- Tokyo inflation tops forecasts, firming BoJ rate hike bets

- USD/JPY breaks 200DMA, extending Monday’s bearish break

- 150, 147.20 downside levels to watch

Overview

An upside inflation surprise, signs of US Treasury yields peaking, thin markets and month-end flows have USD/JPY moving, sending it careening through the important 200-day moving average in Asian trade on Friday. A venture below 150 looks increasingly likely given the price action seen this week.

Tokyo Inflation Tops, JPY Pops

The catalyst to spark the latest unwind was Tokyo’s inflation report for November. Headline inflation rose 2.6% over the year, fourth-tenths above expectations. More importantly, prices ex-fresh food gained 2.2%, up from 1.8% in October and two tenths more than forecast. The Bank of Japan (BoJ) targets a 2% level for this measure as part of its monetary policy deliberations.

Excluding fresh food and energy prices, the core-core rate printed at 1.9%, up from 1.8% a month earlier, while services inflation increased 0.9%, up from 0.8% previously. While this is the Tokyo reading, not national survey released in three weeks time, the detail will build confidence among Japanese policymakers that inflationary pressures are stirring.

December BOJ Hike Firms

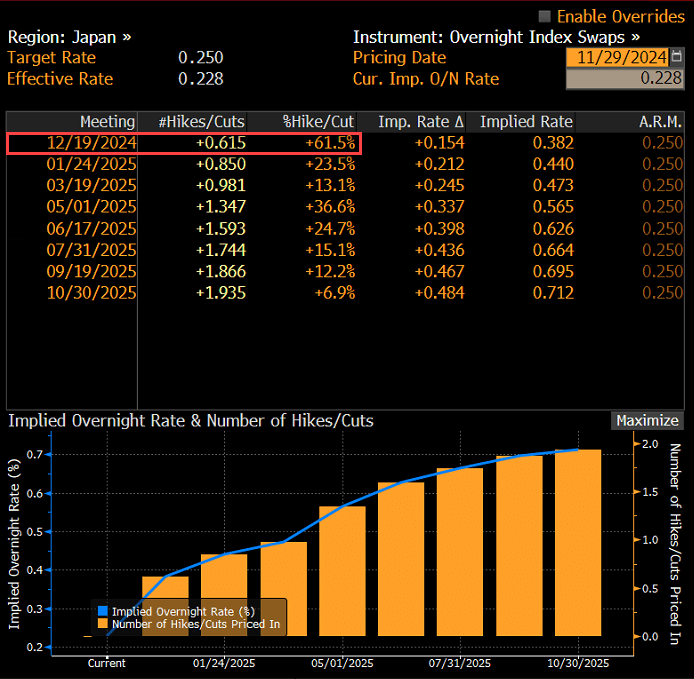

Source: Bloomberg

With markets split on whether the BoJ would lift interest rates in either next month or February, the upside surprises have seen expectations firm marginally towards a 25-pointer being delivered on December 19. According to swaps pricing, the probability of such an outcome is priced just over 60%, with a full 25-point move fully priced by the bank’s meeting in March.

Along with signs that US 10-year Treasury yields may have peaked near-term, an important development considering how closely correlated USD/JPY has been with them over periods this year, it’s combined with holiday market conditions to deliver a meaningful rally in the yen.

USD/JPY: Sub-150 Incoming?

