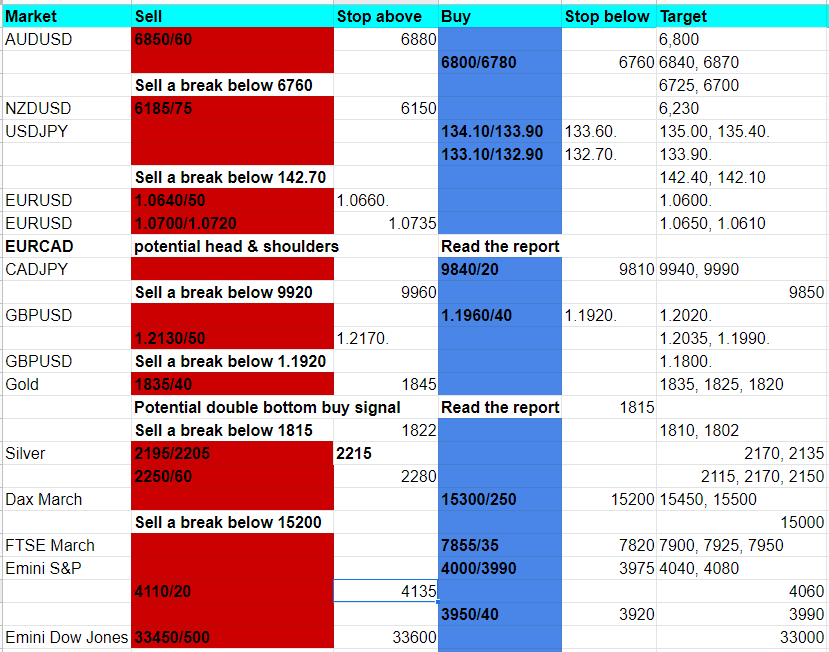

USD/JPY longs at buying opportunity at 134.10/133.90 worked perfectly as we edge slowly in the right direction to reach 135.36 but not enough to hit my target of 135.45/55.

The pair reversed to retest my buying opportunity at 134.10/133.90. A low for the day exactly here. Longs need stops below 133.60. Much better support at 133.10/132.90. Longs need stops below 132.70.

Our new longs at 134.10/133.90 have already reached 134.60. |Above 134.80 can retest 135.20/30. On a break above 135.40 looks for 135.80/90.

EUR/JPY broke first support at 143.10/142.90 for a sell signal & we did bounce to 142.91 before hitting the downside target of 142.40, but not quite as far as 142.00/141.90 for profit taking on shorts. A low for the day is 14 pips above here as I write.

AUD/USD lower as expected this week to hit very strong support at 6800/80. A low for the day exactly here again yesterday. Longs need stops below 6760. A break lower is a sell signal, of course, targeting 6725/20 today.

Our longs now target first resistance at 6850/60 for profit taking - shorts here need stops above 6880. Target is obviously 6800 for profit taking.

EUR/USD broke support at 1.0690/70 as expected for the sell signal targeting 1.0600 with a low for the day exactly at minor support at 1.0590/1.0570. So a break below 1.0560 is the next sell signal targeting 1.0510/00.

I would not be surprised to see a bounce from 1.0590/1.0570 to minor resistance at 1.0640/50. Shorts need stops above 1.0660. A break higher can target 1.0680/90 today.

USD/CAD tests 4-month trend line resistance at 1.3570/90 with a high for the day exactly here. Shorts need stops above 1.3610. A break higher is a buy signal targeting 1.3700.

Shorts at 4-month trend line resistance at 1.3570/90 can target 1.3535 (hit yesterday) & 1.3490/80 for profit taking.

Dollar Index broke above a 3-month bear trend line with the completion of a bull flag - so I think we have another buy signal for the dollar as longs as we hold the trend lines at 103.60/40.

Immediately targets for the dollar index are 105.15 & 105.80.

EUR/CAD I am going to wait to see if a head & shoulders forms.

A high for the day exactly at the 50-day moving average at 1.4440/50 helps this pattern to develop as I stated yesterday, therefore so far this pattern is starting to play out. A break below support at 1.4230/20 will be the sell signal targeting 1.4150 & 1.3980.

CAD/JPY now has a small double top as we trade sideways for a week. We made a low for the day exactly at support at 9830/20. The break below 9920 did not hold yesterday, but if we do make the break today we can target a buying opportunity at 9840/20. Longs need stops below 9800.

GBP/USD made a high for the week at strong resistance at 1.2130/50.

Our shorts here worked perfectly as we hit 1.2030/20 for profit taking.

Strong support again at 1.1960/40.

Video Analysis: