Chipotle Mexican Grill (NYSE:CMG) is having its worst trading day of the year as investors continue to punish the company for its updated guidance figures that point to higher promotional costs. Through Tuesday morning trading hours, shares of the fast-casual chain were down more than 6.3%.

According to a new SEC filing, Chipotle expects marketing and promotional costs to rise between 20 and 30 basis points this year. Additionally, the company said that food costs will remain at 34.2% of total sales, and projections for same-store sales growth in the high-single digits were left unchanged.

The news was disappointing for investors who were optimistic about Chipotle’s continued recovery from the fallout of the foodborne illness breakouts linked to its restaurants in 2015. While it’s understandable that Chipotle would have to spend more cash on marketing in order to repair its brand name, investors were clearly hoping for more of an impact by now (also read: Here's Why Chipotle Stock Dropped Today).

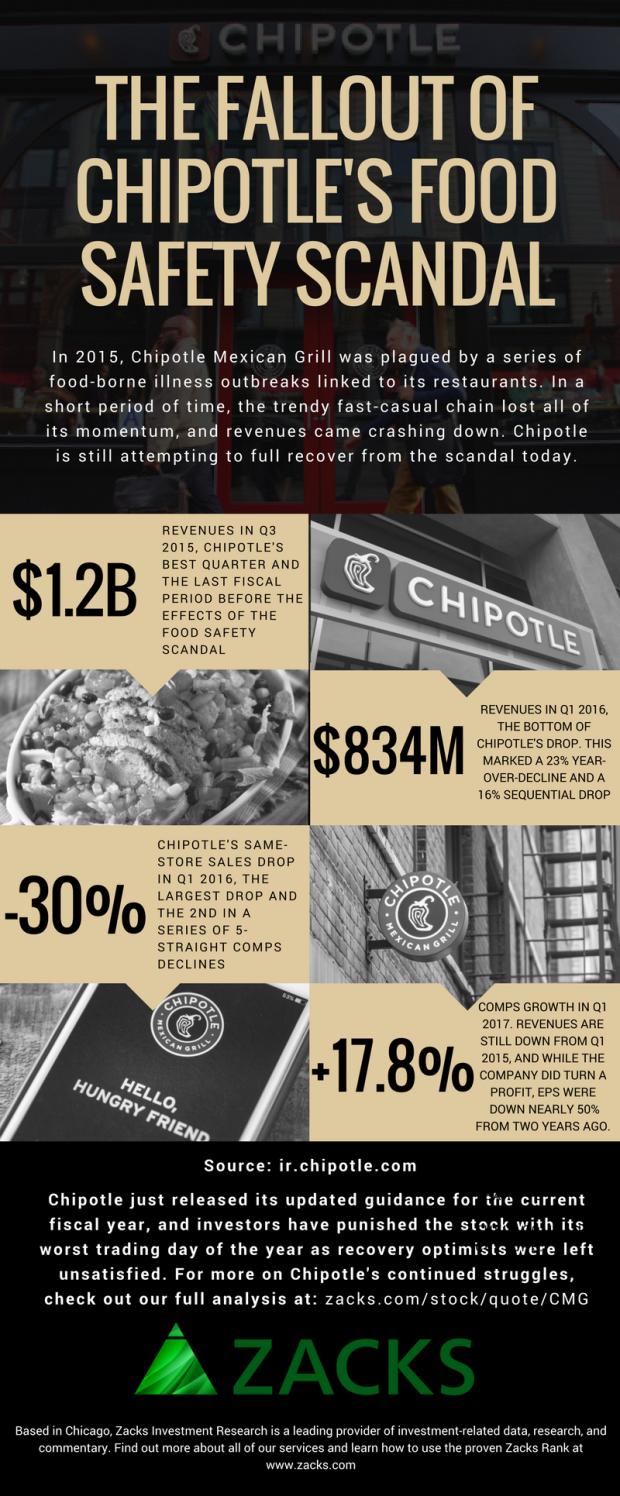

Indeed, the illnesses and ensuing scandals have been devastating for Chipotle, and although much has been made about the company’s recovery this year, the numbers point to a different story entirely. Check out the facts in this Zacks exclusive infographic:

As we can see, despite Chipotle’s recent recovery efforts, the company has still not returned to its pre-scandal levels. For more analysis on Chipotle Mexican Grill, check out the opinion of Zacks Editor Eric Dutram: Why Chipotle Stock is Still Awful for Growth Investors

And make sure to check back here for other exclusive infographics from Zacks Investment Research!

Want more stock market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

Original post

Zacks Investment Research