As the USD/JPY selling pressure continues to mount, so too does speculation that the Bank of Japan may intervene within markets to decisively weaken the yen. Subsequently, given that the pair has had such a torrid time, a review of the key points in the week ahead is now salient.

Last week was extremely negative for the USD/JPY as the pair collapsed in price from the 110.00 handle to finish the week well down around the 106.30 mark. The selloff was torrid and started following the Bank of Japan’s MPC meeting which, despite reiterating the banks desire to take action, failed to provide any easing of further QE extensions. In addition, a range of US economic data signalled some significant softening with the Advance GDP result only rising 0.5% in the last quarter. Subsequently, the latter part of the week saw a significant depreciation against the yen.

Looking ahead, markets will be largely looking towards Friday’s US Non-Farm Employment Change results in light of the broadly softer than expected US economic data. A result below the estimated 200k could see the pair fall further as the market repositions. In addition, there is plenty of speculation that if the currency declines towards the key 105.00 handle that the central bank may need to intervene to sell the Yen. Subsequently, there is plenty of scope for a volatile week ahead for the currency pair.

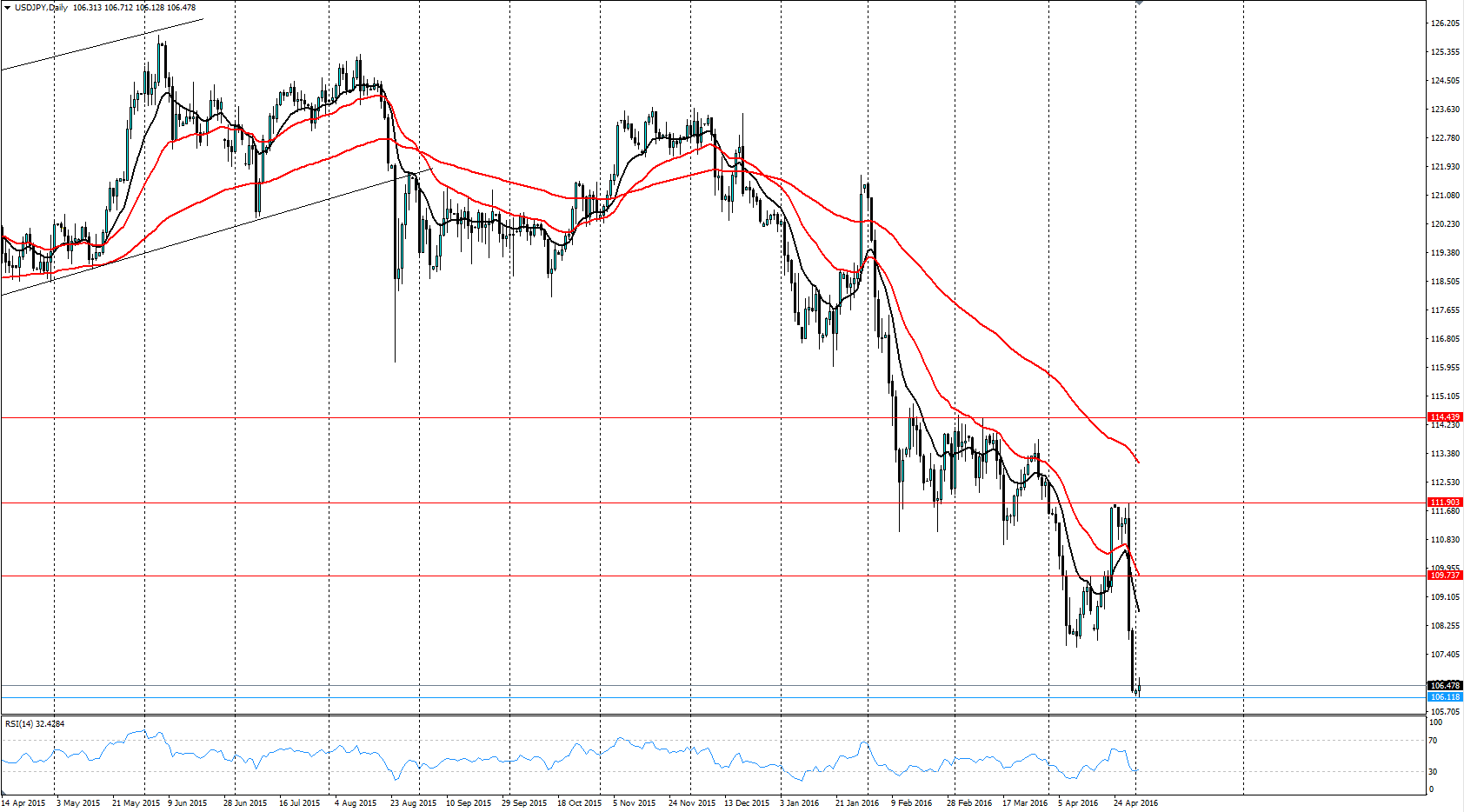

From a technical perspective, the pair largely retains its strongly bearish outlook as the rout looks to continue. In addition, the pair has declined sharply through the long term Fibonacci retracement point at 106.63 which would make the 50% point the corrective target at 100.70. However, RSI is now nearing oversold levels on the daily chart which means there could be some sideways action in the days ahead before a strong decline is recommenced. Support is currently in place for the pair at 106.11, and 105.25, and 100.91. Resistance exists on the upside at 109.73, 111.90, and 114.43.

Ultimately, the 105.00 handle is likely to be the key battleground in the coming week given the importance that the BoJ has quietly placed on that defensive level. Given the range of bearish technical indicators that are currently appearing for the currency, it is highly probable that we may see a test of that level, and the central bank’s resolve, in the coming days.