- USD/JPY hovers at the 200DMA after a bullish breakout

- US inflation to guide yields and FX moves

- Strong core CPI could lift yields, boosting USD/JPY

- A miss may cap gains, inviting fresh selling pressure

Overview

USD/JPY is doing battle with the 200-day moving average on the daily charts, bolstered by a technical breakout and reversal higher in US bond yields. With US 10-year Treasury futures warning of a potential bearish reversal ahead of the US inflation report due later Wednesday, leading to higher US yields, a break above this key moving average could see a quick return to highs struck around the US presidential election.

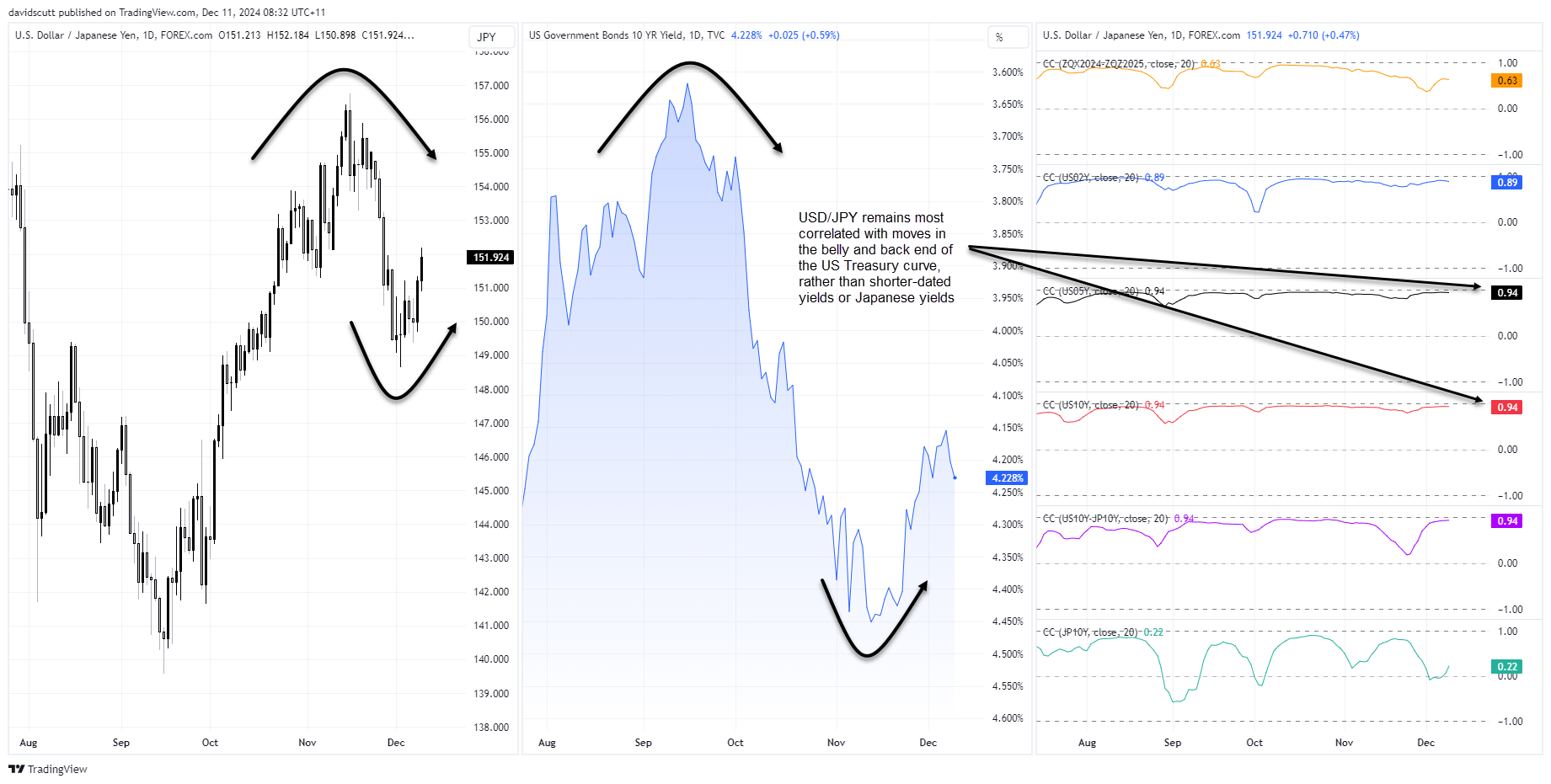

US Bond Yields Still Driving USD/JPY

Source: TradingView

USD/JPY remains tied at the hip to movements Treasury yields in the belly and back end of the US curve, with rolling correlations with 5-year and 10-year yields of 0.94 apiece over the past month. It remains a US growth and inflation-linked play, a point reinforced by the insignificant relationship with Japanese 10-year yields over the same period.

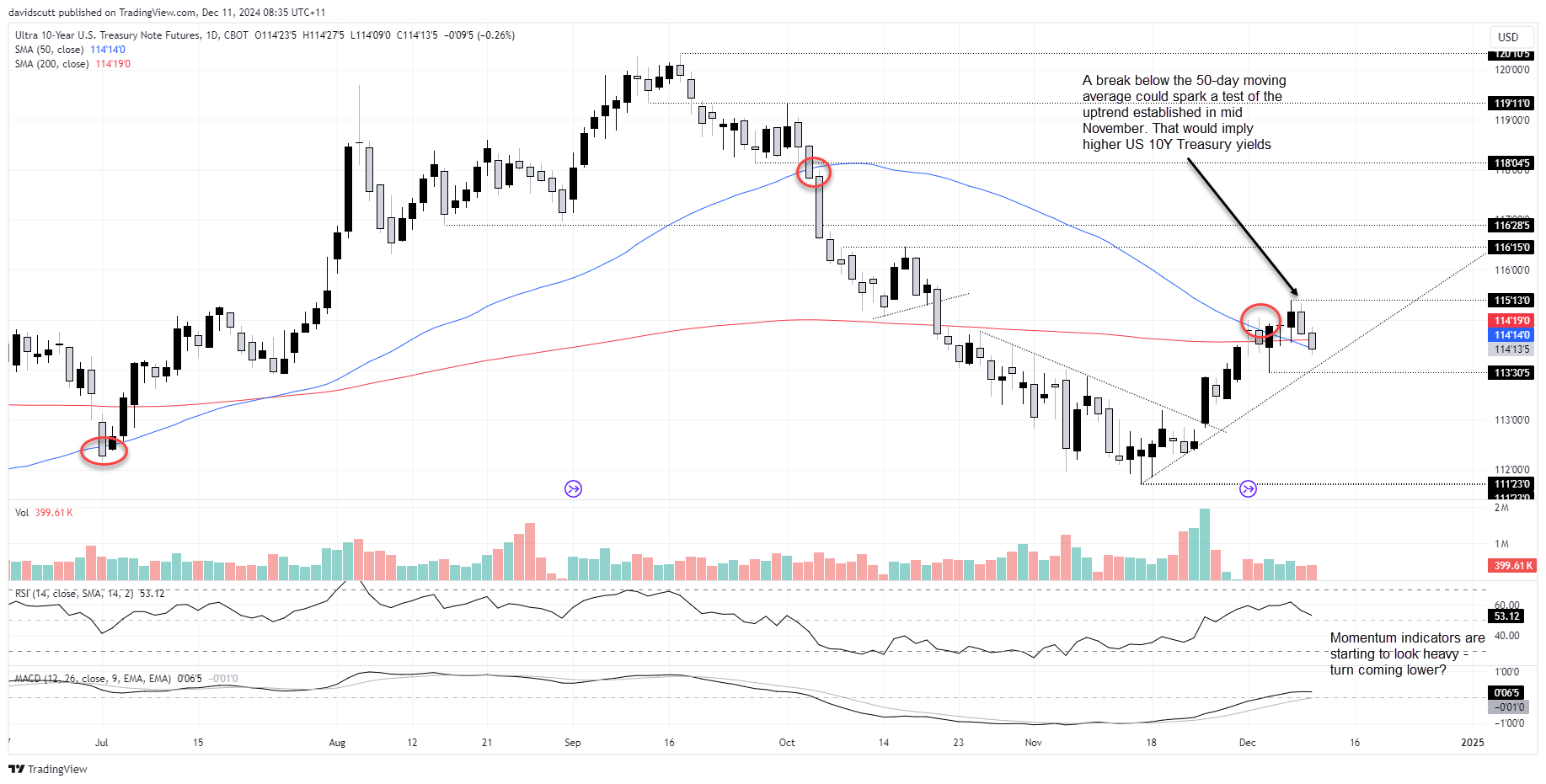

US Treasury Futures Warn of Higher Yields

Of course, it’s difficult to predict which direction US Treasury yields are likely to move before key economic data, but benchmark note futures can give you a sense as to how bond traders are thinking.

Source: TradingView

After a sustained break higher in late November, the rally in futures stalled earlier this week, seeing the price threaten to break back below the key 50-day moving average. Momentum indicators such as RSI (14) and MACD are looking heavy, and while Monday’s candle was not quite a bearish engulfing, you get the sense we may need to see a decent undershot on the core US inflation print later Wednesday to prevent a retest of the uptrend established on November 15.

As the price of futures moves inversely to yields, such a scenario would generate upside risks for USD/JPY given the strong correlation between the two variables.

