Key Points:

- Bearish Channel remains in play for the pair.

- Volatility beginning to see traders return to the yen.

- Near-term rally likely to be seen prior to any major slides lower.

The dollar-yen’s recent stretch of gains is looking somewhat under threat moving ahead, but the oscillating nature of the USD/JPY’s descent gives traders some solid range-trading opportunities. Indeed, the pair should be making a surge higher prior to resuming its overall downtrend which is currently resulting from an uptick in a number of volatility indicators.

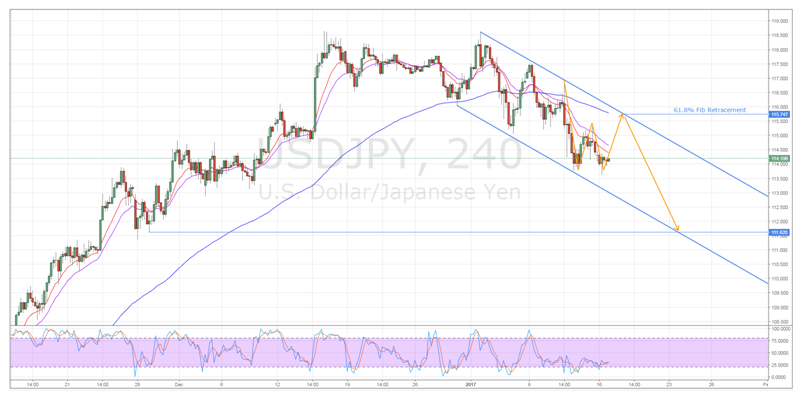

As demonstrated below, over the past number of days the USD/JPY has challenged the 113.62 support twice in a pattern that looks quite distinctly like a double bottom structure. If the pattern completes, we should see the pair begin to recover fairly strongly by week’s end which should bring the USD/JPY back to around the 115.74 level.

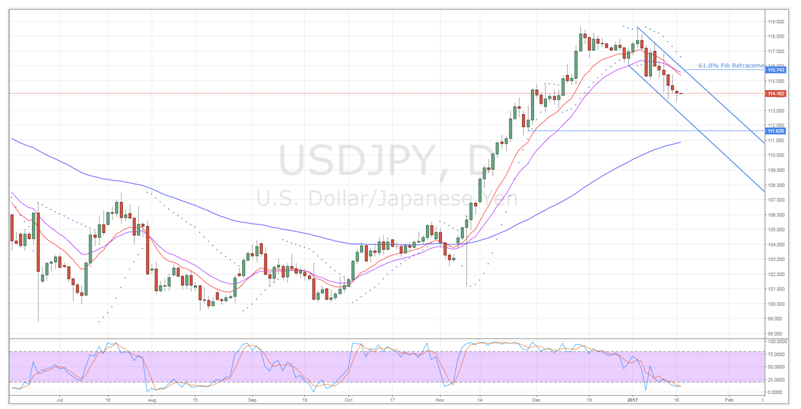

Whilst a near term reversal such as this would be at odds with the EMA bias on both the daily and H4 charts, the oversold daily stochastics should facilitate the near-term reversal. Moreover, whilst ordinarily we would expect the combination of the double bottom and the stochastics to inspire a slightly larger correction than that shown above, in this instance, the constraint of the bearish channel will be severely capping upside potential.

In addition to the channel, the present placement of the 100 period EMA, shown on the H4 chart, will be providing some stiff opposition to any attempts to buck the newly forming downtrend. As a result of this, a subsequent reversal around this 61.8% Fibonacci level is forecasted for the pair which offers yet another chance to capitalise on the oscillating nature of the downtrend.

Specifically, once it has resumed its decline, we can expect to see some fairly decent losses given the bearish bias of both the daily Parabolic SAR and the daily moving averages. However, support will likely kick in around the 111.00 handle as the 100 day EMA makes its presence known and this could result in the beginning of a ranging phase.

Ultimately, we could see losses extend beyond this point given the yen’s safe haven status and the recent uptick in implied volatility. However, we also can’t discount the probability of the Trump effect continuing to bid up the USD as the IMF has recently upgraded US GDP estimates a result of his proposed policies. Therefore, on the balance of things, moderating back to the 111.00 handle seems like the most likely outcome until the Trump presidency is in full swing.