USD/JPY Short-term Elliott Wave view suggests that the rally to 111.40 on May 21 ended intermediate wave (A) as a Diagonal structure coming from March 26 low (104.52) cycle. Pair is currently correcting cycle from 3/26 low within Intermediate wave (B). The pullback shows overlapping price structure suggesting that it is taking the form of a corrective structure i.e either as W,X,Y or W,X,Y,X,Z structure.

Down from 111.40 high, the decline to 108.94 low ended Minute wave ((a)) of W in 5 waves. The bounce to 109.83 high then ended Minute wave ((b)) of W in 3 waves bounce. Afterwards, the decline to 108.10 low ended Minute wave ((c)) and also completed Minor wave W as an Elliott Wave Zigzag structure. Up from there, Minor wave X bounce is in progress to correct the cycle from 111.40 high. The rally should fail in 3, 7 or 11 swings for further downside correction as far as pivot at 111.4 high stays intact. Near-term focus remains towards 109.35-109.59 to finish Minor wave X. This is the 100%-123.6% Fibonacci extension area of Minute wave ((a))-((b)) of a zigzag structure. Once wave X is complete, pair should resume lower provided the pivot at 111.40 high stays intact or should react lower in 3 swings at least. We don’t like buying the proposed rally.

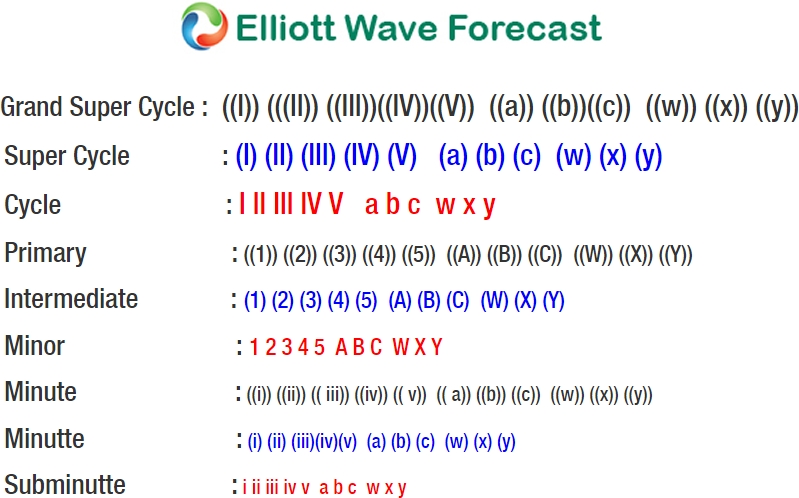

USD/JPY 1 Hour Elliott Wave Chart