The USD/JPY pair climbed to 150.37 on Wednesday, indicating a fading correction from the previous session as trading volumes declined.

Key Drivers Behind the USD/JPY Surge

Investors are shunning risk ahead of potential US retaliatory tariffs, which could weigh on Japanese exports – a key pillar of the economy. Meanwhile, demand for risk assets, including equities and commodities, has further eroded support for the safe-haven yen.

The Bank of Japan’s (BoJ) January meeting minutes, released earlier, revealed policymakers’ willingness to consider further rate hikes, contingent on wage growth and inflation trends. One member even suggested rates could reach 1% in the second half of fiscal 2025.

However, the BoJ’s decision in March to hold rates at 0.5% reinforced its cautious stance, with officials wary of global economic risks, particularly potential US trade measures. Given the central bank’s reluctance to tighten policy soon, the yen lacks a key bullish catalyst.

Technical Analysis of USD/JPY

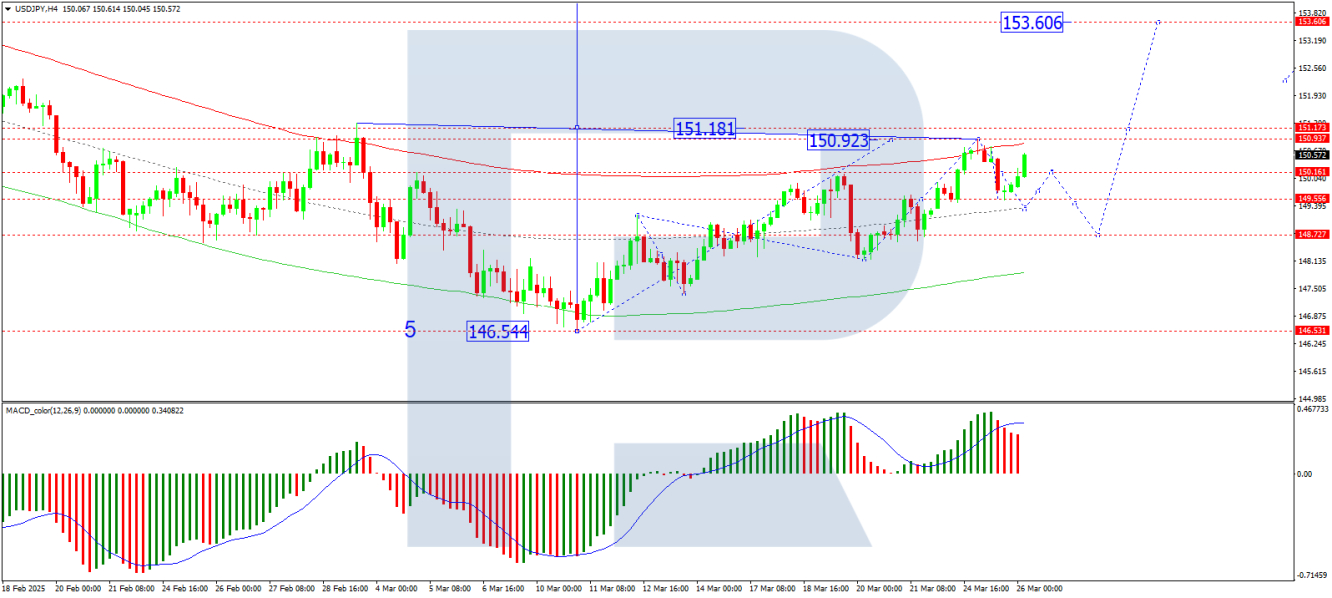

On the H4 USD/JPY chart, the market has formed a growth wave structure up to 150.93. After reaching this target, a pullback to 148.73 is possible, effectively marking the consolidation range at the wave’s peak. A breakout to the upside would indicate a continuation of the trend towards 153.60. This is a local target, after which a correction to 151.20 cannot be ruled out. Technically, this scenario is supported by the MACD indicator: its signal line remains above zero and has exited the histogram zone. A decline towards the zero line is expected.

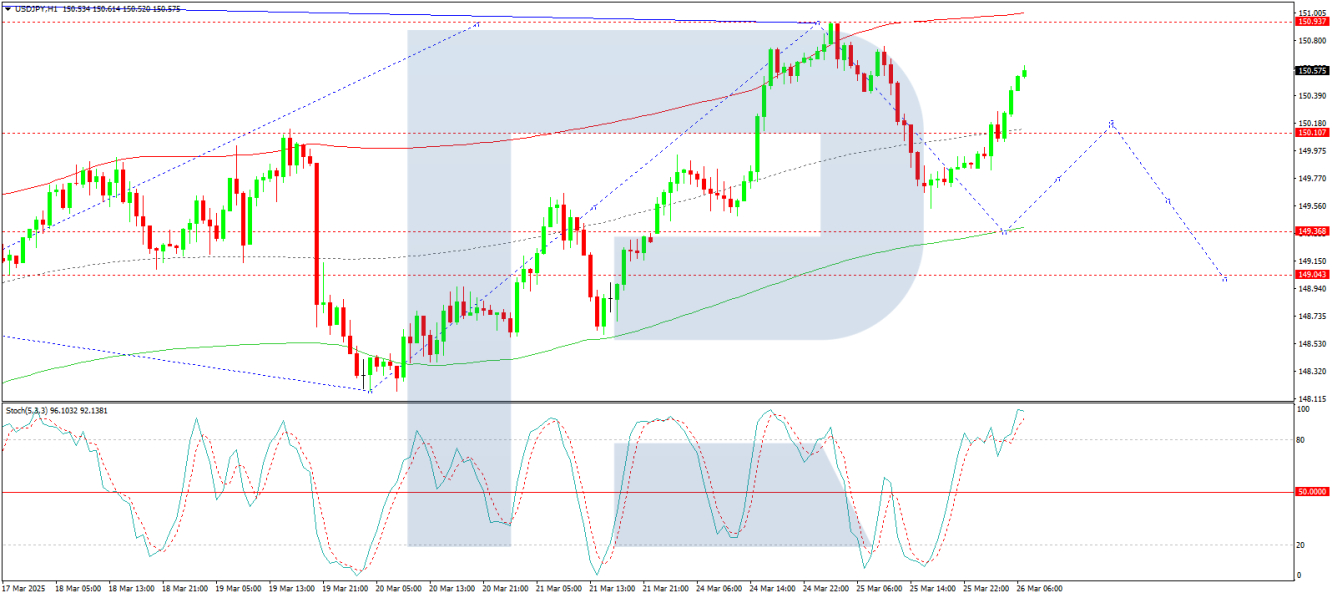

On the H1 USD/JPY chart, the market is forming a correction up to 149.30. Once this pullback is complete, a new growth wave towards 150.97 may begin. This is also a local target. Technically, the Stochastic oscillator confirms this scenario, as its signal line is above 80 and preparing to decline towards 20.

Conclusion

With the BoJ maintaining a dovish stance and risk sentiment weighing on the yen, USD/JPY bulls remain in control. Traders should watch for a breakout above 150.93 to confirm further upside, while corrections could offer short-term pullback opportunities.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.