- USD/JPY in a recovery mode after pullback halts at 50-day SMA

- Momentum indicators are softening but remain in bullish zones

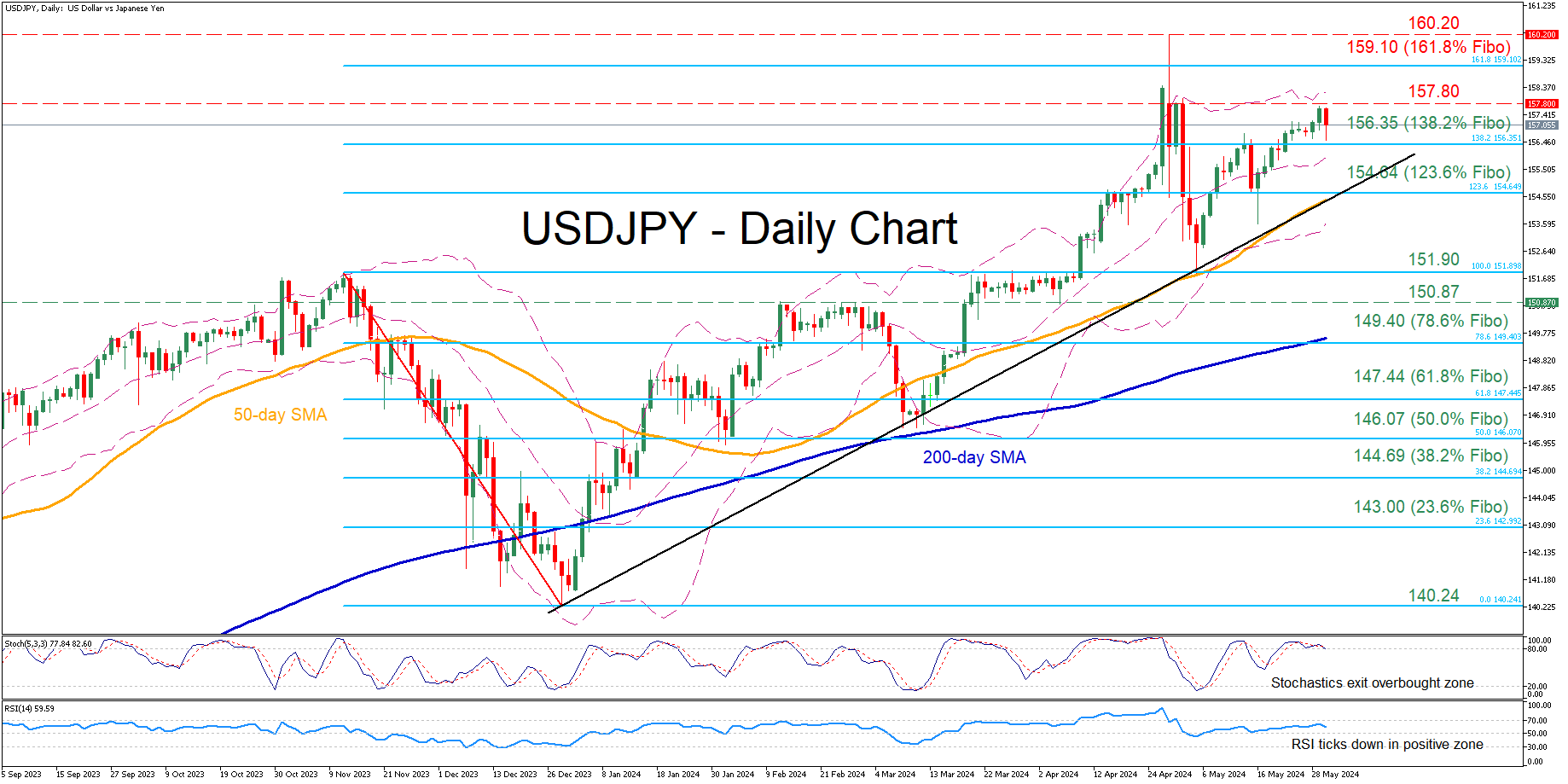

USD/JPY experienced a strong setback from its 34-year high of 160.20 following an intervention by Japanese authorities in late April. However, the pair has slowly but steadily recouped a significant part of these losses, attempting to revisit its recent multi-year highs.

Should bullish pressures persist, the price could initially test the May resistance region of 157.80. Further upside attempts could then cease at 159.10, which is the 161.8% Fibonacci extension of the 151.90-140.24 down leg. A violation of that territory could pave the way for the 34-year peak of 160.20.

Alternatively, if the pair comes under selling pressure, immediate support could be found at the 138.2% Fibo of 156.35. Failing to halt there, the price could descend towards the 123.6% Fibo of 154.64. In case the bears push the pair even lower, the May deflection point of 151.90 may provide downside protection.

In brief, despite the strong selloff in the aftermath of a fresh 34-year peak, USDJPY has been steadily regaining lost ground. Therefore, we could see some heightened volatility moving forward as the price approaches levels that the Japanese side seems willing to defend.