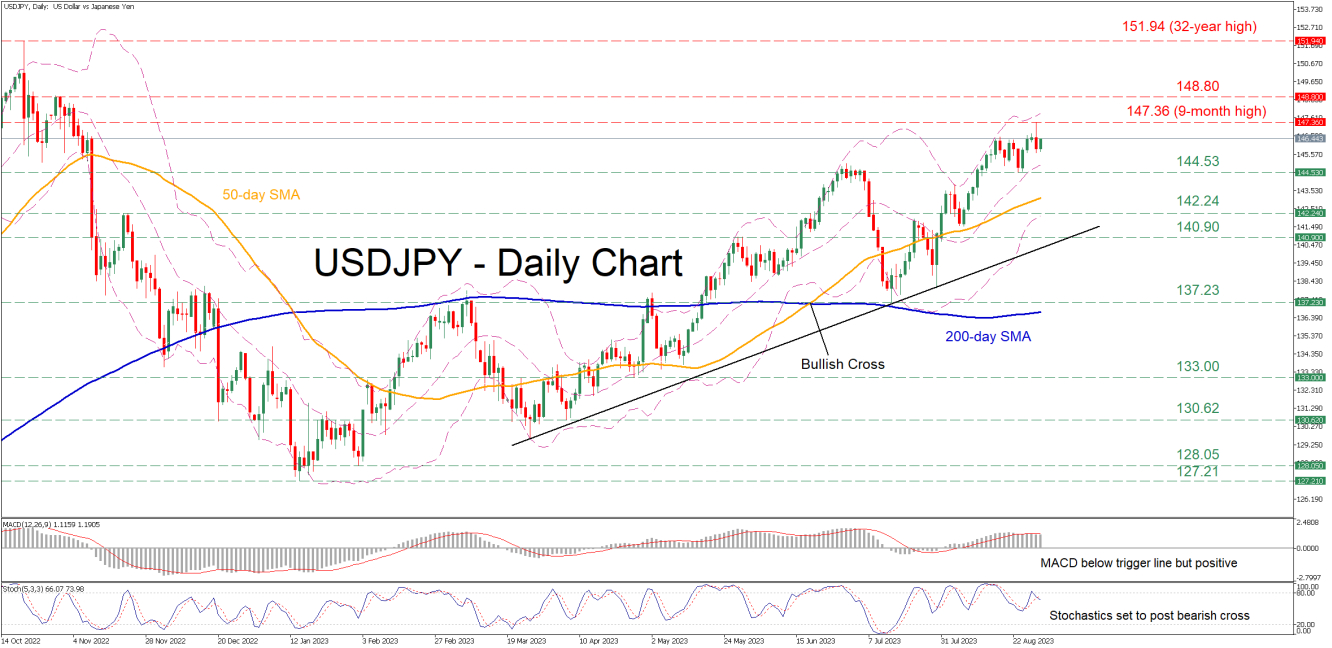

USDJPY has been in a steady uptrend since the beginning of the year, posting a fresh nine-month high of 147.36 on Tuesday before paring some gains. Undoubtedly, the probability of an impending pullback appears to be heightening as the pair has surpassed the level around where the first round of intervention by the Japanese authorities took place.

The momentum indicators currently suggest that the bullish forces are fading. Specifically, the MACD is hovering below its red signal line in the positive zone, while the stochastic oscillator is set to post a bearish cross.

If buying interest wanes, the recent support of 144.53 could prove to be the first barrier for sellers to claim. Sliding beneath that floor, the price could descend towards previous resistance zones such as 142.24 and 140.90, which could now serve as support levels. Further declines could then cease at the July low of 137.23.

Alternatively, if the relentless year-to-date rally extends, the pair could initially face the recent nine-month peak of 147.36. A break above that zone could trigger an advance towards the 148.80 resistance territory observed in November 2022. Should that obstacle fail, the spotlight could turn to the 32-year high of 151.94.

Overall, USDJPY seems to be stuck in a steep uptrend, but the price has reached levels that in previous occasions the Japanese policymakers were willing to protect. Will this scenario play out again?