- A 2-year auction demanded a 5.055% yield, lower than the prior auction yield of 5.085%

- Bid-to-cover 2.64x vs 2.73x prior (lower than 1-year average)

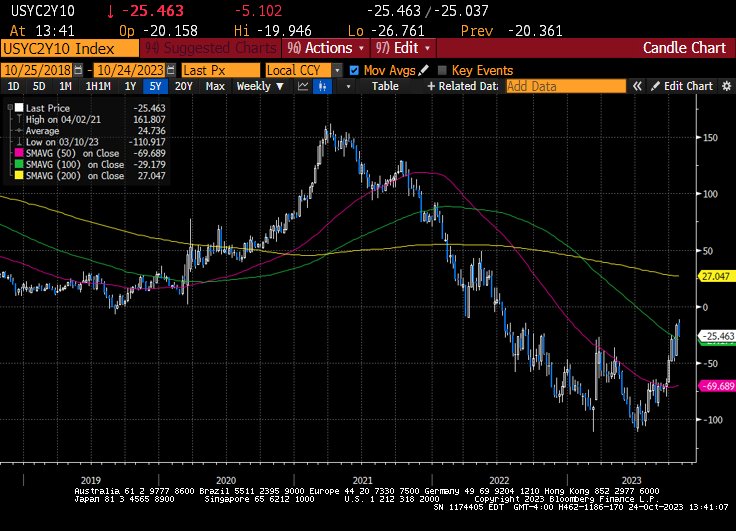

- Flattening trade remains: 2-year yield +3.2bps; 5-year +0.2bps; 10-year -1.9bps; 30-year -2.7bps

With US debt becoming a focal point for traders, Wall Street is now paying close attention to Treasury auctions. The early afternoon 2-year Treasury auction went relatively smoothly. The demand came in-line with the 1-year average with this breakdown: indirect (62%), directs (20.3%), and dealers (17.6%). Tomorrow’s 5-year note auction might see a bigger reaction given the rising uncertainty the longer you go on the Treasury curve.

The inverted yield curve is disappearing and that might mean bad news for the economic outlook. This recession indicator is getting close to uninverting, which means the housing market will remain in trouble as mortgage rates remain high and it will cost more for businesses to get loans.

The dollar is holding onto its earlier gains in the session and still remains steadily below the 150 level against the dollar. FX traders are awaiting the November 1st BOJ policy decision that could see a tweak to its current yield curve control program. If Treasury resumes skyrocketing move higher, the BOJ will be pressured to allow Japanese yields to move higher. The BOJ isn’t quite ready to end negative rates, but if Tokyo inflation comes in hotter, we could see building for a hike at the next couple of meetings.