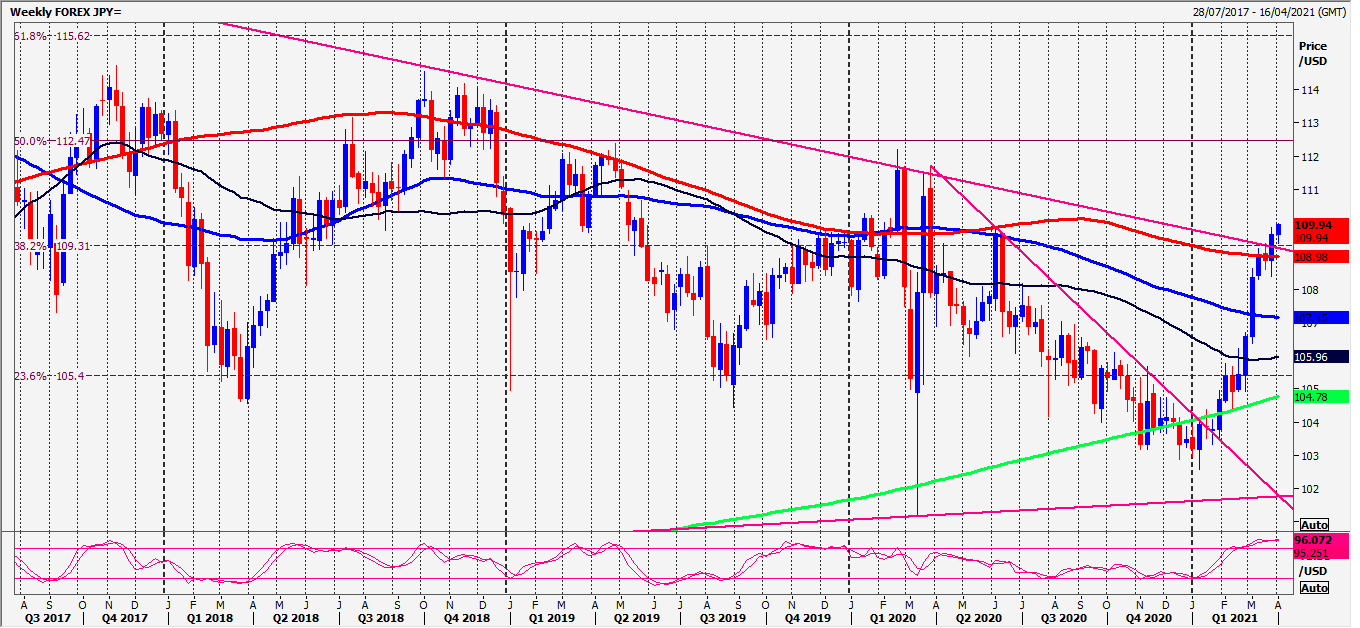

USD/JPY beat 109.20 for a buy signal.

EUR/JPY beats 6 year trend line resistance at 133.05/25 for a buy signal initially targeting 134.00/10 and 134.35/45.

CAD/JPY finally finds some direction as we beat 9070.

Today’s Analysis

USD/JPY beat 109.20 to test 4 year trend line resistance at 109.65/75 and we are holding above here. Bulls now need a break above 110.10 for another buy signal initially targeting 110.20/30 and 110.80/90.

First support at 109.10/00.

EUR/JPY finally beats 6 year trend line resistance at 133.05/25 for a buy signal initially targeting 134.00/10 and 134.35/45, perhaps as far as 134.85/95.

Bulls need the pair to close this week above support at 133.10/00.

CAD/JPY ends the consolidation phase with a break above 9073 to continue the bull trend targeting 9120/30 and 9140/45.

First support at 9070/60 of course. The last line of defence for bulls is at 9030/20. A weekly close below here would be more negative for next week.

Disclaimer: No representation or warranty is made as to the accuracy or completeness of this information and opinions expressed may be subject to change without notice. Estimates and projections set forth herein are based on assumptions that may not be correct or otherwise realised. All reports and information are designed for information purposes only and neither the information contained herein nor any opinion expressed is deemed to constitute an offer or invitation to make an offer, to buy or sell any security or any option, futures or other related derivatives.