- USD/JPY falls to five-week lows as US-Japan yield spreads narrow

- BoJ rate hike on Friday nearly fully priced; risks skewed to disappointment

- Key support zone near 155.00 could act as a springboard for a rebound

Summary

Narrowing interest rate differentials between the US and Japan are starting to reassert their influence on USD/JPY, driving the pair to fresh five-week lows on Tuesday.

However, early optimism over trade policy was dashed by confirmation the Trump Administration is likely to impose 25% tariffs on imports from Canada and Mexico starting in February. With a Bank of Japan (BoJ) rate hike this week nearly fully priced, could this latest slide in USD/JPY present a buy-the-dip opportunity?

Narrowing Yield Differentials Weigh

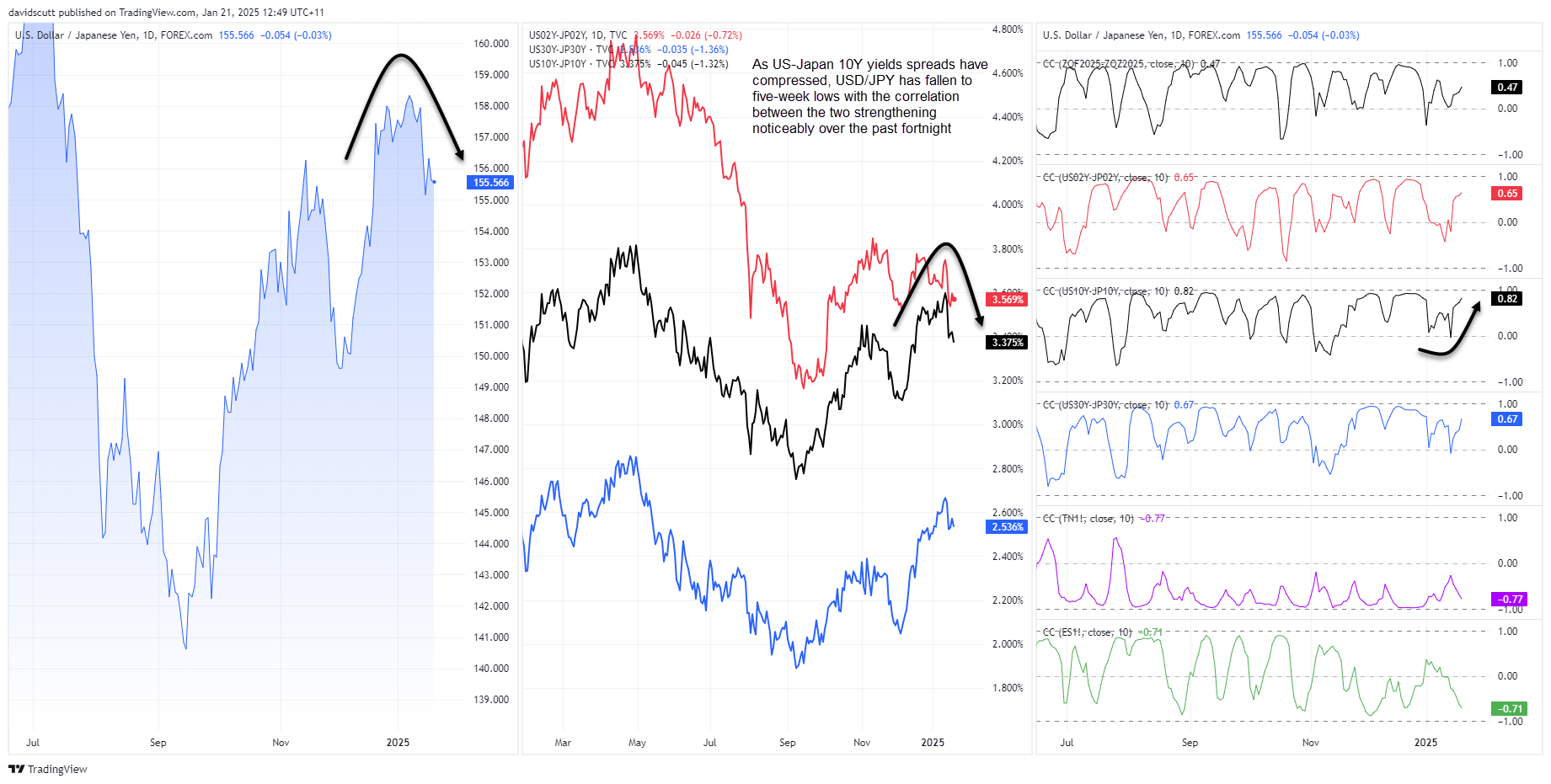

The strengthening relationship between interest rate differentials and USD/JPY is evident in the left-hand pane of the chart below, showing the rolling 10-day correlation coefficient between the two variables.

