- USD/JPY is trading sideways as the yen shows some signs of life

- Market participants are preparing for central bank meetings

- Momentum indicators are mostly bullish at this stage

USD/JPY is trading sideways today, following Tuesday’s red candle, which was the first negative session for this pair after six consecutive green candles that pushed it towards the 154.52 level again. While the Fed is expected to cut rates by 25bps at today’s meeting, Trump’s imminent return to the White House and the gradually reduced probability of a BoJ rate hike have contributed to the continued underperformance of the yen.

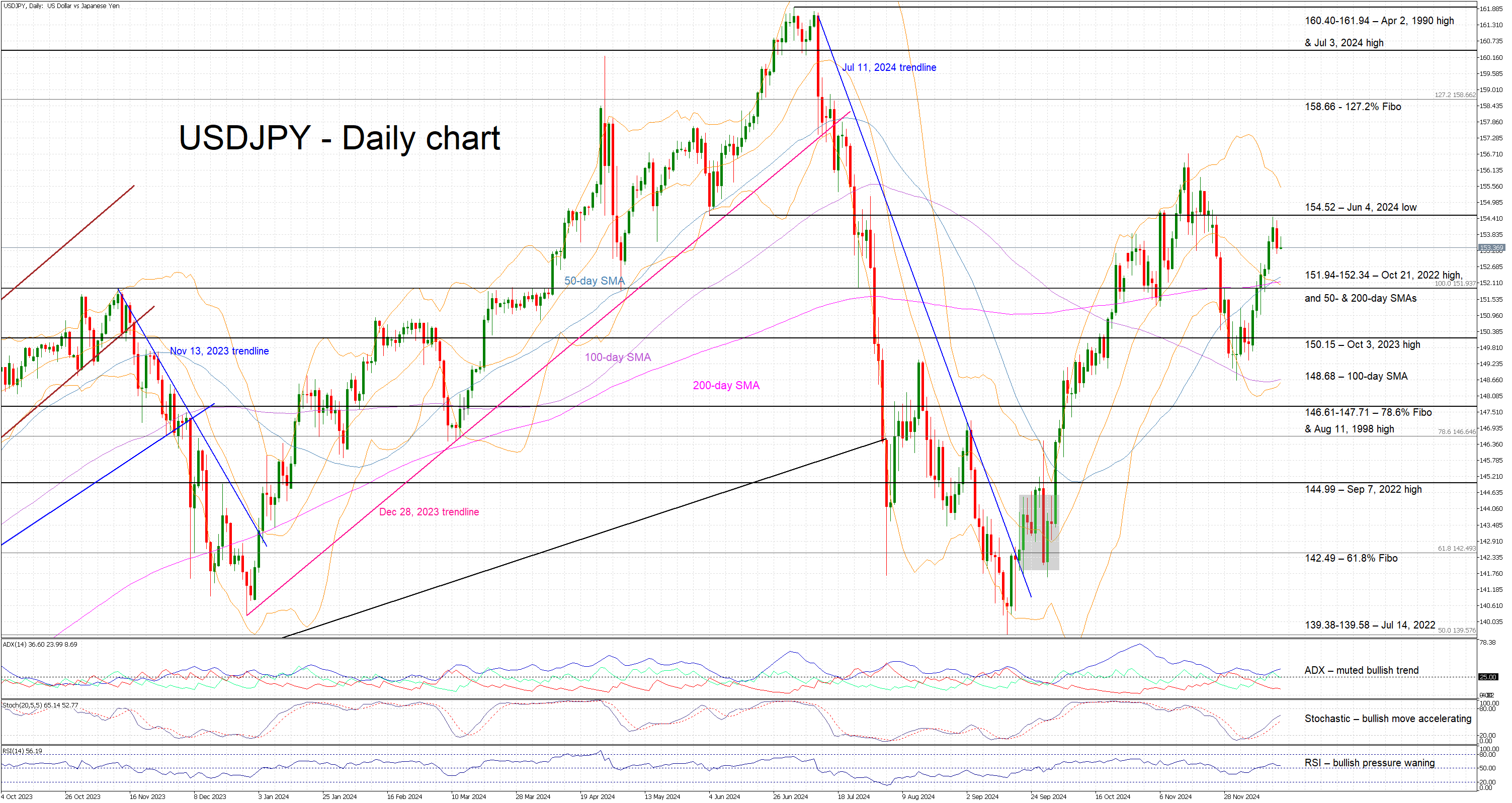

Meanwhile, the momentum indicators are mostly bullish. Specifically, the RSI is hovering slightly above its midpoint, pointing to a weak bullish trend in USD/JPY. Similarly, the Average Directional Movement Index (ADX) is edging higher, above its 25 threshold, and thus signaling a muted bullish trend in USD/JPY.

Interestingly, the stochastic oscillator is trading higher, above its moving average, and moving towards its overbought territory (OB). Should it return inside its OB area, it could be seen as a signal of strong bullish pressure in USD/JPY.

Should the bulls remain hungry, they could try to push USD/JPY above the June 4, 2024 low of 154.52, and then target a higher high above the November 15, 2024 high of 156.74. If successful, the door would then be open for a test of the 127.2% Fibonacci extension of the October 21, 2022 - January 16, 2023 downtrend at 158.66. Such a move would most likely attract the interest of Japanese government officials, causing another round of verbal interventions.

On the flip side, the bears are keen to recapture the market reins and push USD/JPY lower, towards the busy 151.94-152.34 area. This region is populated by the October 21, 2022 high, and the 50- and 200-day simple moving averages (SMAs). A break below this zone would signal that the bearish move is gaining traction. The next key support areas are likely to be the October 3, 2023 high and the 100-day SMA, at the 150.15 and 148.68 levels respectively.

To sum up, USD/JPY’s rally appears to have paused, with the two central banks meetings today and tomorrow potentially proving critical for the next USD/JPY leg.