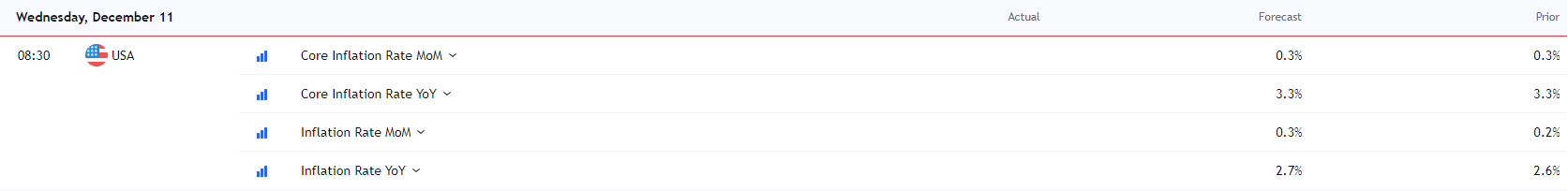

US Inflation Report a Key Risks Event

The key number to watch in the inflation report is the core reading, which strips out energy and food prices. It’s expected to print 0.3% in November, an outcome that would be the fourth identical print in a row. Whether you’re talking one or three-month timeframes, monthly prints of that magnitude annualise to 3.6%, near-double the Fed’s 2% target.

Source: TradingView

If we were to see a print in line or above expectation, especially if not dominated by shelter prices, it could easily see markets pare expectations for four Fed rate cuts by the end of next year substantially, pushing yields higher further out the US interest rate curve.

An undershoot in the core measure would deliver the opposite outcome, of course.

