- A further rise in the JGB yields may increase the cost of JPY-funded carry trade strategies

- The pace of the JGB yield upmove has increased significantly since March-end

- A lower-end offered amount of 425 billion yen for BOJ’s scheduled bond-buying programme on 31 May for JGBs with residual maturity of 5 to 10 years may see a further rally in JGB yields

- Watch the key short-term resistance of 158.30 on the USD/JPY.

- Since our last publication, the USD/JPY has continued its tepid ascend and almost hit 158.00 key short-term resistance level (printed an intraday high of 157.71 on Wednesday, 29 May).

The FX carry trade strategy that involves the major G-10 JPY crosses has continued to rack in positive returns that involve selling (borrowing) in JPY that has a lower yield to fund the purchase of currencies with a higher yield (interest rate).

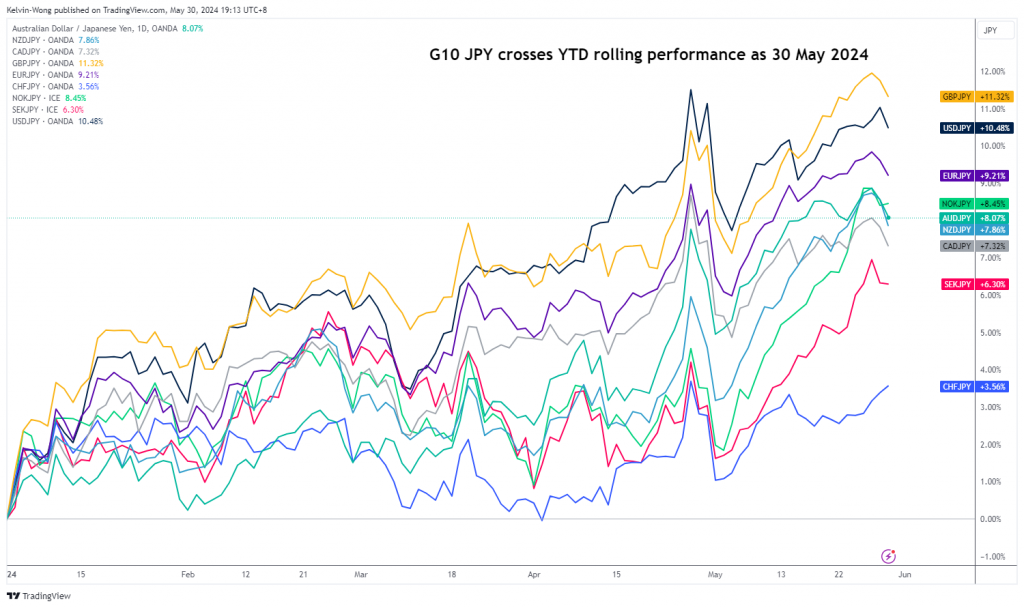

2024 year-to-date performance for G-10 JPY crosses

Fig 1: 2024 YTD performances of G-10 JPY crosses as of 30 May 2024 (Source: TradingView)

The year-to-date performance as of 30 May 2024 of the top five G-10 JPY cross pairs are GBP/JPY (+11.30%), USD/JPY (+10.50%), EUR/JPY (+9.20%), NOK/JPY (+8.45%), and AUD/JPY (+8.10%) (see Fig 1).

One of the main factors that is driving the positive performances of these G-10 JPY cross pairs is the Bank of Japan (BoJ)’s meddling or intervention in the Japanese Government Bonds (JGBs) market to prevent market forces from dictating the pace of directional movement for JGBs yields which in turn suppresses the pace of JGBs yield appreciation.

Despite the ending of BoJ’s “Yield Curve Control” programme on the 10-year JGB yield announced on its 19 March 2024 monetary policy meeting, it has left a little “caveat” on its new monetary policy framework by stating that it will continue its JGB purchases with broadly the same amount and may increase the amounts if there is a rapid rise in long-term interest rates.

Therefore, BoJ seems to imply there is some form of “residual shadow” quantitative easing initiatives left in the new monetary policy framework despite the official announcement of the end of YCC that put a ceiling on a potential JPY significant bullish reversal which in turn created a conducive environment for speculators to wager on yen funded carry trades that triggered a positive feedback loop into the price actions on the G-10 JPY cross pairs.

