EUR/USD hit by news from France, but still above crucial support levels

Macroeconomic overview

Two hard-left candidates said on Friday they were discussing cooperation in their bid for the French presidency, jolting investors already nervous over the possibility of a win for far-right candidate Marine Le Pen. Socialist party officials and pollsters said cooperation between Benoit Hamon and Jean-Luc Melenchon was very unlikely, due partly to their policy differences, but French bond yields rose amid uncertainty over its possible impact on the election.

Investors believe a tie-up could either backfire and catapult Le Pen into the Elysee palace or succeed and land France with a far-left president pursuing deficit-boosting economic policies. A Cevipof poll published on Thursday gave Hamon, who won a primary last month to become the Socialist party's candidate, 14-14.5% in the first round of the election on April 23. Melenchon, who has Communist backing, had 11.5-12%.

They are well behind frontrunners Le Pen, centrist Emmanuel Macron and Francois Fillon of the centre-right, but a combined vote could allow one of the leftists to survive the first round and possibly face Le Pen in the decisive May 7 second round.

The EUR recovered some ground against the USD today after weekend talks aimed at finding a leftist unity candidate for France's presidential election showed little sign of progress. Policy proposals outlined by Melanchon on Sunday underscored the gap he would have to bridge with Hamon to find a common platform for the April and May polls.

Trade today will be cooled by the absence of U.S. markets for the Presidents Day holiday.

Technical analysis

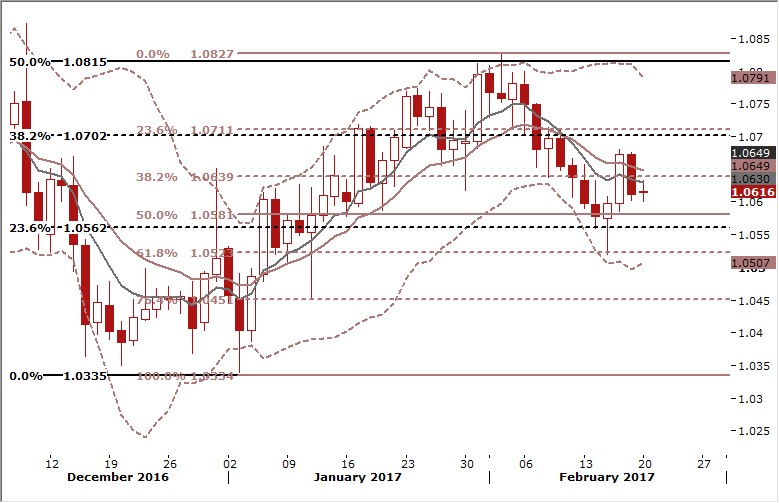

The support at 1.0600 (55-dma and the 50% fibo of 1.0522-1.0679 rise) is under threat after the 200-hma stemmed attempts to rally. However, we know that the move on Friday was mainly the result of news from France. Long lower shadow on February 15 is still an important bullish signal. A close above 7-day exponential moving average, currently at 1.0631, will boost confidence of EUR/USD bulls.

Trading strategy

We keep the short-term strategy unchanged.

USD/JPY: A close below 112.87 will unmask our short-term target at 112.00

Macroeconomic overview

Japan's exports rose in January at a slower pace than the previous month due to a decline in shipments to the U.S. and the Lunar New Year holidays. The trade balance came to a deficit of JPY 1.09 trillion vs. the median estimate for a JPY 636.8 billion deficit.

Exports in January rose 1.3% from the same period a year ago, less than the median market estimate for a 4.7% annual increase and slower than a 5.4% yoy increase in December. It is the second month in a row exports have grown, following 14 straight months of contraction.

Japan's exports to the U.S. fell 6.6% in January from a year ago, due to fewer shipments of auto and electronic parts. Stronger economic growth in the U.S. suggests the decline in Japan's U.S.-bound exports could be temporary, but U.S. President Donald Trump's repeated pledges to pull back from free trade have raised concerns that protectionism will spread.

Exports to China, Japan's largest trading partner, rose 3.1% yoy in January, slower than a 12.4% annual increase in the previous month as factories slowed production before the Lunar New Year holidays. Imports rose 8.5% in the year to January, faster than the median estimate for a 4.7% annual increase. That marked the first increase in more than two years due to a surge in imports of crude oil from Saudi Arabia and coal from Australia, the data showed.

The JPY weakened slightly after weaker-than-expected trade balance data.

Technical analysis

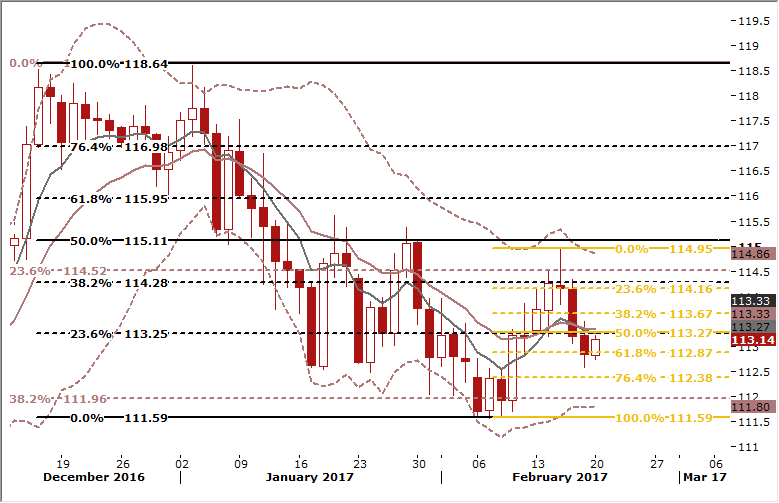

Long upper shadow on Wednesday’s candlestick line weighs heavily on the USD/JPY, adds to the underlying downside tilt. The USD/JPY broke 112.87 on Friday (61.8% retrace of 111.59-114.95 rise), but failed to register a daily below. A close below this level will open the way to 112.00.

Trading strategy

We keep our short taken at 114.20 for the short-term target of 112.00. Long-term outlook remains bearish.