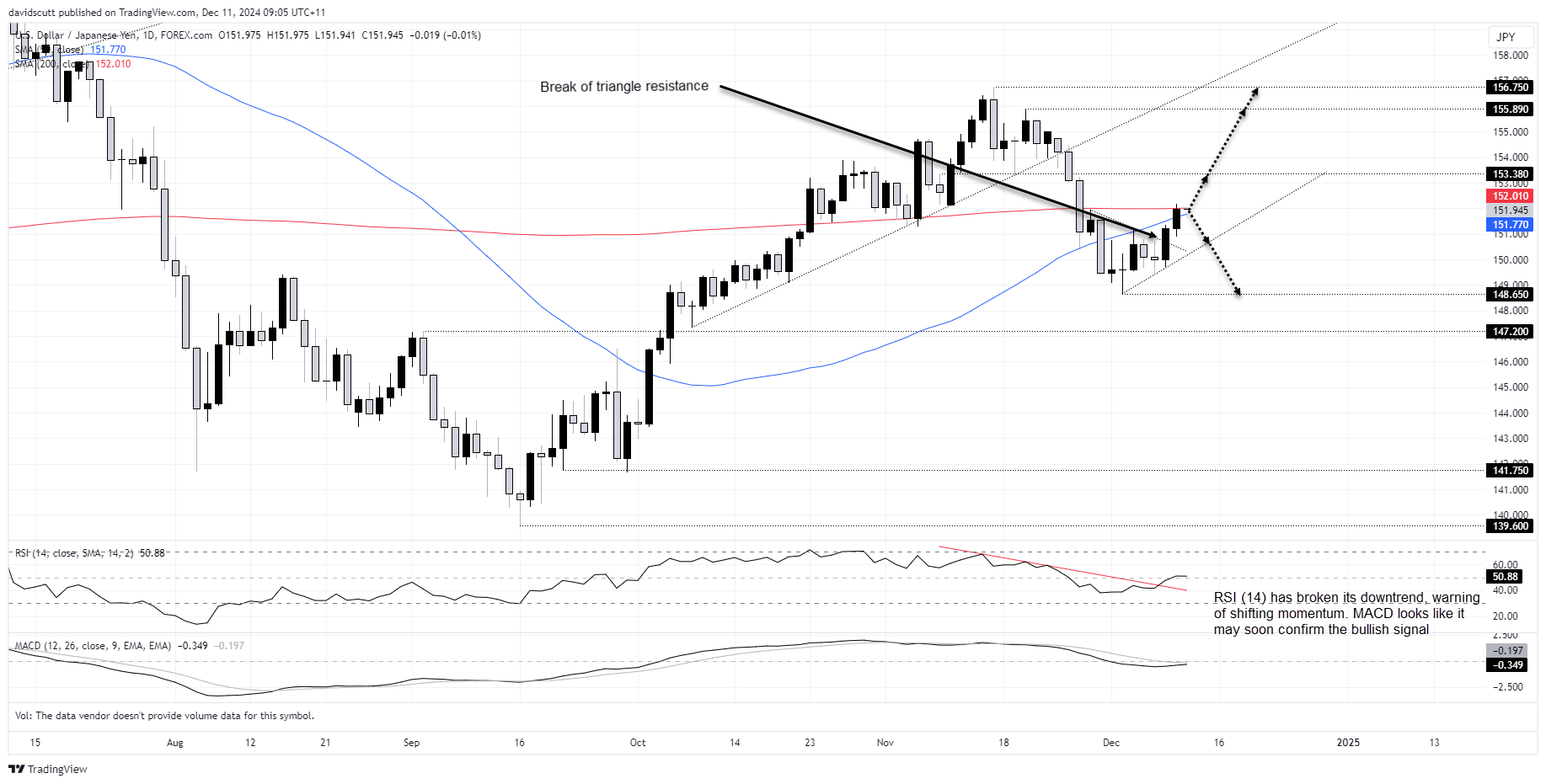

USD/JPY Tests 200DMA Following Bullish Break

Source: TradingView

Looking at the USD/JPY daily chart, both price and momentum risks appear to be turning higher. The former broke out of the symmetrical triangle pattern it had been trading in with gusto earlier this week, extending the move before eventually stalling at the 200-day moving average.

A sustained break above the 200DMA would bring a retest of 153.38 into play, a level that acted as both support and resistance during November. Above, there’s not a lot to speak of until 155.89 and 156.75.

Traders could use the 200DMA to build trade setups around, allowing for a stop to be placed on the opposite side to entry depending on how the price interacts with the level.

If the price were unable to break the 200DMA, shorts could be initiated beneath with a stop above for protection. Potential targets include former triangle support located around 150.25 today or even 148.65.