The Japanese yen is slightly lower on Friday. In the European session, USD/JPY is trading at 141.75, up 0.27%.

The US dollar has taken a tumble in recent weeks against most of the major currencies, including the yen. Since mid-November, the yen has jumped 6.4% against the ailing US dollar. This has relieved pressure on Tokyo to intervene in the currency markets, which was a serious concern just six weeks ago when the exchange rate was above 151.

The Bank of Japan didn’t adjust its policy settings at the December meeting, although speculation was high that the BoJ might make a shift after Governor Ueda hinted at a change in policy before the meeting. The BoJ could make a move in January or perhaps in April, after the annual wage negotiations in March.

The markets are expecting the Fed to hit the rate cut button early and often next year. The markets have priced in a rate cut by March at 86% and anticipate 150 basis points in cuts next year. The Fed is more cautious, and Fed members have urged the markets to lower these expectations.

Chicago PMI Expected to Decelerate

The US releases Chicago PMI, an important business barometer, later today. The PMI was unexpectedly strong in November with a reading of 55.8, which marked the first expansion after fourteen straight months of contraction. The 50 line separates expansion from contraction.

The upward spike may have been a one-time occurrence due to the end of the United Auto Workers strike as activity rose in the auto manufacturing industry. The consensus estimate for December stands at 51.0, which would point to weak expansion.

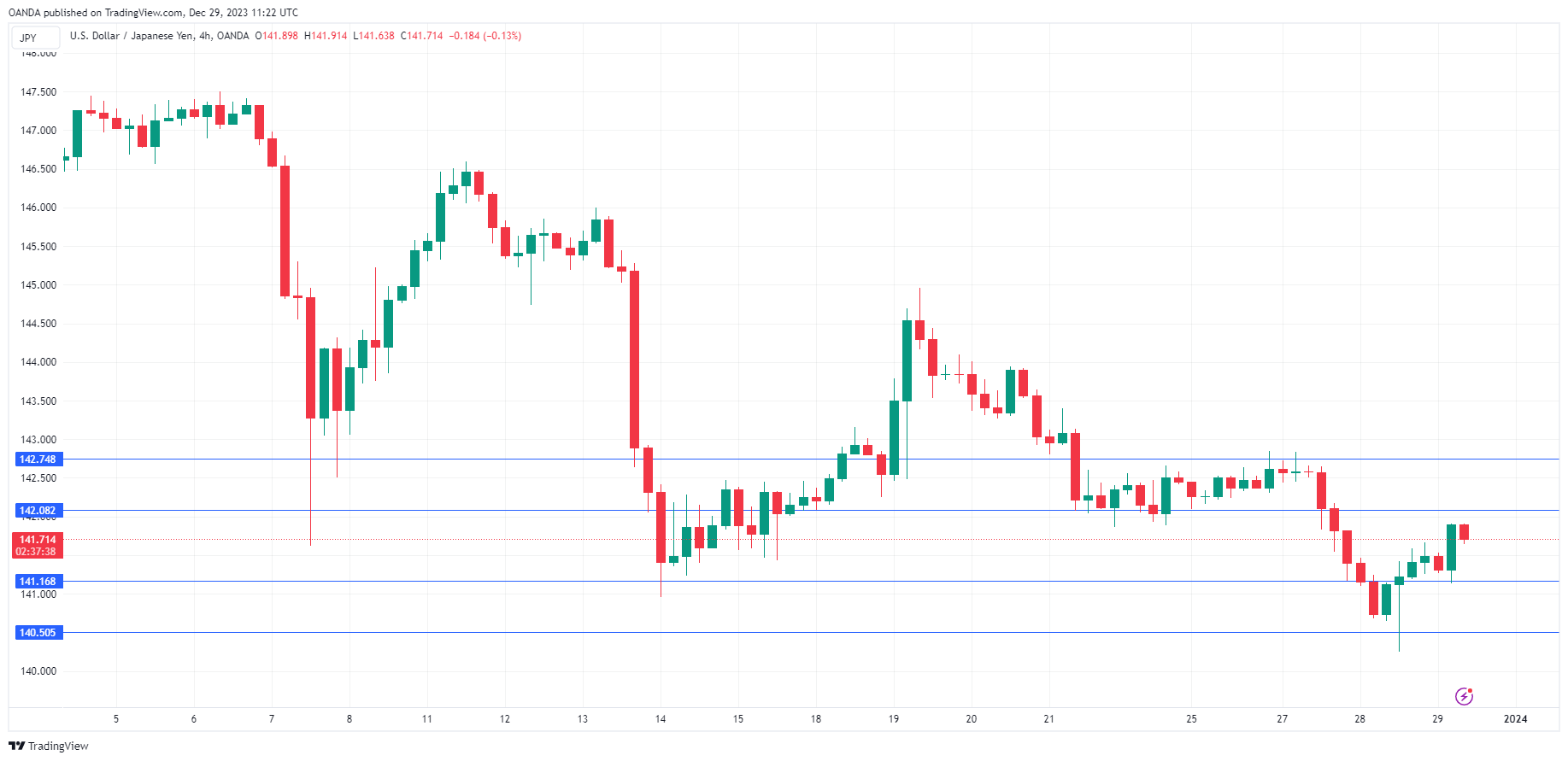

USD/JPY Technical

- USD/JPY tested support at 141.16 before reversing directions. The next support level is 140.50

- There is resistance at 142.08 and 142.74