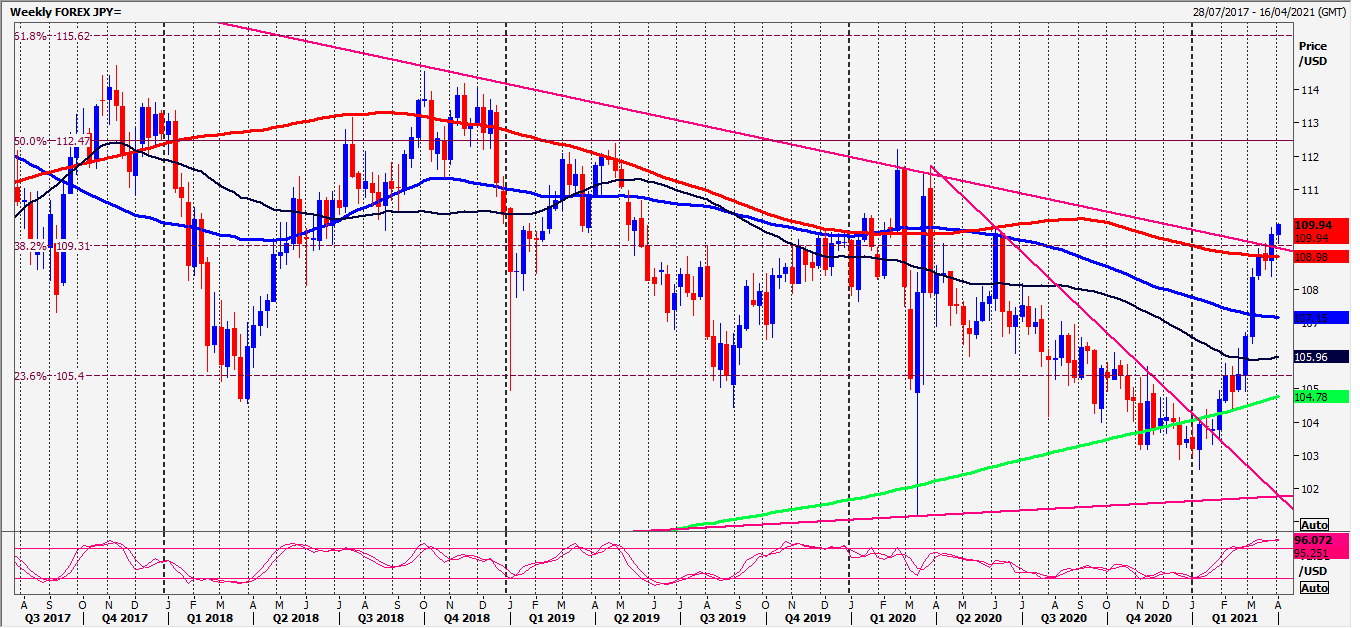

USD/JPY unable to beat 109.30 as we hold a range of less than 100 pips all last week.

Up one day, down the next day in the sideways trend. Holding below 109.00/108.90 should be a sell signal for this week. The pair topped exactly here yesterday.

EUR/JPY minor negative weekly chart candle at 6 year trend line resistance at 133.05/25 looks likely to lead to losses this week.

CAD/JPY still magnetised to 14 year 38.2% Fibonacci resistance at 9030. We have held a range of less than 120 pips all week.

Today’s Analysis

USD/JPY holding below 109.00/108.90 targets last week’s low at 108.58/55, perhaps as far as 108.40/30. Further losses look for 107380/70.

Bulls need prices above 109.20 to test 4 year trend line resistance at 109.65/75. A break above 109.85 is a buy signal initially targeting 110.20/30 and 110.80/90.

EUR/JPY has run in to 6 year trend line resistance at 133.05/25. Shorts need stops above 133.55. A break higher is a buy signal initially targeting 134.00/10.

Shorts at 133.05/25 targets 132.70/60 then first support at 132.30/20. Longs need stops below 132.05. A break lower to target very strong support at 131.55/45. Longs need stops below 131.35.

CAD/JPY hovered about 50 pips either side of 14 year 38.2% Fibonacci level of 9020/30. A break above last week’s high at 9073 targets 9120/30 and 9140/45.

Failure to hold above 9000 increases risks to the downside initially targeting 8955/45 and important 14 year trend line support at 8900/8880. Longs need stops below 8850.

Disclaimer: No representation or warranty is made as to the accuracy or completeness of this information and opinions expressed may be subject to change without notice. Estimates and projections set forth herein are based on assumptions that may not be correct or otherwise realised. All reports and information are designed for information purposes only and neither the information contained herein nor any opinion expressed is deemed to constitute an offer or invitation to make an offer, to buy or sell any security or any option, futures or other related derivatives.