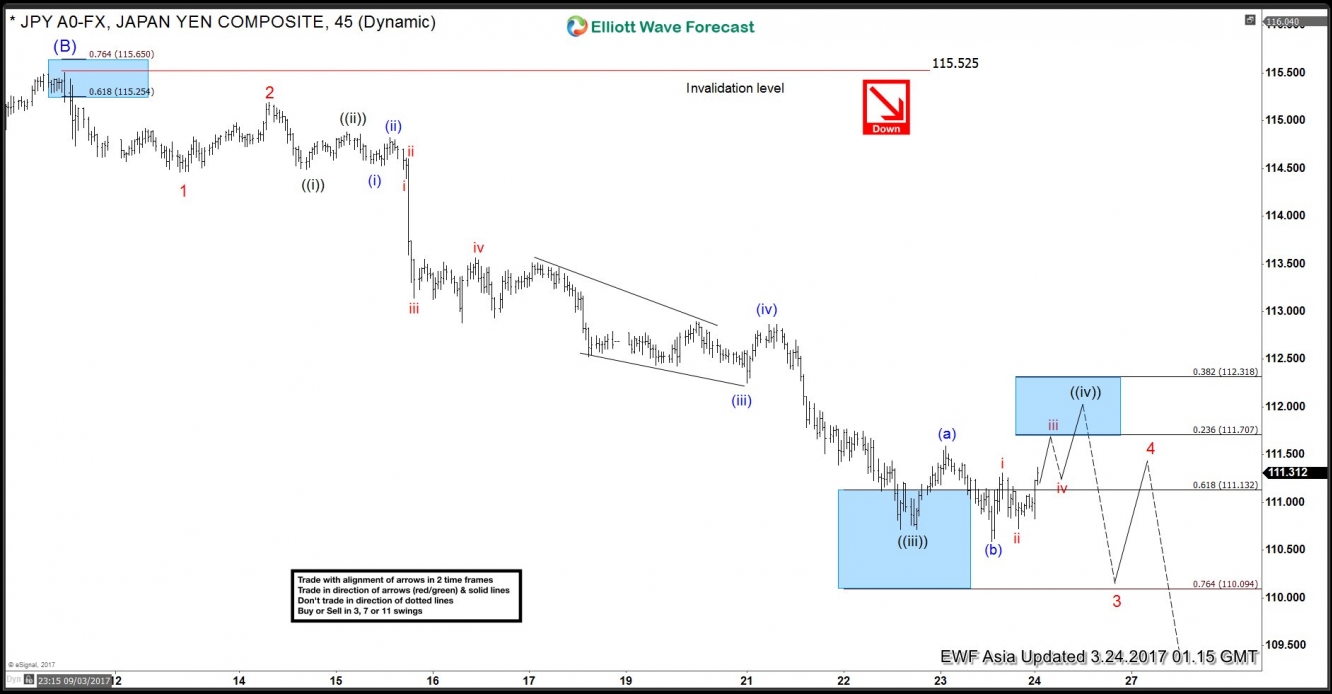

We are taking the more aggressive view in USD/JPY and calling the rally to 115.48 on 3/10 as Intermediate wave (B). Decline from there is unfolding as a 5 waves impulse Elliott wave structure with an extension in wave 3. Down from 115.48, Minor wave 1 ended at 114.46 and Minor wave 2 ended at 115.2. Minor wave 3 is extended and further subdivided into 5 impulse waves where Minute wave ((i)) ended at 114.49, Minute wave ((ii)) ended at 114.82 and Minute wave ((iii)) is proposed complete at 110.714.

Minute wave ((iv)) currently is in progress as a Flat Elliott Wave structure towards 111.7 – 112.3 area before pair turns lower in Minute wave ((v)) of 3. Afterwards, pair should bounce in Minor wave 4 and later on still see further downside to complete Minor wave 5 towards as low as 106.85 – 108.5 area. Bounces therefore are expected to be limited and shallow.

If current bounce is getting too big, then as an alternate, the move lower in USD/JPY from 115.52 high is unfolding as a zig zag Elliottwave structure where Minor wave A ended at 110.58 low with subdivision of 5 impulsive waves . Current bounce will then be Minor wave B to correct decline from 3/10 high (115.52) before pair resumes lower again in Minor C.

This alternate view is the less aggressive view but still calling for more downside in the pair as far as pair stays below 3/10 high. In both views (aggressive and less aggressive), we don’t like buying the pair.

1 Hour USD/JPY Elliott Wave Chart