With headlines surrounding tariffs and Fed cuts subsiding, it allows NFP to have its monthly spotlight back. As for the dollar, earnings could prove to be the difference between bullish or bearish.

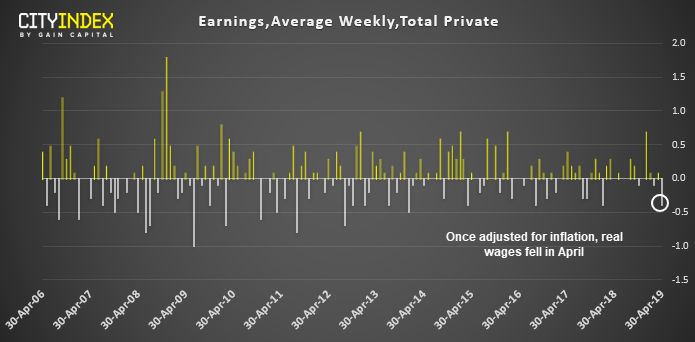

As Matt Weller outlined in his NFP Preview, the Fed will be keeping a close eye on the wage component of the report as its essentially an input for inflation. For the past two months US average earnings has ticked higher just 0.2% MoM so, with an expectation of 0.3% MoM later today, it leaves the potential for disappointment if it falls short of expectations. However, this is just the headline number and does not take inflation into account. If we look at ‘real’ weekly earnings from BLS, it shows that real wage growth was is lowest since January 2018 in April. And, given traders are now sensitive to the Fed cutting rates, a mere 0.2% print for average earnings could send the USD markedly lower.

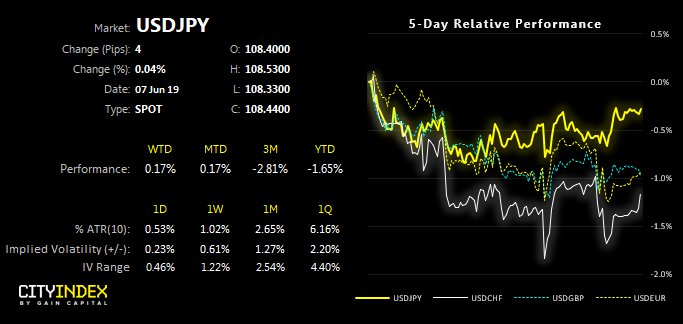

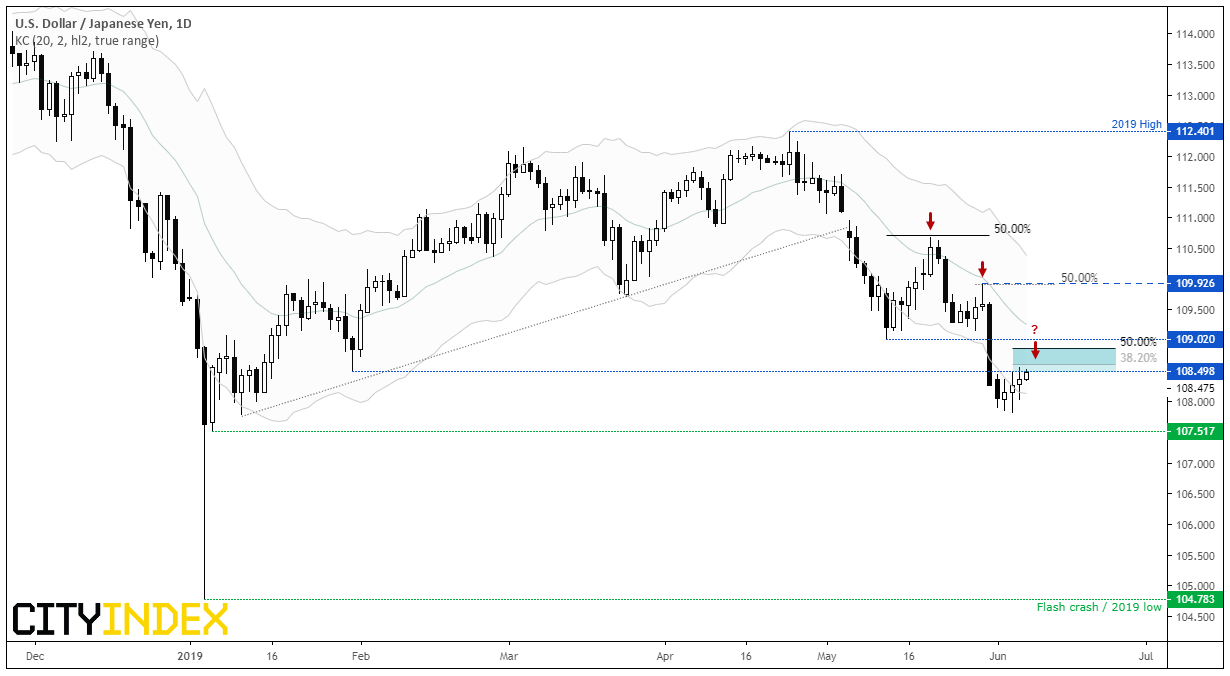

USD/JPY remains a traders’ NFP favourite, although it has retraced cautiously from its ‘risk-off’ lows. The pullback was clearly due, as last week it had become too extended beneath its lower Keltner band. Yet as its now within its 4th bullish day during a downtrend, we’re closely watching for bearish momentum to make its return, in line with its bearish trend.

- We’d prefer to fade into rallies below 109.00, although the trend remains technically bearish beneath 109.93.

- The 38.2% level is capping as resistance, yet the prior two retracements have stalled at the 50% level. We can create a zone between these two levels to consider fading into (unless an unexpectedly strong NFP report materialises).

- Interim bearish targets include last week’s low and the 107.75, although it would be an open target if prices were to break lower.