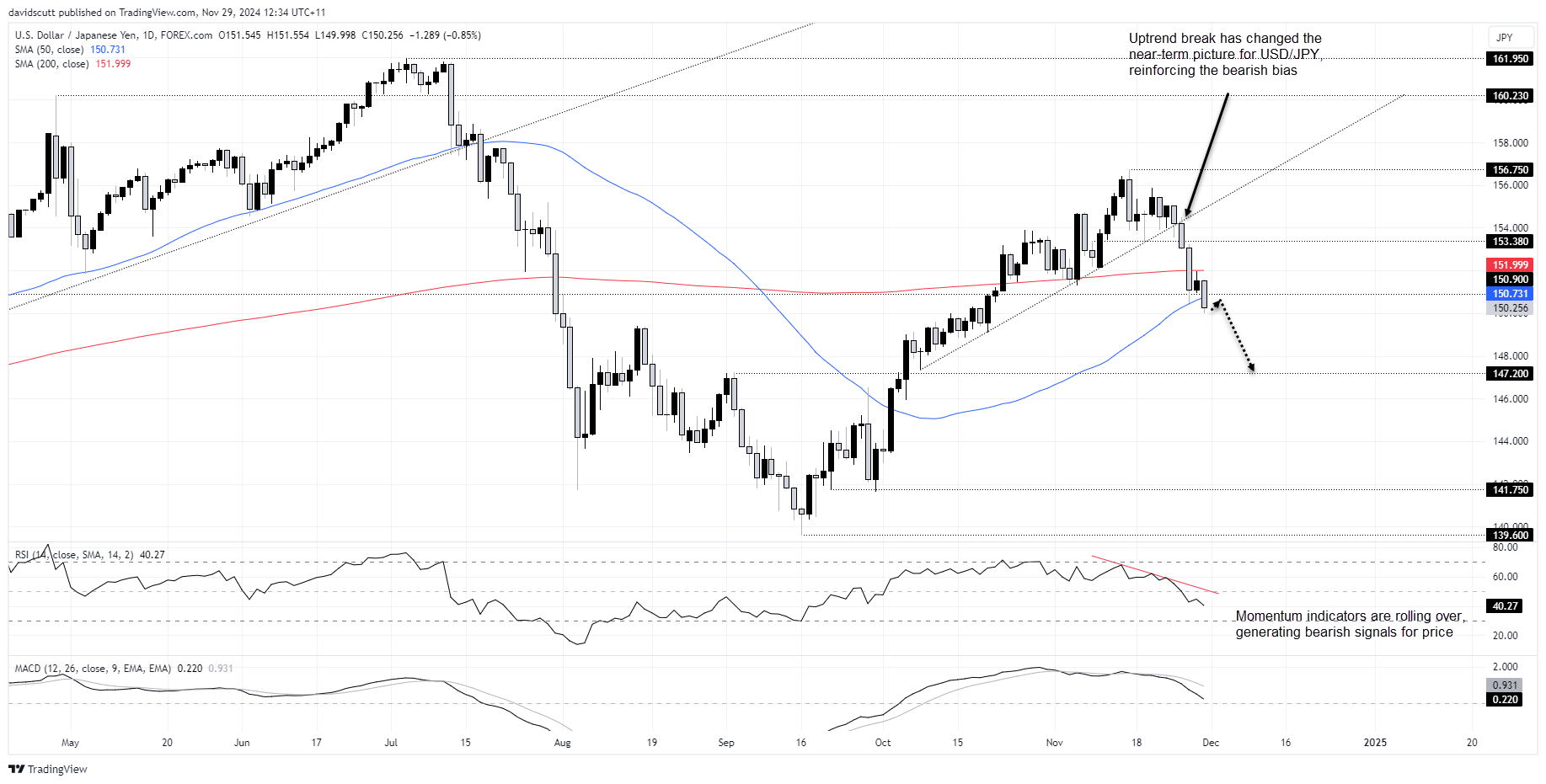

Source: TradingView

With USD/JPY breaking through uptrend support earlier in the week, the price signal has confirmed the bearish momentum picture with MACD and RSI (14) also trending lower. It screens as an sell-on-rallies play right now.

Having sliced through the 200-day moving average, a level often respected in the past, it has generated fresh setups for traders to consider.

If we were to see the price push back towards the 200DMA, shorts could be established beneath with a protective stop above either it or 150.90, another long-running level that has offered support and resistance in the past. The price has so far bottomed at 150, suggesting round numbers have relevance for those considering the setup. Having destroyed so many levels in the rout of July and August, there isn’t a lot of support evident until 147.20. That’s a target to put on the radar.

If the price were to reverse back above the 200DMA/150.90 zone, the bearish bias would be invalidated.