- BoJ Summary of Opinions takes note of higher inflation

- US job report a mixed bag

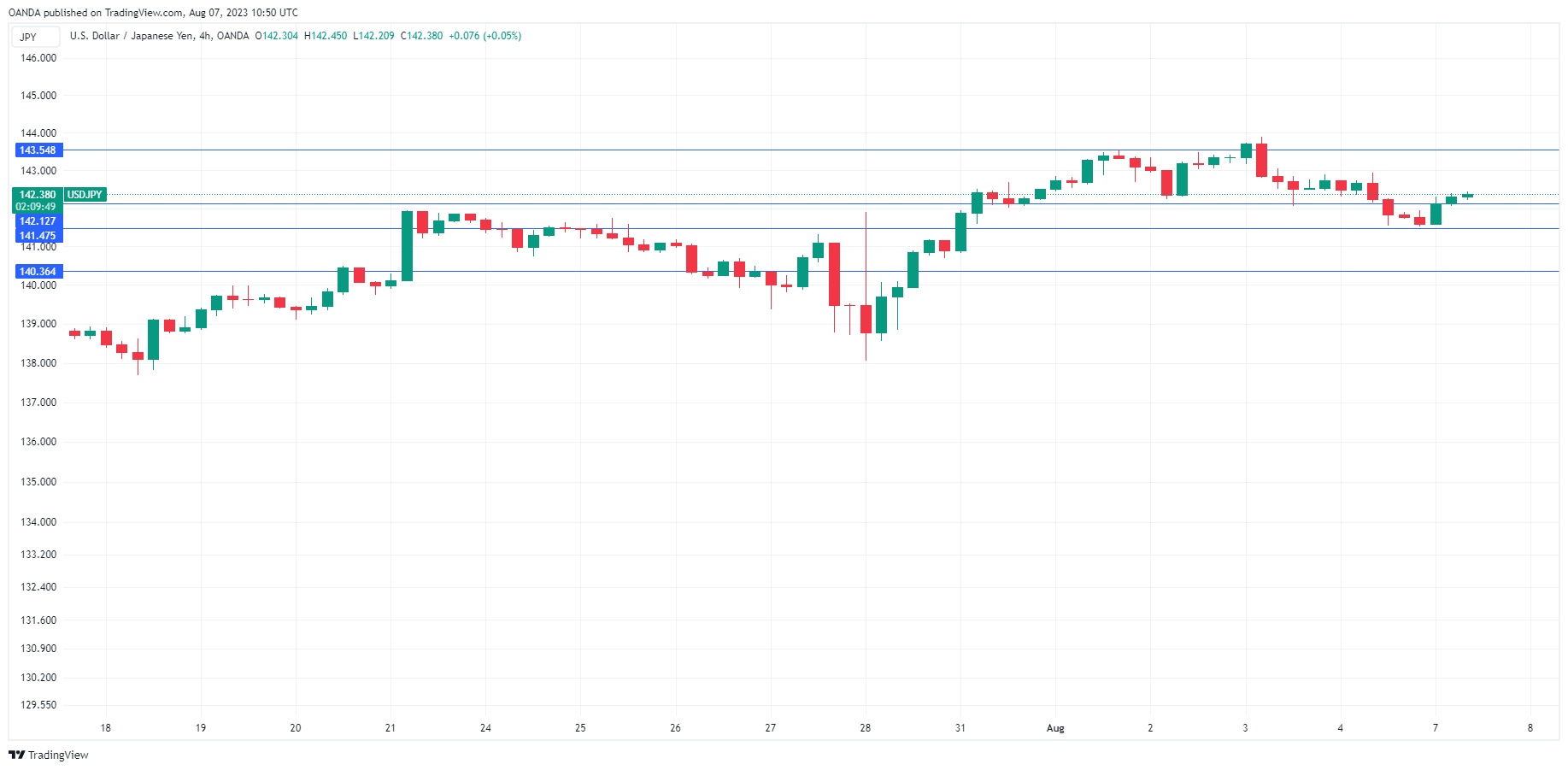

The Japanese yen has started the week in negative territory. In the European session, USD/JPY is trading at 142.36, up 0.42%.

BoJ says monetary easing to continue

Inflation continues to be a key issue for the Bank of Japan, although it is much lower than in other major economies, at around 3%. Still, inflation is above the Bank’s 2% target and this continues to raise speculation that the BoJ will have to tighten policy sooner or later. The BoJ has pushed back against talk that it will tighten, and when the central bank recently made its yield curve control (YCC) more flexible, Governor Ueda was careful to stress that the step did not represent a move towards normalization.

Against this backdrop, the BoJ released its Summary of Opinions earlier today. The members reiterated the necessity to keep an ultra-easy monetary policy in place, but some members noted that inflation and wages could continue to increase. One opinion went as far as to state that 2% inflation “in a sustainable and stable manner seems to have clearly come in sight” and urged the BoJ to make YCC more flexible. This BoJ internal conversation could be a signal that policymakers are slowly acknowledging that inflation, which has been above the 2% target for months, may be sustainable. That would mark a sea change in the BoJ’s thinking and could have major ramifications on the exchange rate.

The US employment report for July was a mix. Nonfarm payrolls were soft at 187,000, despite a banner ADP release which fuelled expectations of a breakout nonfarm payrolls release. Job growth is slowing, but the unemployment rate ticked lower to 3.5% down from 3.6%, and wage growth stayed steady at 4.4%.

After the Fed’s July rate hike, what’s next? The money markets are expecting the Fed to take a pause at the September meeting, with a probability of 84%, according to the FedWatch. It’s entirely possible that the Fed is done with tightening, but that will depend to a large extent on the data, particularly inflation and employment reports.

USD/JPY Technical

- USD/JPY is testing resistance at 142.12. Above, there is resistance at 143.55

- 141.47 and 140.36 are providing support