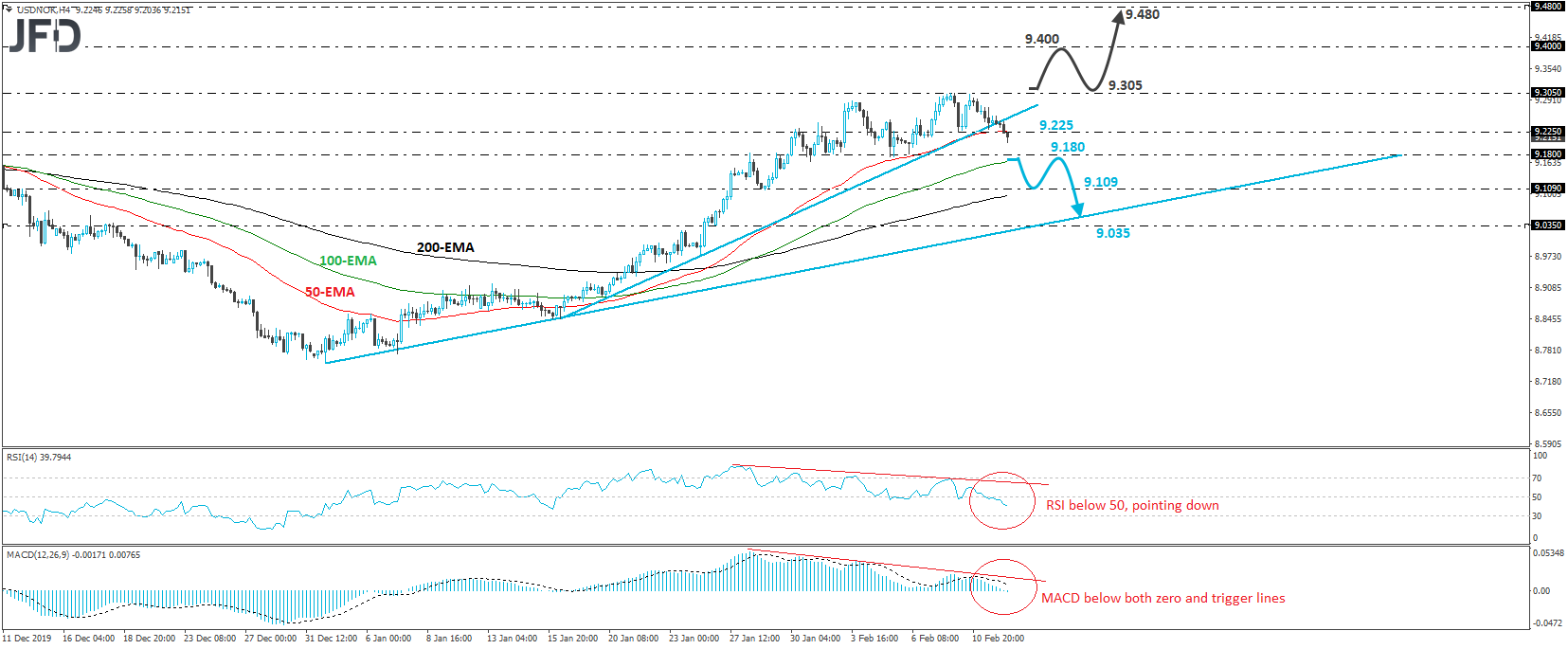

USD/NOK has been trading in a sliding mode since yesterday, after hitting resistance twice near the 9.305 zone. Today, the pair managed to clearly break below the upside support line taken from the low of January 16, suggesting that the bulls may have left the field for a while. However, in order to get confident on more declines, we prefer to wait for a dip below the 9.180 area, which provided decent support between January 31 and February 6.

If indeed the bears manage to reach and breach that hurdle, we may see them diving towards the 9.109 territory, defined as a support by the lows of January 28 and 29. If they are not willing to stop there either, we could see the slide extending towards another upside support line, drawn from the low of January 2, or toward the 9.035 barrier, marked by the low of January 27.

Taking a look at our short-term oscillators, we see that the RSI lies below 50 and points down, while the MACD, already below its trigger line, has just touched its toe below zero. What’s more, there is negative divergence between both these indicators and the price action. All these momentum signs suggest that the bears may have the necessary speed to overcome the 9.180 zone and drift south for a while.

On the upside, we would like to see a strong recovery above 9.305 before we start examining a resumption of the prevailing uptrend. Such a move would confirm a forthcoming higher high and could initially aim for the psychological zone of 9.400. Another break, above 9.400, may set the stage for advances towards the 9.480 area, near the highest point of June 2001.