JGB yields have continued their northward climb at an increasing pace

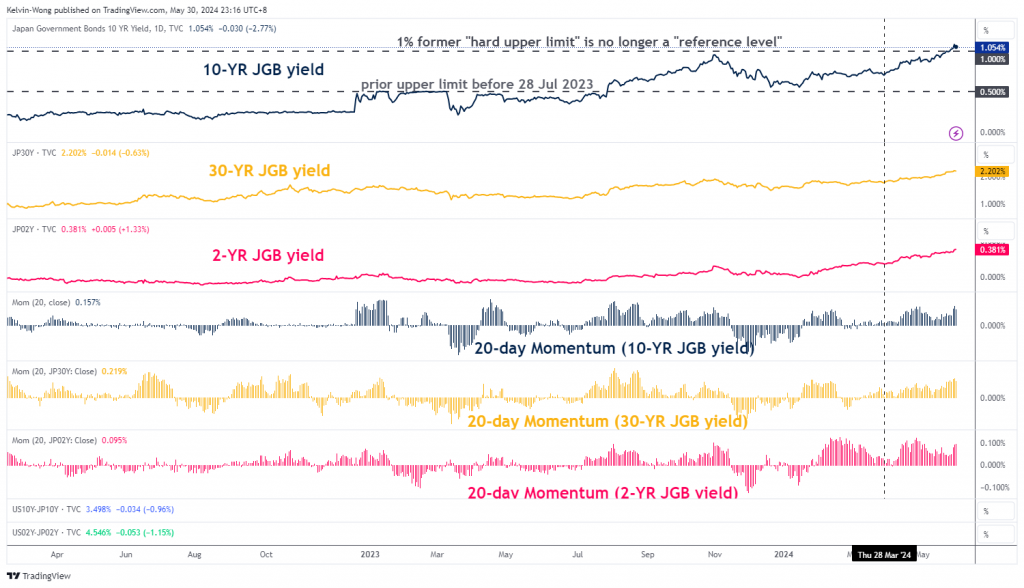

Fig 2: 2, 10 & 30-year JGB yields with momentum indicators as of 30 May 2024 (Source: TradingView)

Based on the latest data as of 30 May 2024, short to long-end JGB yields have increased remarkably since the end of March 2024. The 10-year JGB yield cleared above its historical milestone of 1% and traded at 1.05%, almost a 13-year high.

Similar movements can be seen for the 30-year JGB yield that rallied to 2.20%, and the 2-year JGB yield that is more sensitive to BoJ’s short-term policy rate hit a 15-year high at 0.38% from a mere 0% at the start of 2024 (see Fig 2).

All in all, the 20-day rolling momentum readings of these JGB yields have increased significantly since the end of March 2024 reinforced by BoJ’s reduction of the offer amount for JGBs with five to 10 years left to maturity to 425 billion yen for the recent three bond-buying operations held on 13 May, 17 May, and 23 May from 475 billion yen previously on 24 April.

In addition, the respective last three offer amounts came in at the lower end of the range of 400 billion to 550 billion yen for BoJ’s preannounced quarterly schedule (April to June 2024) of outright purchases of JGBs with residual maturity of more than 5 years, and up to 10 years.

On Friday, 31 May, BoJ will hold another auction on its JGB buying programme for more than 5 years to 10 years range of residual maturity, if the offered amount comes in again at the lower end of the range (425 billion to 400 billion yen), and also with the possibility of a newly announced lower low-end amount range for the 5-10 years and 1-3 years JGB purchases per operation listed for the scheduled dates of June.

These possible reductions in the JGB buying programme may increase the pace of JGB yield upmoves which in turn makes the carry trade strategies funded by the yen more costly and unattractive. Hence, this is a potential catalyst that may trigger a short to medium-term JPY strength revival.

USD/JPY has flashed out bearish momentum conditions

Fig 3: USD/JPY medium-term & major trends as of 30 May 2024 (Source: TradingView)

Fig 4: USD/JPY short-term trend as of 30 May 2024 (Source: TradingView)

The daily MACD trend indicator of the USD/JPY has flashed out an impending bearish crossover condition which suggests a possible imminent multi-week corrective decline within its major uptrend phase that remains intact since the 28 December 2023 low of 140.25 (see Fig 3).

Watch the 158.00/30 short-term pivotal resistance and a break below 155.90 near-term support (also the 20-day moving average) may reinforce the bearish tone on the USD/JPY to expose the next intermediate support zone of 154.30/153.70 (also the 50-day moving average) in the first step (see Fig 4).

On the other hand, a clearance above 158.30 invalidates the bearish bias for a retest on the 159.50/160.30 long-term pivotal resistance zone.