- USD/JPY erases recent rebound as US-China tensions intensify

- Short-term signals are negative, eyes on support trendline near 143.85

USD/JPY will be closely watched in the coming sessions, as the FOMC meeting minutes and Thursday’s US CPI inflation data may generate fresh volatility in the depreciating market.

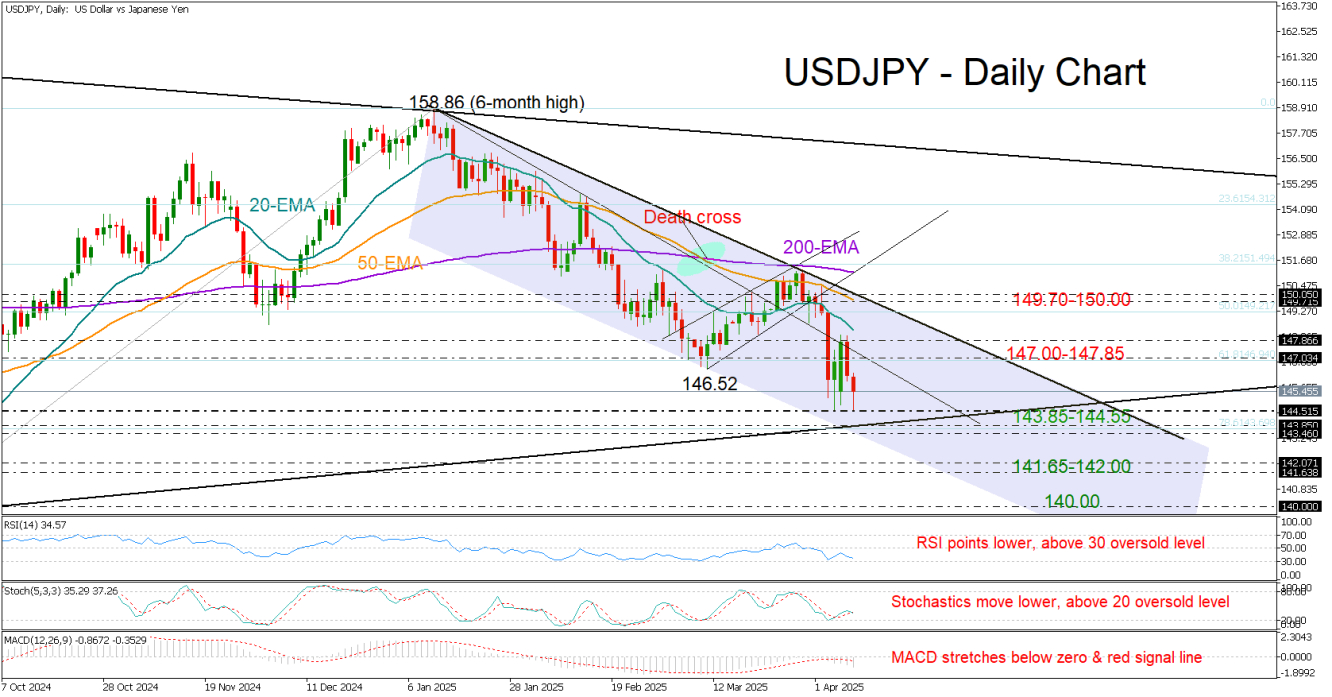

The key question is whether a pivot is imminent, as the price hovers just above the tentative support trendline that connects the 2023 and 2024 lows near 143.85. Still, last week’s failed bullish attempt and the negative slope in the RSI and stochastic oscillator - which have yet to bottom out in the oversold zone - suggest that the bulls are not waiting around the corner.

If the 143.85 floor - where the 78.6% Fibonacci retracement of the previous up-leg lies - breaks, the selloff could accelerate toward the descending line from February, seen within the 141.65–142.00 zone. Even lower, the next battle could unfold somewhere between the psychological 140.00 mark and the 2024 low of 139.56.

If the bulls make a stand within the 144.55–144.85 area, they may initially target the 147.00–147.85 territory. The 20-day exponential moving average is also nearby, and if it gives way, the recovery phase could extend toward the 50-day EMA at 149.70 and the key 150.00 round level.

Overall, USD/JPY remains exposed to its 2025 downward trajectory. Having recently posted a new lower low, the pair may face further downside according to the technical signals - unless the protective trendline at 143.85 manages to absorb the selling pressure.