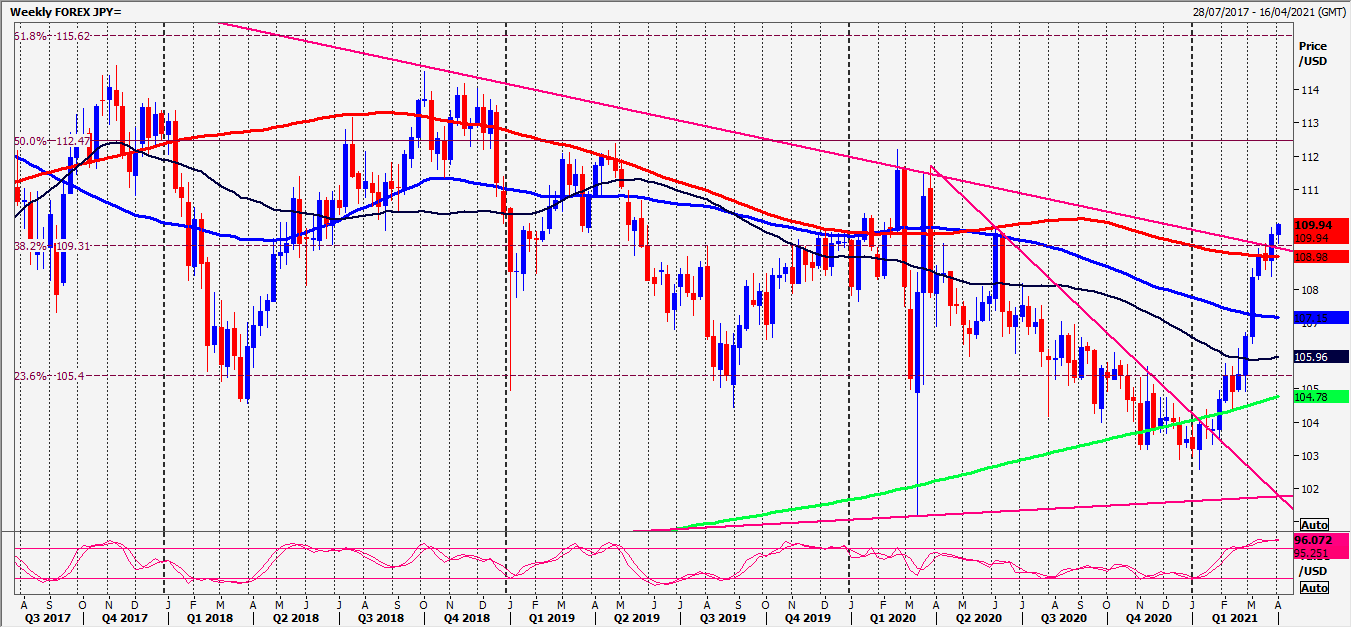

Previously, we wrote that USD/JPY risks forming a double top for a sell signal pattern, after we failed to sustain a break above 111.00. Yesterday we dipped to 10 pips above first support at 110.30/20.

EUR/JPY has sold off from very strong resistance at 132.50/60. Shorts are working!! As we wrote previously, further losses look likely targeting 131.25/05…The pair hit this target and bottomed exactly here.

CAD/JPY is holding strong resistance at 9020/30 and hitting our targets of 8990/80 and 8940/20. We bottomed exactly here but the outlook remains negative.

Today’s Analysis

If USD/JPY fails to hold above 111.00, it risks the formation of a double top sell signal. The pair is edging slowly lower to 110.60/55 and almost as far as first support at 110.30/20. Below 110.00 look for 109.75/65. Gains are likely to be limited with minor resistance at 110.60/70. Strong resistance at 111.00/111.10. A break above 111.20 kills the double top sell signal and is a buy signal initially targeting 111.40/50 then 111.70/80.

With EUR/JPY, we are short at very strong resistance at 132.50/60 and hitting the next target of 131.25/05 perhaps as far as minor support at 131.10/00 today. A break below the 100 day moving average at 130.90/80 is a sell signal targeting 130.60/50 and 130.20/00. A break below here is a sell signal targeting 129.80 and support at 129.50/40.

Gains are likely to be limited with minor resistance at 1.3180/90. Above 132.00, however, allows a recovery towards very strong resistance again at 132.50/60. Shorts need stops above 132.80. A break higher is a buy signal targeting 133.20/30, perhaps as far as 133.55/65.

CAD/JPY is holding strong resistance at 9020/30 and hitting our targets of 8990/80 and 8940/20. Further losses look likely to 8880/70. Gains are likely to be limited with minor resistance at 8955/65. Above 8980, however, allows a recovery towards strong resistance again at 9020/30. A break above 9040 targets 2 week highs at 9070/80.

Disclaimer: No representation or warranty is made as to the accuracy or completeness of this information and opinions expressed may be subject to change without notice. Estimates and projections set forth herein are based on assumptions that may not be correct or otherwise realized. All reports and information are designed for information purposes only and neither the information contained herein nor any opinion expressed is deemed to constitute an offer or invitation to make an offer, to buy or sell any security or any option, futures or other related derivatives.