USD/JPY Key Points

- From the biggest rise in retail sales since April 2022 to a much-needed decline in initial jobless claims, traders are now more reassured that the US economy is not tipping into recession, at least any time soon.

- If the US economy continues to outperform the rest of the developed world, traders will likely continue to invest in the US, potentially leading to a revival of the USD/JPY carry trade.

- A confirmed break above the 149.50 barrier on USD/JPY could open the door for a steeper bounce toward the 50% retracement near 152.00 next

All across the good ol’ US of A, economically savvy observers were celebrating this morning’s run of strong data. From the biggest rise in retail sales since April 2022 to a much-needed decline in initial jobless claims, traders are now more reassured that the US economy is not tipping into recession, at least any time soon.

One entity that is almost certainly NOT celebrating today’s US data though is the Bank of Japan. The big 15bps surge in 2-year Treasury bond yields has revived talk of the so-called USD/JPY “Carry Trade,” where traders borrow yen (paying the attendant near-zero interest rate in Japan) and buy higher-yielding US assets.

The Bank of Japan sought to disrupt this trade and put a floor under the value of its currency repeatedly over the last couple of years through a combination of direct intervention in the FX market and a long-awaited interest rate increase.

After the big drop in USD/JPY throughout July and the first half of August, it looked like the BOJ had accomplished its goal, but if the US economy continues to outperform the rest of the developed world, traders will likely continue to invest in the stars and stripes, potentially leading to a revival of the carry trade.

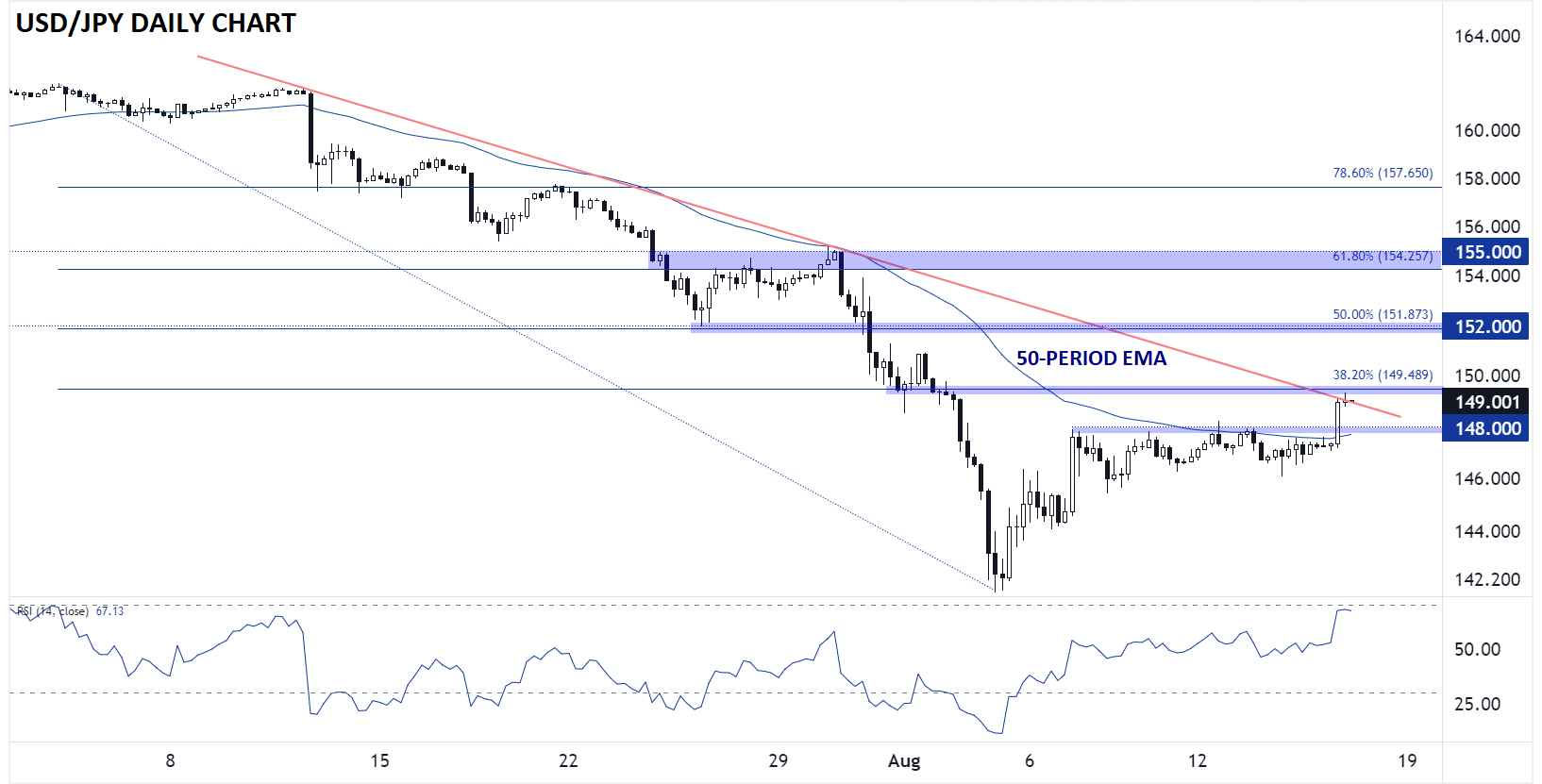

Japanese Yen Technical Analysis – USD/JPY Daily Chart

Source: TradingView, StoneX

From a technical perspective, USD/JPY has seen an impressive recovery this week, bursting back above 148.00 resistance on the back of this morning’s strong US data.

However, the pair is now testing a key short-term resistance level near 149.50, where a bearish trend line meets the 38.2% Fibonacci retracement of the July-August drop.

With no major US (or Japanese) economic data set for release ahead of the weekend, a near-term pullback toward 148.00 may be in the cards, but as long as 148.00 holds as support, there’s potential for more substantial gains in USD/JPY.

A confirmed break above the 149.50 barrier could open the door for a steeper bounce toward the 50% retracement near 152.00 next.