Mexican Peso

The Mexican Peso has continued to weaken as uncertainty over an update of the North American Free Trade Agreement (NAFTA) continues. White House economic adviser Larry Kudlow has reported that President Donald Trump is considering separate trade talks with Canada and Mexico. Moreover, focus remains on the country’s election as the leftist presidential candidate, Manuel Lopez Obrador, is expected to reduce efforts to open up the oil industry and generate growth which not expected to be good for the currency.

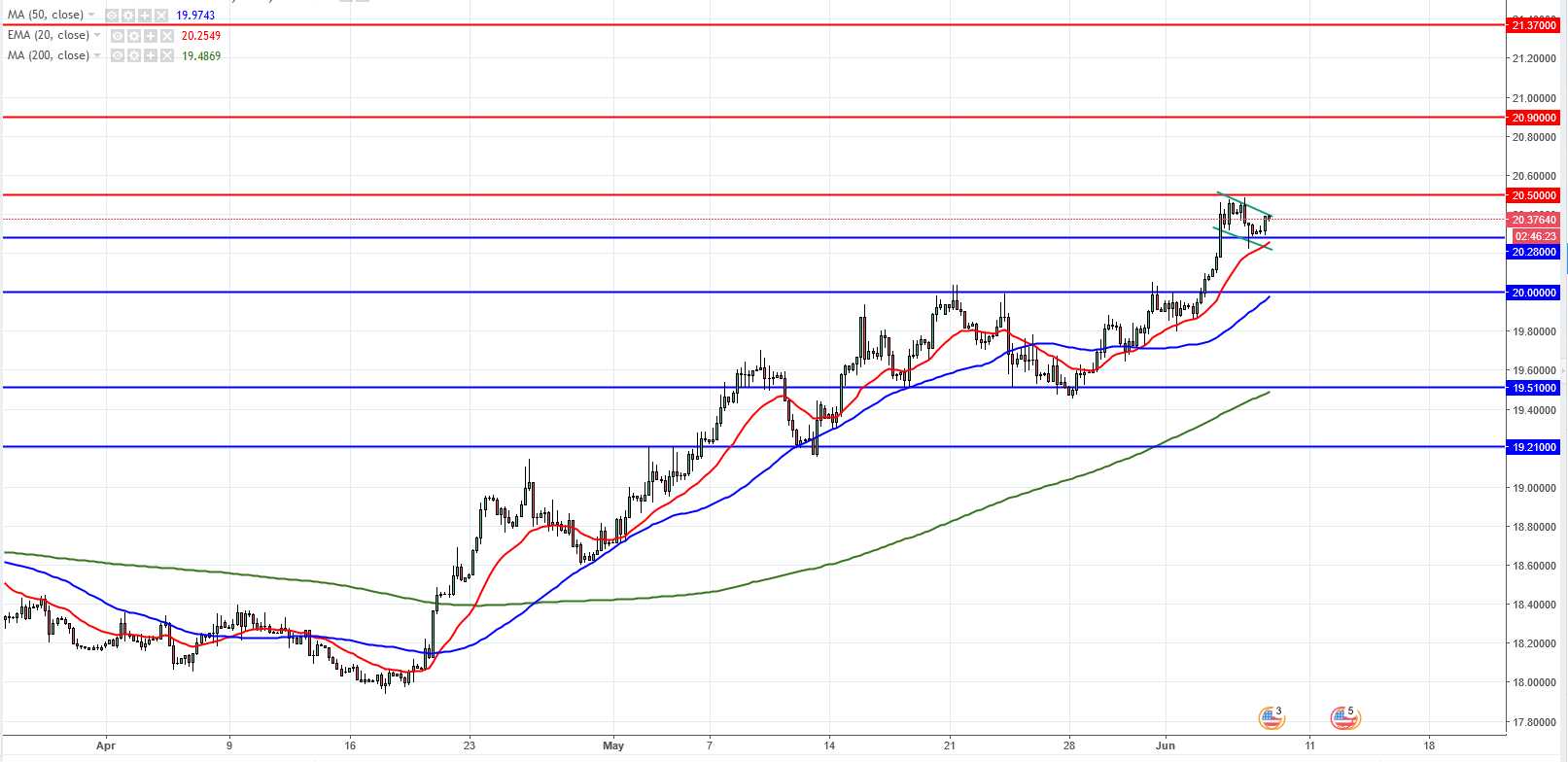

On the 4-hourly chart, USD/MXN is in an uptrend with immediate support at 20.28. A break of the potential bull flag and recent highs at 20.50 is needed for continued upside towards the target at 20.90 and then resistance at 21.37. A reversal and break of at 20.28 will find strong support at 20.00.

Turkish Lira

Today, the Turkish Central Bank has hiked interest rates once again to 17.75% against expectations of no change. The Turkish Lira is gaining on the back of the decision.

The USD/TRY pair has suffered recently from the sharp rally in the US Dollar on higher US interest rates. The Turkish economy is in the grips of rampant inflation and because it imports most of its oil, the rising cost of energy creates price pressure. However, the central bank now seems to be acting to restore its credibility and stem the free fall in the Lira.

On the 4-hourly chart, USD/TRY is attempting to break to the downside. A close below the 50% retracement from the April lows at 4.45 should see a deeper correction towards the 61.8% retracement level of 4.37. On the flip-side a reversal back above 4.54 will change the outlook with resistance at 4.63.