- Yen improves after soft US nonfarm payrolls

- BOJ September minutes indicated members saw no need to tweak YCC

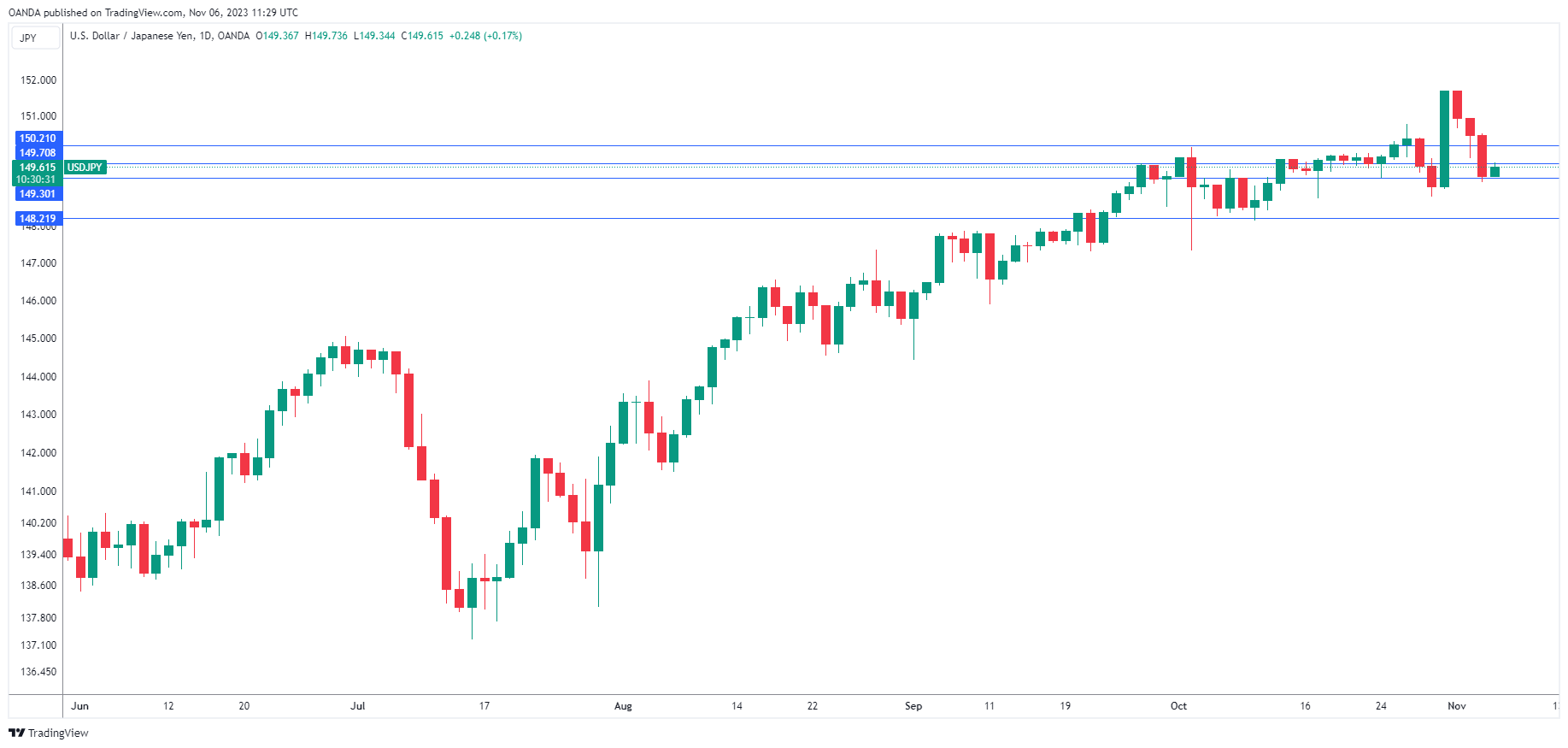

- USD/JPY tested resistance at 149.70 earlier. Above, there is resistance at 150.21

- There is support at 149.29 and 148.21

The Japanese yen is steady on Monday. In the European session, USD/JPY is trading at 149.66, up 0.20%.

US Nonfarm Payrolls Cements Pause in December

US nonfarm payrolls fell to 150,000 in October, down from a downwardly revised 297,000 in September and shy of the consensus estimate of 170,000. The reading wasn’t a massive miss but supports the view that the US labor market is cooling and the Fed might be able to avoid further hikes. The US dollar was broadly lower after the release and the yen pushed back below the key 150 level on Friday. The Fed rate odds of a hike in December have fallen to 10%, compared to 24% just a week ago, according to the CME Fed Watch Tool.

It was a roller-coaster week for the yen, which took a massive tumble on Tuesday, falling 1.78%. The decline was in response to a dovish Bank of Japan meeting, at which the central bank said it would “patiently” maintain its ultra-loose policy. The BoJ kept in place its 1% upper limit on 10-year government bond yields but redefined this upper limit as a “reference” rather than a hard cap.

The sharp drop resulted in a stern verbal intervention from Masato Kanda, Japan’s top currency official. Kanda warned that the Ministry of Finance (MoF) is on “standby” and ready to take action “against excessive volatility” and that he was “very concerned about one-sided, sudden moves in currencies”. The jawboning may have achieved its purpose, as the yen rebounded by gaining 1.5% over the rest of the week.

The Bank of Japan’s minutes from the September meeting indicated that board members didn’t see a need to tweak yield curve control (YCC). The BoJ decided to tweak YCC at the October meeting, but in September, US Treasury yields had not yet climbed sharply. This suggests that the move in October had not been planned well in advance and was a reaction to the sharp rise in US Treasury yields.