- Last week’s drop of 2.8% seen in the USD/JPY has almost reached a key support of 151.70.

- An overstretched decline with high volatility on top of an oversold condition increases the odds of a mean reversion rebound scenario for USD/JPY.

- Watch the potential upside trigger of 154.10 on the USD/JPY.

This is a follow-up analysis of our prior report, “USD/JPY: Another potential relief rally leg looms for JPY” published on 22 July 2024.

The price actions of the Japanese yen have indeed strengthened against the US dollar as highlighted in our analysis.

The USD/JPY broke below 156.50 support last Tuesday, 23 July, and plummeted by 2.8%/435 pips to hit an intraday low of 151.94, just a whisker away from the next key support of 151.70 (also the 200-day moving average).

Right now, several technical factors are potentially advocating for at least a mean reversion rebound scenario to unfold ahead of this week’s major key risk events; the monetary policy decisions of the US Federal Reserve and Bank of Japan that will take place on Wednesday, 31 July.

Overstretched Decline with High Volatility Condition

Fig 1: USD/JPY medium-term & major trend phases as of 29 Jul 2024 (Source: TradingView)

The recent three consecutive weekly losses inflicted on the USD/JPY since its 52-week high of 161.95 printed on the week of 1 July has reached a high volatility overstretched condition as depicted by the Bollinger Band Width indicator (that measures the distance of the Bollinger Upper Bands and Lower Bands).

Based on its recent speed of decline seen in the USD/JPY, it has led the Bollinger Band Width to hit a significantly high level of 7.14 at this time of the writing, its highest level since early January 2023 which also implied that the price actions of USD/JPY have hit more than two standard deviations below its 20-day moving average.

In addition, the daily RSI oscillator has remained in an oversold condition of below 30 since last Wednesday, 24 July (see Fig 1).

These observations suggest that from a statistical standpoint, the odds have skewed toward a potential minor mean reversion rebound scenario within an ongoing medium-term downtrend phase of the USD/JPY as its price actions have breached below the 50-day moving average that supported prior dips since 15 March 2024.

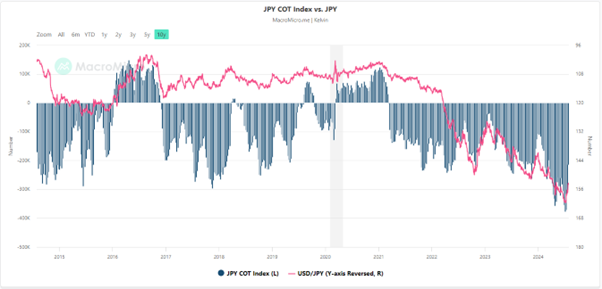

Large Speculators Have Trimmed Extreme Short Positions on the JPY Futures

Fig 2: Commitments of Trader large speculators’ net positioning in JPY futures as of 22 Jul 2024 (Source: Macro Micro)

Based on the Commitments of Traders data as of 22 July 2024 (compiled by Macro Micro), the aggregate net bearish open positions of large speculators in the JPY futures market after offsetting the aggregate positions of large commercial hedgers have been reduced by 43 percent to -215,876 contracts from a historical low of -378,768 as of 1 July 2024 (see Fig 2).

Given the reduction of large speculators’ net bearish open positions on the JPY futures from a prior extremely high level, the “fuel tanker” for another potential short squeeze has not been replenished yet, which in turn lowers the odds of another leg of rally in the JPY against US dollar at this juncture.

Watch the 154.10 Near-Term Resistance on the USD/JPY

Fig 3: USD/JPY short-term trend as of 29 Jul 2024 (Source: TradingView)

In the hourly chart of the USD/JPY, the recent two days of bounce since last Thursday, 25 July have faced a near-term ceiling at 154.10 (also the upper boundary of the minor descending channel from 11 July 2024 high) (see Fig 3).

A clearance above 154.10 increases the odds of the mean reversion rebound scenario for the next intermediate resistances to come in at 155.80/156.50 and 157.70.

However, a break below the 151.70 pivotal support invalidates the mean reversion rebound scenario for the continuation of the impulsive downmove sequence of the medium-term downtrend phase to expose the next intermediate supports of 150.80/40 and 150.00/149.50 in the first step.