- Fed officials at the June 26th meeting saw significant upside risks

- A couple of officials wanted to keep rates on hold

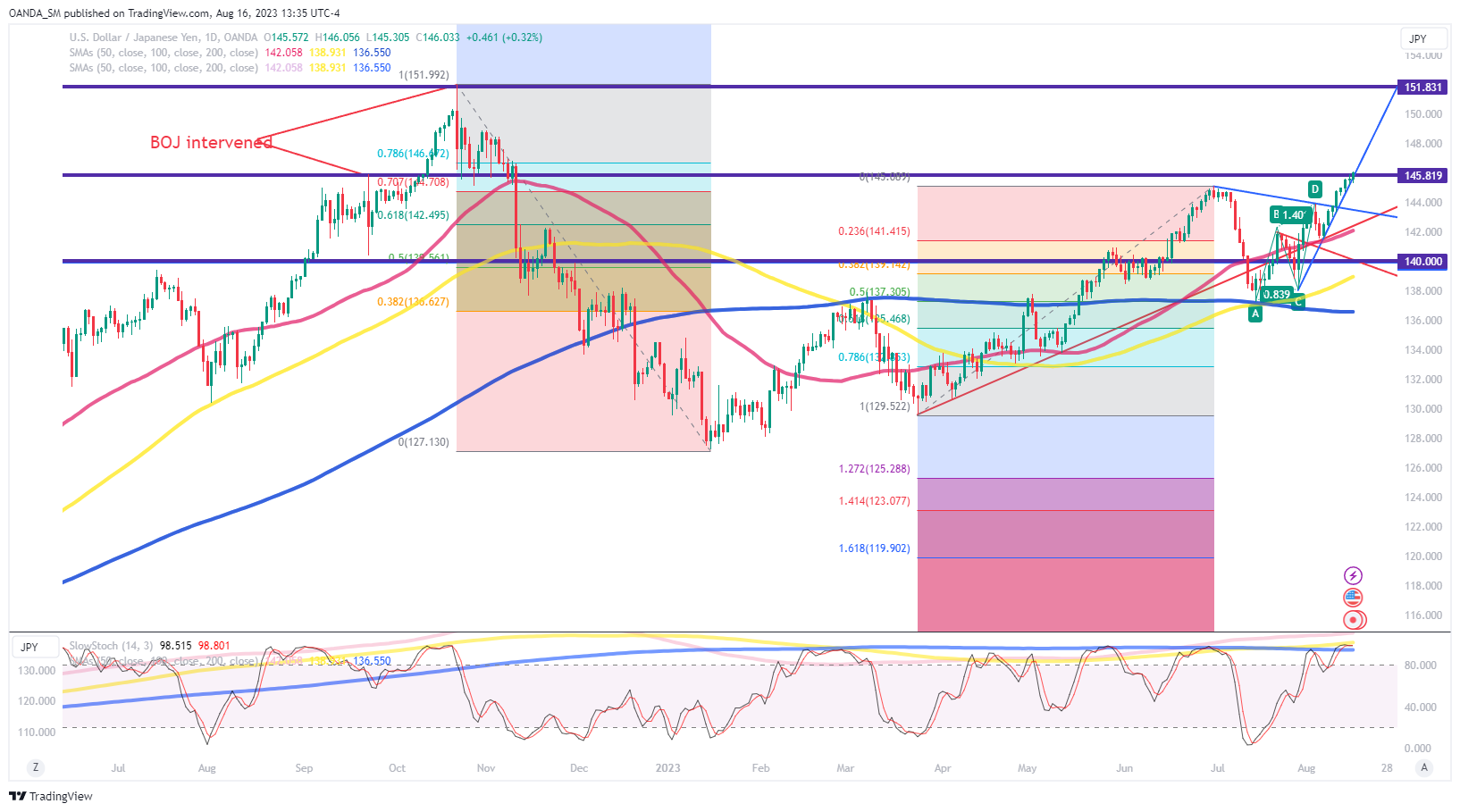

- Before the Minutes release the yen fell to levels that triggered intervention last September

At 3 am Tokyo time(2 pm NY), Japanese officials watched the yen weaken to the dollar following the release of the Fed Minutes. The US dollar index hit a two-month low as Fed officials remain worried about inflation and are still positioned to deliver more tightening. Only two Fed voters wanted to keep rates steady, which has many traders thinking that the Hawks are clearly in control.

The key sentence on inflation was

“Participants cited upside risks to inflation, including those associated with scenarios in which recent supply chain improvements and favorable commodity price trends did not continue or in which aggregate demand failed to slow by an amount sufficient to restore price stability over time, possibly leading to more persistent elevated inflation or an unanchoring of inflation expectations.”

The Minutes also noted that uncertainty about the economic outlook remained elevated and agreed that policy decisions at future meetings should depend on the totality of the incoming information and its implications for the economic outlook and inflation as well as for the balance of risks.

Fed rate hike expectations rose to just over a one in three chance of a rate hike. If the economy does not show material weakness soon, Wall Street might start believing they were too optimistic in pricing at the end of the Fed’s tightening cycle.

Japan in focus

This week, Japan Finance Minister Shunichi Suzuki said that he’s watching market trends with a “sense of urgency.” This morning, the yen fell to 149.92 against the dollar, a key level that triggered the September intervention. The key region that every FX trader has eyes on is the 150 area.

FX traders are trying to figure out what will be potential triggers for Japan’s Ministry of Finance to intervene. Yen's weakness beyond the 148 level should lead to more verbal intervention, but a collapse beyond 150 could trigger clear action.

USD/JPY will remain key FX trade for the rest of the summer as so many traders may try to capture both sides of the trade; first betting on further dollar strength, but then trying to be on the right side when Japan caves and steps into the market.