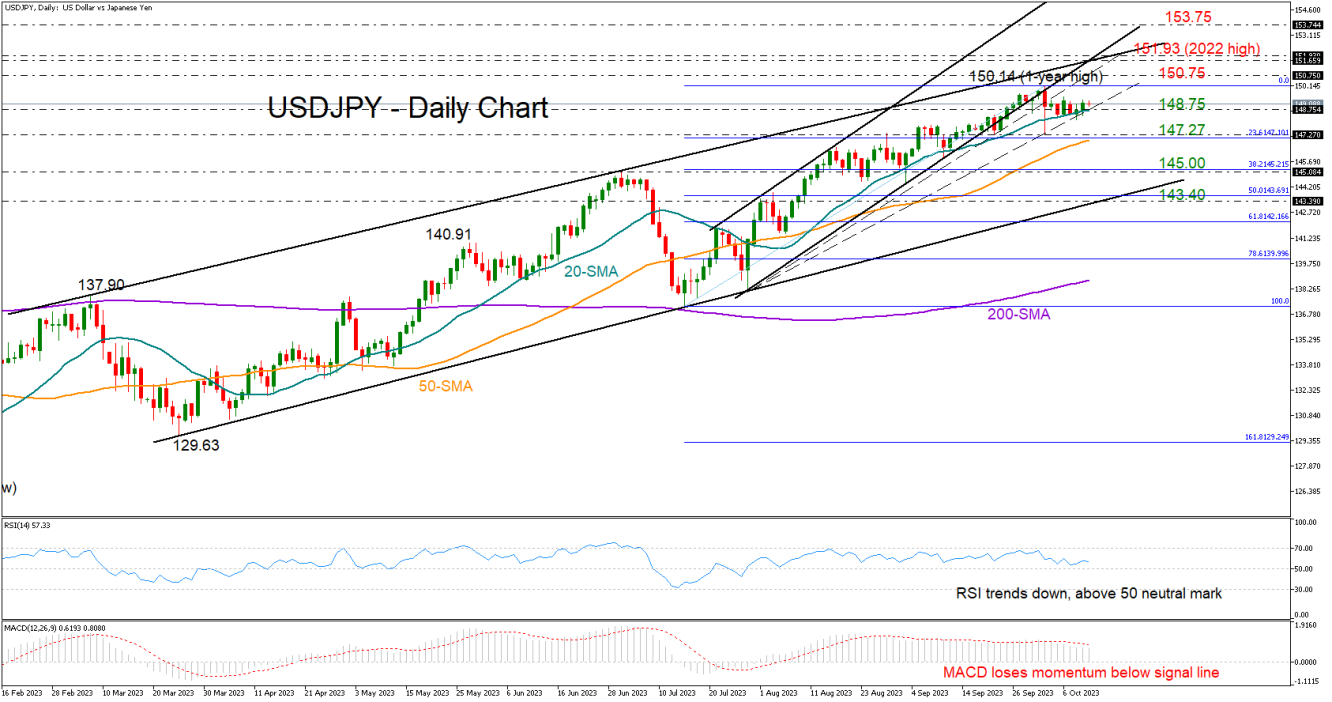

USDJPY keeps its footing on 20-day SMA at 148.75

Broad uptrend intact, but technical signals warrant some caution

USDJPY remains range-bound around its 20-day simple moving average (SMA) for the sixth consecutive trading day as investors eagerly wait for September’s US CPI inflation report due at 12:30 GMT.

Despite the resilience in the price, the RSI and the MACD cannot warrant a bullish reversal. The former, although above 50, keeps trending southwards, while the latter is also decelerating below its red signal line. Furthermore, the candlestick arrangement at the uptrend's high resembles a bearish hanging man pattern, suggesting an upcoming market downturn.

If the floor around the 20-day SMA at 148.75 collapses, the pair could dive to meet its 50-day SMA near 147.27. The 23.6% Fibonacci retracement of the latest upleg is within the neighborhood. Hence, a step lower could confirm an extension towards the 145.00 constraining zone, where the price peaked in June. A defeat there would distort the positive trend in the market, though only a slump below the broad bullish channel at 143.30 would indicate a bearish change in the trend.

Alternatively,another positive close above the 20-day SMA could lift the price into the 150.75-151.65 key resistance zone. A bullish channel breakout above the 2022 high of 151.93 could prompt an advance towards the 155.30-156.15 restricted zone and the ascending line from June, unless the 1987 barrier of 153.75 blocks the way up.

In brief, the technical short-term outlook has not improved so far this week, but a key support area is still solid at 148.75. Any declines below that threshold could put sellers in the driver’s seat.