While not as strong as in some prior periods, the relationship remains robust, particularly with 10-year benchmark yield spreads where the correlation currently sits at 0.82. This suggests that narrowing yield spreads, as seen recently, have often weighed on USD/JPY.

Source: TradingView

As US-Japan yield spreads narrowed to five-week lows, USD/JPY followed suit. However, with large-scale tariffs still on the table, heightening inflation risks, the yield compression may have largely run its course for now. A continued muted market reaction to the tariff news could also provide a foundation for a USD/JPY rebound.

BoJ Hawkish Hike Needed to Prevent Yen Unwind

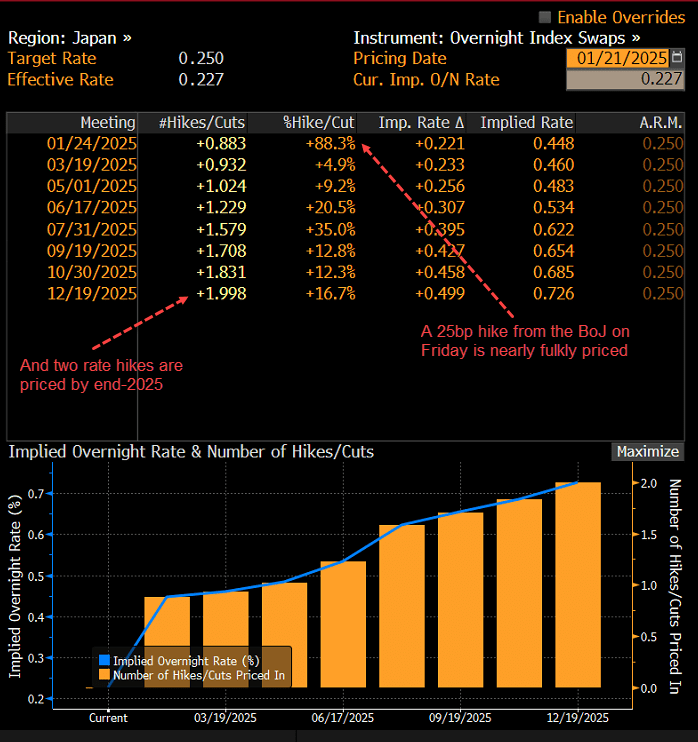

Furthering that risk, swaps markets are pricing in 22 basis points (bp) of hikes from the BoJ on Friday and two full 25bp moves by the end of 2025. This leaves the yen vulnerable to disappointment if the BoJ delivers anything less than a hawkish 25bp hike. A smaller hike, consistent with earlier moves in the tightening cycle, or no hike at all, would likely lead to a sharp weakening in the yen.

Source: TradingView

USD/JPY Nears Key Support Zone

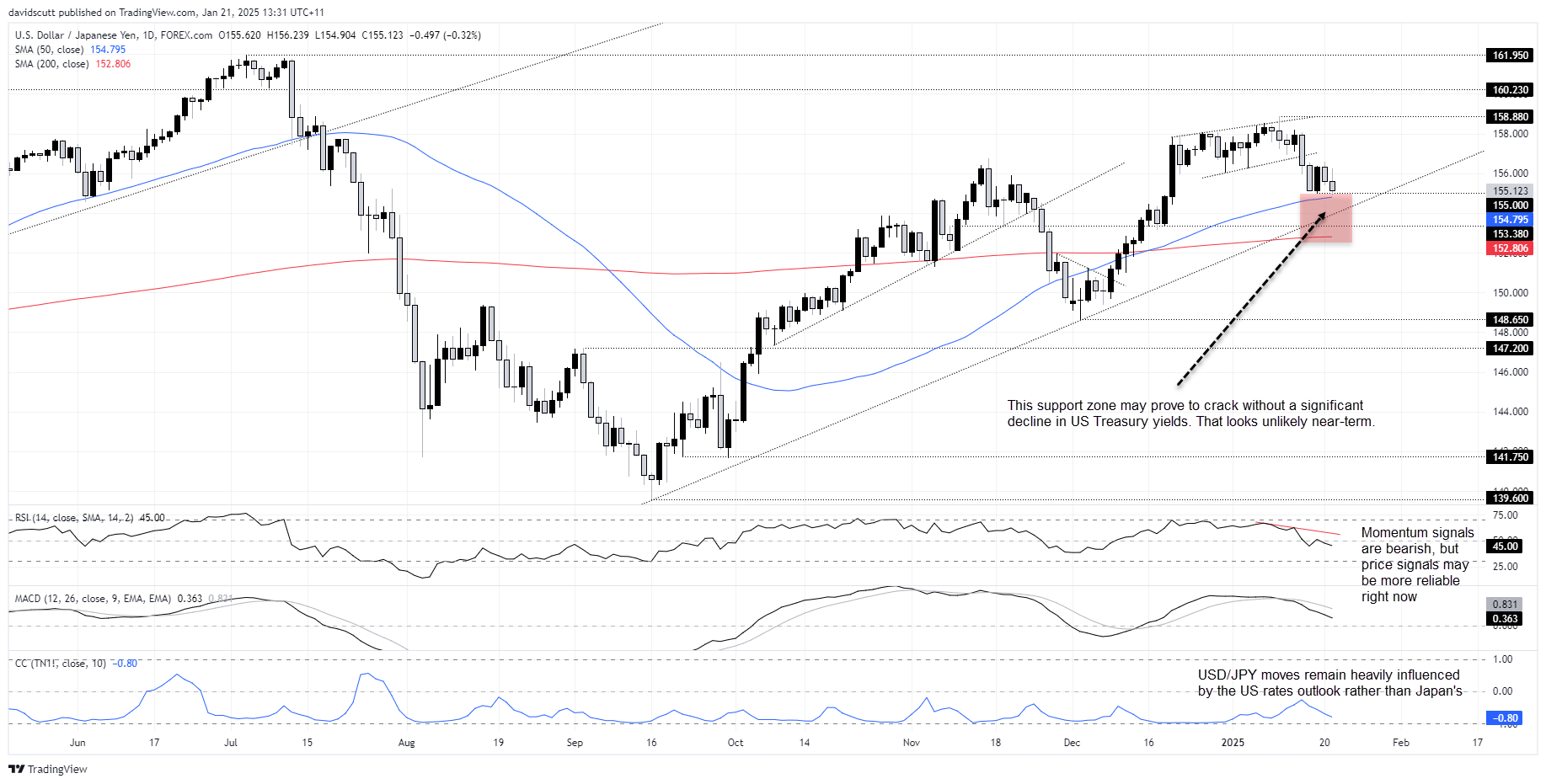

The recent USD/JPY dip has seen the pair move towards a key support zone, including minor horizontal support at 155.00, the 50-day moving average, an uptrend from September 2024, and the 200-day moving average. These levels have proven influential in the past, particularly the 200-day moving average which looms as a significant hurdle for bears unless there’s a substantial further compression in yield differentials, a scenario unlikely without a major shock event.

Source: TradingView

Absent such left-tail risks, this support zone may appeal as a logical place for stop placements for traders considering long positions. Key resistance levels to watch on the upside include 158.88, 160.23, and 161.95.

Conversely, a break and close below the 200-day moving average would shift sentiment decisively bearish, paving the way for trades seeking downside.

Momentum indicators are bearish with RSI (14) trending lower and MACD crossing below its signal line and widening. That said, in headline-driven markets such as these, price action may prove to be the more reliable indicator.