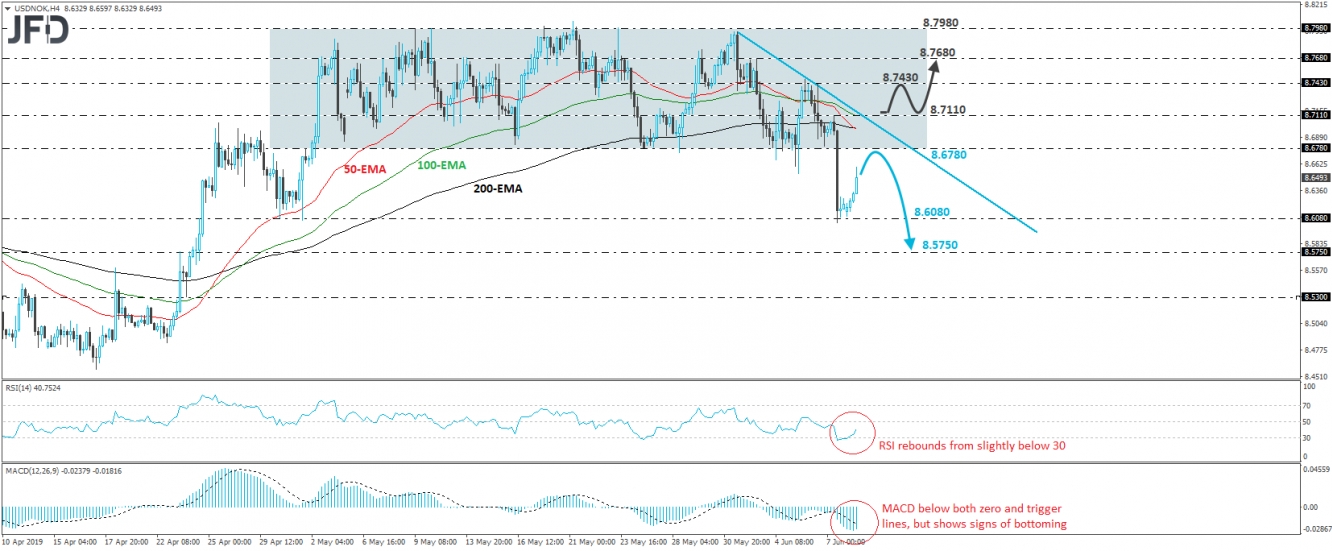

USD/NOK tumbled on Friday, breaking below 8.6780, the lower boundary of the sideways range that was containing most of the price action since May 2nd. The rate hit support near 8.6080, a hurdle marked by the lows of April 30th and May 1st, and today it rebounded. However, as long as the pair is trading below the lower end of the aforementioned range, we will hold a bearish stance and we would expect the sellers to jump back into the action sometime soon.

The current recovery may continue for a while more, perhaps for the rate to challenge the 8.6780 zone as a resistance this time. That said, the bears could take advantage of that zone and perhaps pull the trigger for another test near 8.6080. If they are not willing to hit the brakes near 8.6080, we may see the slide extending towards the 8.5750 zone, defined by the inside swing high of April 23rd.

Taking a look at our short-term oscillators, we see that the RSI rebounded from near its 30 line and now looks to be heading towards 50, while the MACD, although below both its zero and trigger lines, shows signs of bottoming. These indicators support our view that the current recovery may continue for a while more, before the bears decide to take charge again.

In order to switch back to neutral, we would like to see a decisive break above 8.7110. Such a move would also bring the rate above the tentative downside resistance line drawn from the high of May 31st, and may confirm the rate’s return within the range. The pair could then travel towards the 8.7430 area, the break of which may allow further recovery, perhaps towards the 8.7680 obstacle, defined by the high of June 3rd.