Key Points:

- USD/JPY continues to trend towards near term resistance

- Japanese economic data continues to worsen

- Watch for an upside break above resistance in the coming week

The USD/JPY was strongly bullish through most of last week as the pair reacted to the strong U.S. ISM Manufacturing PMI and Non-Farm Payroll figures. Subsequently, there was a relatively strong sentiment swing towards the greenback which saw the pair close the week sharply higher at 113.89. However, it remains to be seen if the pair can retain its bullish predilection in the week ahead. So let’s take a look at which events could shape its near term trend.

The USD/JPY continued to triumph over the past week as the pair was buoyed by some encouraging U.S. economic results. In particular, the U.S. ISM Manufacturing PMI figures surprised the market, coming in well above forecasts at 57.8, which saw the pair catch a long and steady bid. Additionally, the exceedingly strong Non-Farm Payroll figures also played a role in seeing the pair gain some traction with the benchmark posting a solid 222k gain. Subsequently, the sentiment swing towards the greenback was relatively strong and this saw the pair closing the week out around the 113.89 mark. In fact, the strong U.S. results meant that evidence of a gain in Japanese wage inflation was largely ignored by the broader market.

The coming week is likely to largely focus upon the Japanese Tertiary Industry Activity Index and the U.S. PPI results. However, the forecast for the former isn’t positive with most economists predicting that the Tertiary Industry Activity is likely to fall sharply to -0.6% m/m. In contrast, the PPI, and to a lesser extent the Core CPI, figures are expected to post robust returns which support the narrative of a U.S. recovery. Subsequently, it’s difficult to see much in the way of bullish fundamental drivers for the JPY in the week ahead.

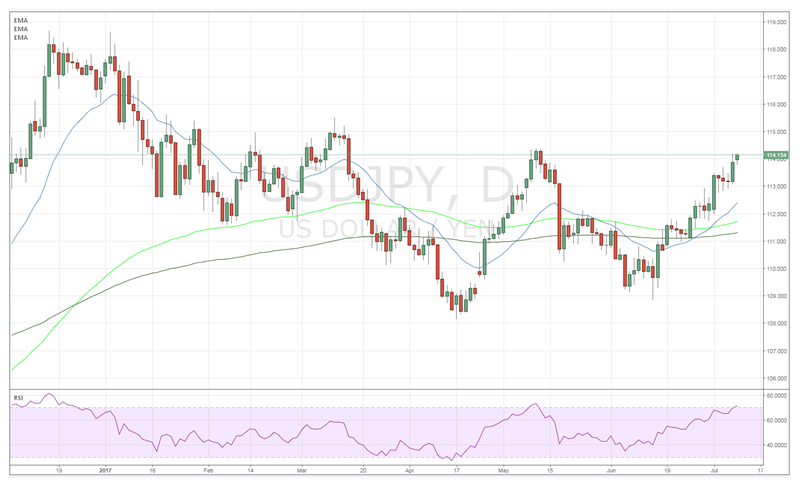

From a technical perspective, the bullish trajectory is likely to continue in the week ahead with price action making an almost linear drive towards the 114.35 high. In addition, price action currently retains its position above support at 112.88 and there appears to be no sign of topping yet. However, the RSI Oscillator has just ticked into oversold and will enter a period of reprieve at some stage. Subsequently, our bias is bullish with the caveat to watch for a potential short period of consolidation. Support is currently in place for the pair at 112.88, 111.80, and 110.50. Resistance exists on the upside at 114.36, 114.94, and 115.49.

Ultimately, the pair is likely to continue its ascent of the recent high in the coming week especially given the depth of despair that appears to be the trend for the Japanese economic data. Subsequently, keep a close watch for a breakout above near term resistance around 114.40 as this is likely to signal the start of an additional bullish leg.