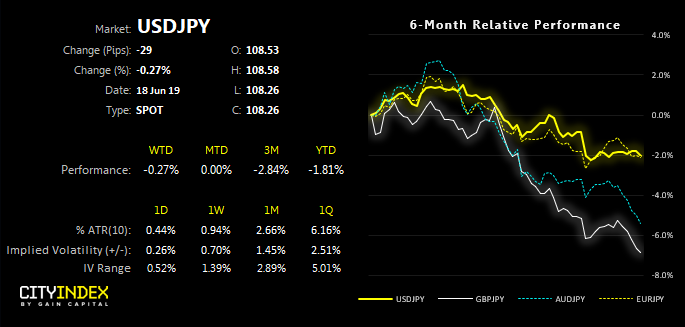

We’ve been patiently monitoring corrective price action on USD/JPY in hope of it confirming a swing high. With a FOMC meeting on tap, the meeting could spark the volatility required to make or break the bearish bias.

We can see on the daily chart the USD/JPY has had a decent relationship with the 50% retracement level during its downtrend. We previously highlighted a likely resistance zone bears could fade into, by using the 38.2% and 50% retracement levels below 109. Indeed, whilst the correction has dragged on a little, the area continues to hold as resistance. Furthermore, we’ve seen a few upper spikes within the zone to show a reluctance to push higher.

Of course, we have the FOMC meeting and this is currently capping volatility. As my colleague Fawad Razaqzada pointed out in his Week Ahead report, a consensus is growing they’ll use tomorrow’s meeting to guide markets towards a July cut. At the time of writing, markets are pricing in a 20.8% chance of a cut tomorrow and a 67.9% chance of a cut in July. And, with USD/JPY rising into resistance, the FOMC meeting could provide the catalyst for a swing trade short if they deliver a dovish hold tomorrow.