The Japanese yen is drifting on Tuesday. In the North American session, USD/JPY is trading at 148.67, up 0.10%.

The Bank of Japan continues to stick to its script that inflation is transient and that it has no plans to phase out its monetary stimulus. Inflation has remained above the BoJ’s inflation target of 2% for months and the markets are keeping a close eye on a possible shift in policy. The BoJ has caught the market flat-footed before and is unlikely to provide any advance notice of a change in policy.

Will FOMC minutes provide any insights about Fed plans?

The Federal Reserve will release the minutes of the September meeting on Wednesday. The Fed held rates in a range of 5.25%-5.50%, but the decision was a “hawkish pause” as the Fed warned that rates could remain “higher for longer”. Investors will be combing through the minutes, looking for clues about future rate policy.

US yields have been rising, and that could affect Fed rate policy. On Monday, Fed members Jefferson and Logan said the spike in long-term bond rates could mean less of a need for the Fed to raise rates. The reason is that borrowing has become more expensive and inflation could ease without the Fed needing to raise rates.

Higher yields on Treasuries have led to an increase in other borrowing costs, including mortgages and consumer loans. This is providing support for the Fed to hold rates until next year. The odds of a rate hike before the end of 2023 have dropped to 24%, compared to 39% just one week ago, according to the CME FedWatch Tool.

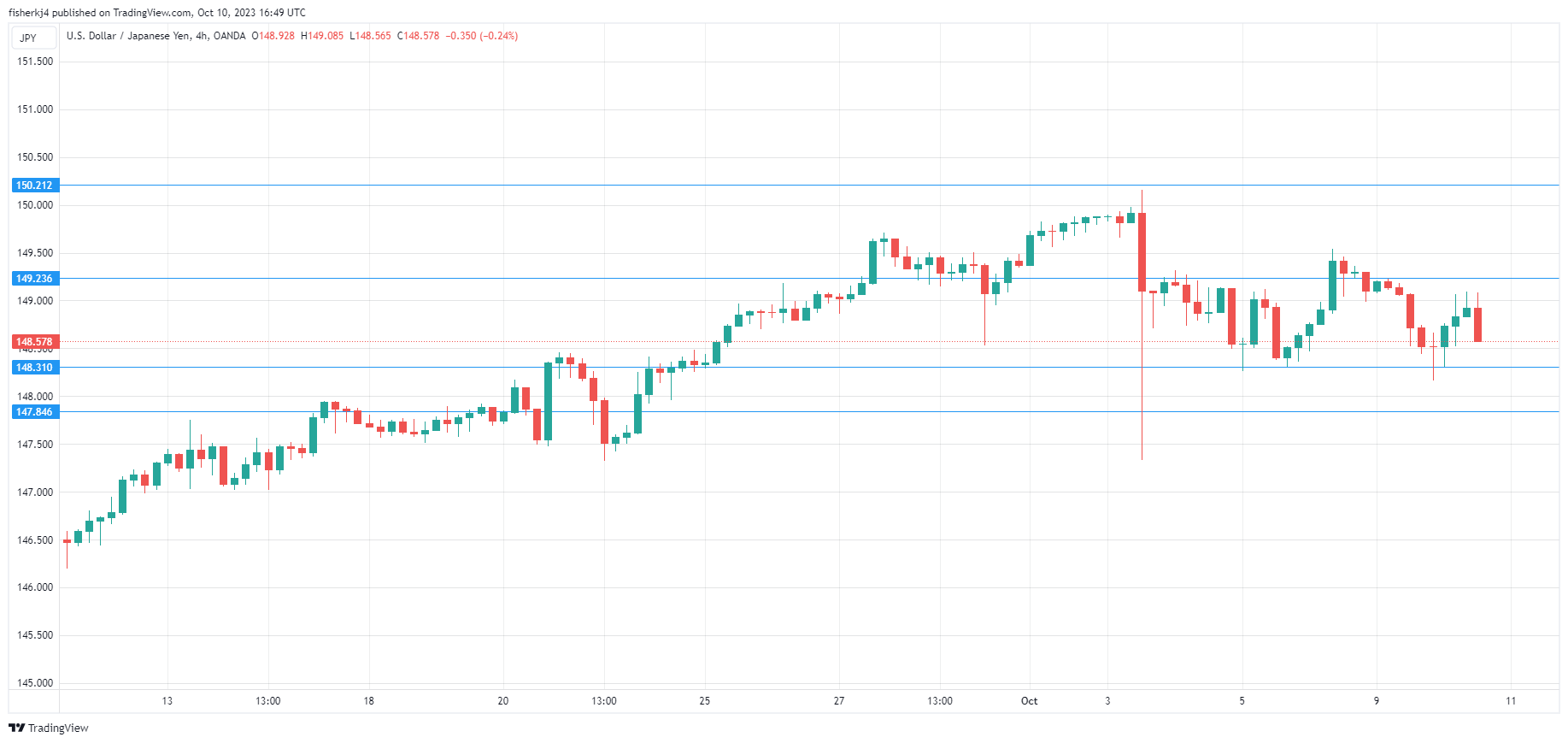

USD/JPY Technical

- 148.31 and 147.84 provide support

- There is resistance at 149.23 and 150.21